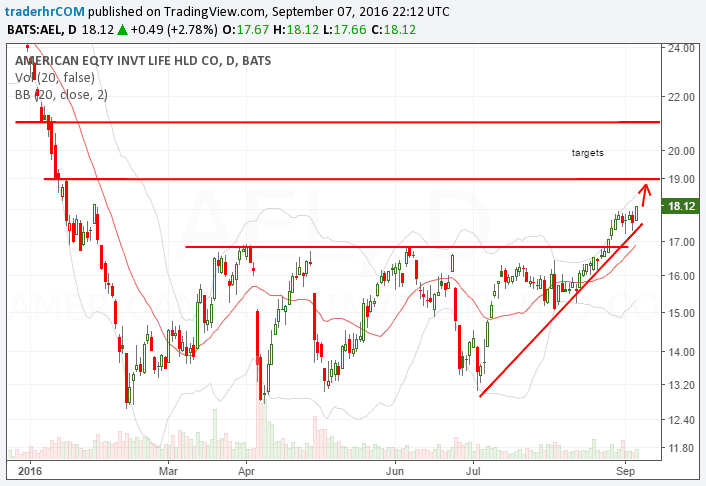

Five Swing Trade Ideas for Thu, Sep 8, 2016: American Equity Investment Life Holding Company (AEL), American Express Company (AXP), CSX Corp. (CSX), MGM Resorts International (MGM), Southwestern Energy Company (SWN).

(more…)

(more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Harry Boxer’s Charts of the Day

Overhead Resistance

SPX, NDX and RUT have been rallying as expected, RUT made a new swing high first on Friday, NDX has made a new all time high today, and SPX has come within a few handles of the ATH retest but no cigar as yet.

I want to talk about the trendline resistance that I’ll be watching over the next two or three weeks during this likely bull window. The daily bollinger bands are so compressed that we could see a break up through these trendlines, or possibly see a break down before the cycle high window opens. The daily bollinger bands average about 3% to 4% between the upper and lower bands on the daily, and anything under 2% is compressed, and anything under 1.5% is very compressed. SPX is now at about 1%, at a degree of compression that has not been seen before in many years, and possibly never seen before at all. This is likely to resolve into a decent expansion, which should be downwards, but could be up. If it is going to be a break upwards then there are two important trendlines to watch.