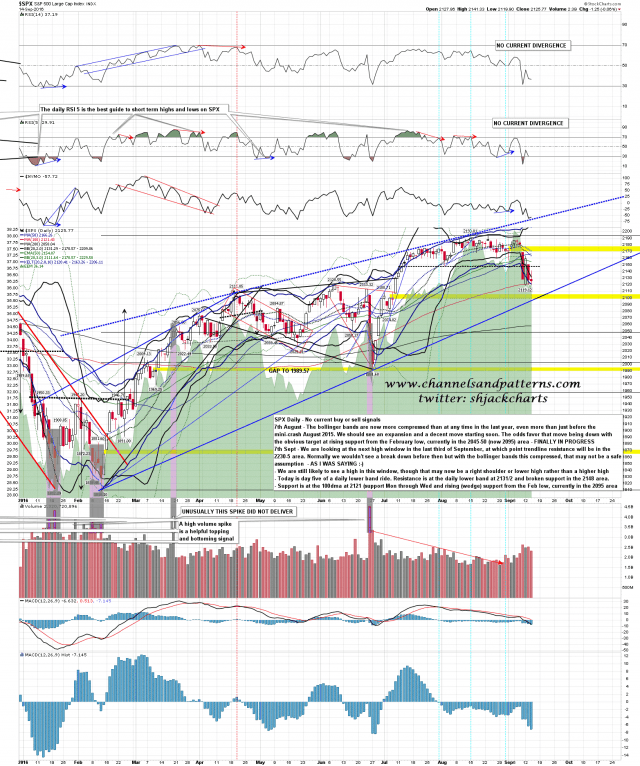

SPX has now completed for days of a daily lower band ride, and for the last three days SPX has been testing the 100dma at 2121/2, and that’s been looking pretty solid. The two obvious targets below are the minimum 3.9% target below from weekly upper band punch stats at 2108 and rising wedge support in the 2095 area.

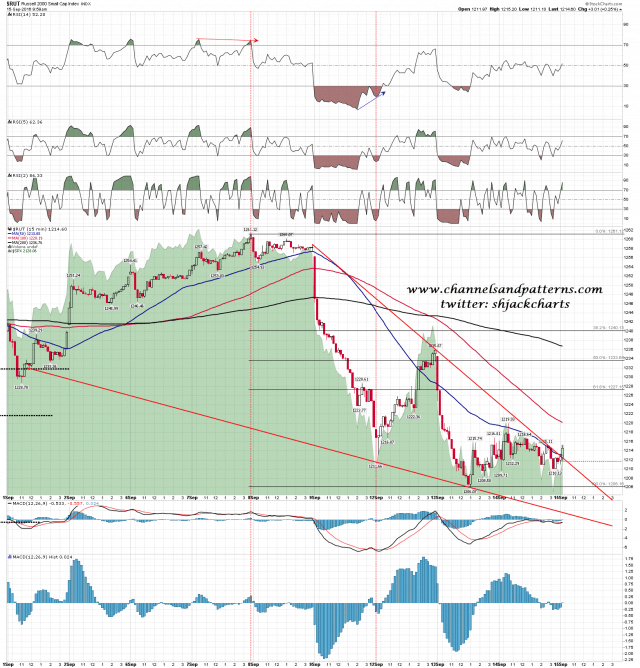

Do those targets need to be hit on this move? Well if SPX returned to retest the ATH and only made a marginal new high then this might just be part of the topping process, something which I think is likely in any case, in which case the 2108 target could be hit, and likely exceeded on the next swing down. The current low would also be a (bigger picture) near miss of wedge support on SPX, something seen often before a rally, and then break down through it. It’s possible that this retracement low could be in, though so far I only have 60min buy signals fixed on ES, and brewing on RUT. That’s thin but maybe.

If we do see a strong rally here then the resistance levels to watch are the 5dma at 2134 (daily close basis), the 50 hour MA in the 2155 area, and the 50dma and daily middle band currently both in the 2166-8 area. SPX daily chart:

What is prompting these musings about a possible early low? Well I mention regularly that I watch RUT carefully as it patterns very well, and this break up on the falling wedge on RUT from the highs is not an encouraging sign for more downside short term. RUT 15min chart:

If the short term low is in then this shouldn’t be a big low. I’d be looking for a marginal new all time high on SPX, ideally in the 2210 area in a few days, and then a bigger retracement that would start there. We’ll see how it goes today. At the time of writing I am considering this a possible trend up day. We’ll see how that goes.

Stan and I are doing a free educational webinar after the close tonight on trading using compression and expansion. Feel free to come and I can say with confidence that at a total price of $0.00 this would be the best value TA research you could do today :-). You can register for that here.

As an aside, as part of my project to mention nice calls I make more often, this GC long call I made on the subscriber twitter feed at theartofchart.net an hour ago is looking pretty sweet at the time of writing. If that is the retrace low then the nice target within the wedge is wedge resistance, currently in the 1440-50 area. On one GC contract that’s a $13k + move which makes our services there look very very very cheap by comparison. There’s another setup on CL this week that may well deliver even more on a single contract. Just sayin’.