This is as much a comment cleaner as anything else – – all the same, it’s a lovely little pattern! See you folks on Thursday morning.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Currency Messages From Several Views

Each week in NFTRH we review the multi-currency (weekly) chart and occasionally take a look at various pairs and ratios as well. With the look of things this year (so many items are going sideways) it is hard to fathom how anyone would want to be a FOREX jockey right now.

The multi-index chart shows Uncle Buck, Euro, Canada Dollar and Aussie Dollar going sideways with only the bias varying (e.g. CDW looks bearish and XAD tinged bullish). What a boringly sad crew with the exception of the Yen, which is still in rebellion (breakout) mode and the terribly bearish GPB, which could be making a bounce pattern.

USD-EUR is in an ugly pattern above support. (more…)

Swing Trading ATI, MGM, PAG, ADM, AXP

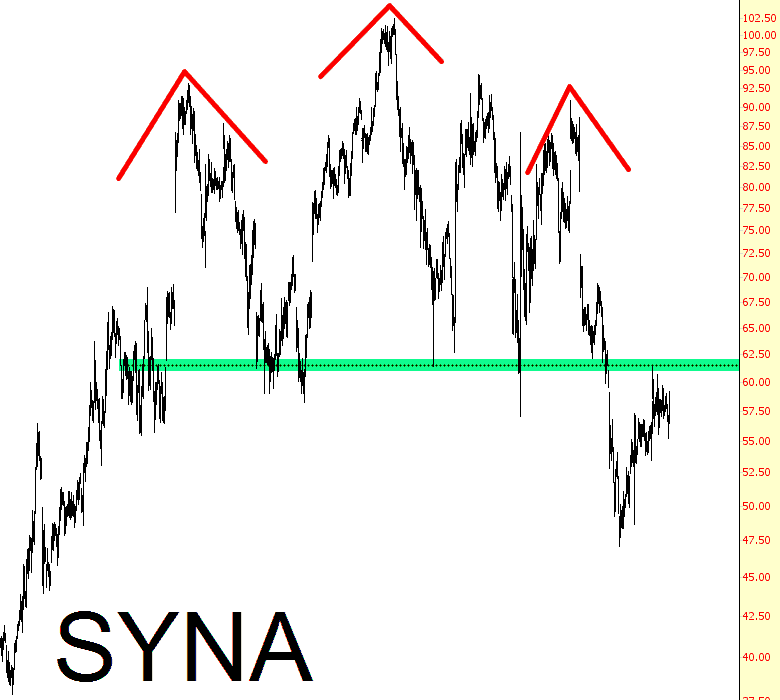

Symmetry

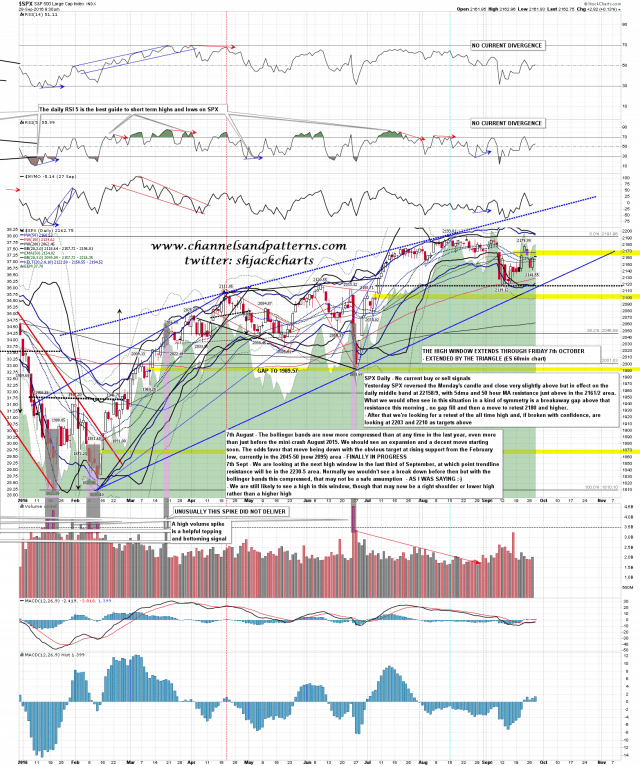

SPX made a marginal lower low yesterday as expected and then rallied back into main resistance at the daily middle band, which closed yesterday at 2158/9, with the 5dma and 50 hour MA slightly above in the 2161/2 area. SPX closed a handle above the middle band but in practical terms I count a close less than two handles away from the band as a close on it.

One thing you often see in this kind of situation is a kind of symmetry where unusual setups can repeat several times in a short period and we might have a situation like that here. The last two times that the middle band was tested SPX gapped through it and at the open today SPX has gapped through it again. Both of the last two gaps were breakaway gaps that did not fill that day or the day after. We may see that again today and, if so, that would be a strong start to the ATH retest that we are expecting. SPX daily chart: