Each week in NFTRH we review the multi-currency (weekly) chart and occasionally take a look at various pairs and ratios as well. With the look of things this year (so many items are going sideways) it is hard to fathom how anyone would want to be a FOREX jockey right now.

The multi-index chart shows Uncle Buck, Euro, Canada Dollar and Aussie Dollar going sideways with only the bias varying (e.g. CDW looks bearish and XAD tinged bullish). What a boringly sad crew with the exception of the Yen, which is still in rebellion (breakout) mode and the terribly bearish GPB, which could be making a bounce pattern.

USD-EUR is in an ugly pattern above support.

USD-CAD has a bullish look to it above the weekly moving averages.

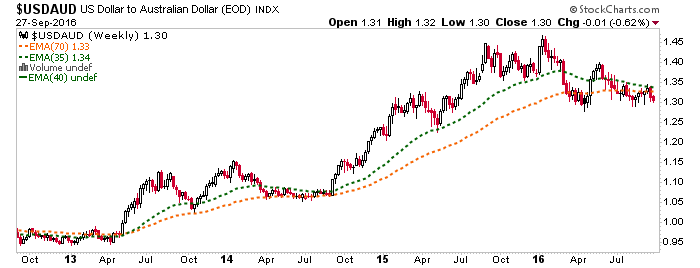

USD-AUD is still bearish. It is interesting that USD is potentially at odds in its message vs. the two commodity currencies.

USD-CHF is about as lame (and neutral) as you can get.

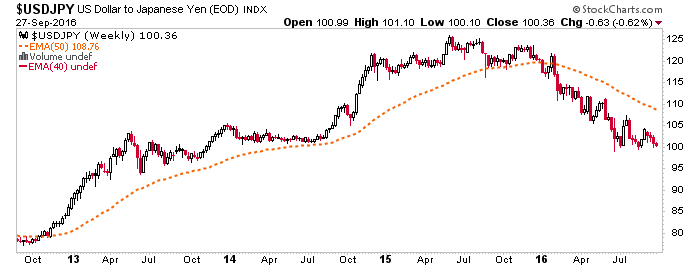

USD-JPY has been firmly down trending all year long. Quite bearish.

USD-JPY (monthly) has advised that a potential support area is at hand. So far, Uncle Buck’s not taking the opportunity vs. Johnny Yen.

Gold vs. Swiss Franc has been another of our views into market confidence with respect to the various currencies and the clowns overseeing and competitively debasing them. The theory being that the signal is a vote of ‘no confidence’ when the metallic risk ‘off’ asset is outperforming the paper risk ‘off’ asset. Though consolidating since June, gold has been in a solid uptrend vs. Swissy for all of 2016.

Finally, by way of an ‘if/then’ statement, this daily chart advises that if Yen is bullish vs. USD, then gold and silver are bullish too.

Subscribe to NFTRH Premium for your 30-45 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter @BiiwiiNFTRH, StockTwits or RSS.