From my deathbed: a very interesting infographic (I’ve placed it below the fold so the home page isn’t silly):

(more…)Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Remember This Meme Stock?

‘Anti’ Markets

These daily charts are flipped over to a view that is ‘anti’ their normal selves

Whereas I have often referred to the improbably bullish (to many) US dollar as an anti-market, the liquidity collector from the global liquidity driven and speculative mess created by the Fed and its fellows, here is a look at some markets (ETFs & indexes) in their opposite or ‘anti’ suit. In other words, here are some charts flipped over. If the chart is bullish the underlying asset/market is not.

The major risk in my opinion is in the over-hyped inflation trades as inflation signals fade. That means commodities, mainly. But also Materials, Financials and other areas thought to be ‘reflation’ sensitive and highly cyclical.

(more…)Well Hel-LO, Saylor!

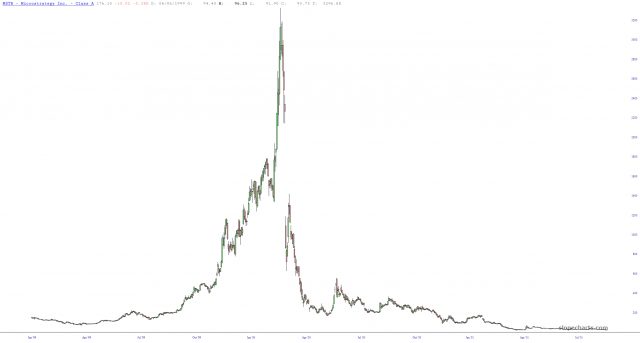

Most of you are acquainted with Microstrategy (ticker MSTR). Back in the Internet bubble, it was one of the poster children for the collapse, having plunged from about $3,300 to about 1% of that amount. It was absolutely catastrophic (and, to this day, I have no idea what products or services they make). Somehow they survived.

Resurrecting Energy

Below are the energy-related companies against which I own puts; energy was very good to me a number of weeks ago, and I’m back for a second helping.