Preface to all three parts: after the bullgasm on Friday, I trimmed away bearish positions that I thought might be better to enter later at better prices. I have a total of 21 positions, 7 of which are shown here:

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Preface to all three parts: after the bullgasm on Friday, I trimmed away bearish positions that I thought might be better to enter later at better prices. I have a total of 21 positions, 7 of which are shown here:

From time to time, a question will appear in the comments section which is worthy of a response in a post. Havoc left just such a comment (I’ve boldfaced some of it for emphasis):

(more…)Questions…. I’ve been watching you trade for about 15 years, and you have made adjustments to your method over that time. Your style has similarities and differences to my own, and I’m curious as to how you honestly feel about the long-dated options-only method. I still am very impressed with your strategy of holding dozens of individual short positions (while I only short the SPX in a couple of ways). You have convinced me of the benefit in a crashing market of the added time it takes to exit all those positions, for example. How do you value the price of the options in your spreadsheet, is it the midpoint of the bid/ask? When you decide to enter, or exit a position, are you entering limit orders to prevent bad fills within these wide spreads? Most importantly, in what ways have you found this style to be better than being actually short the individual stock? I’ve actually started building a portfolio of options that expire in 1/24, and am finding peace of mind with it.

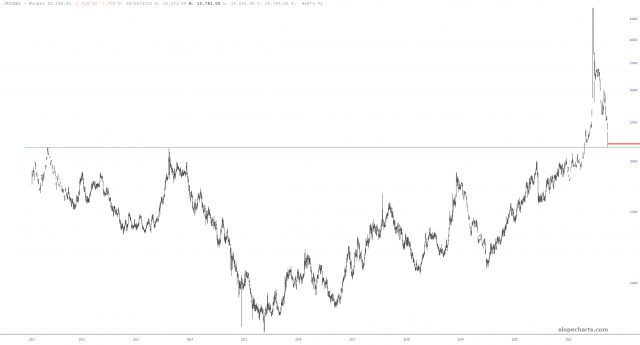

Remember all the zaniness in early March about how commodities were going to the moon, and metals such as nickel were so red-hot that the exchange literally had to shut down so that a short-seller in China wouldn’t blow up? Well, sure enough, the insanity top-ticked the entire market, and it has completely retraced.

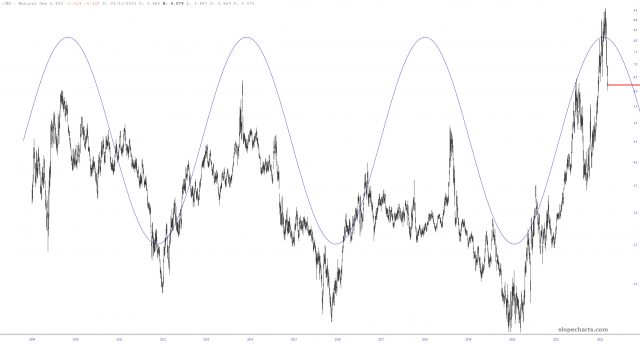

A week or two ago, I overlaid the sine wave from SlopeCharts onto the chart of natural gas. Interesting how it seems to be working so far! This suggests much lower prices in the months ahead.