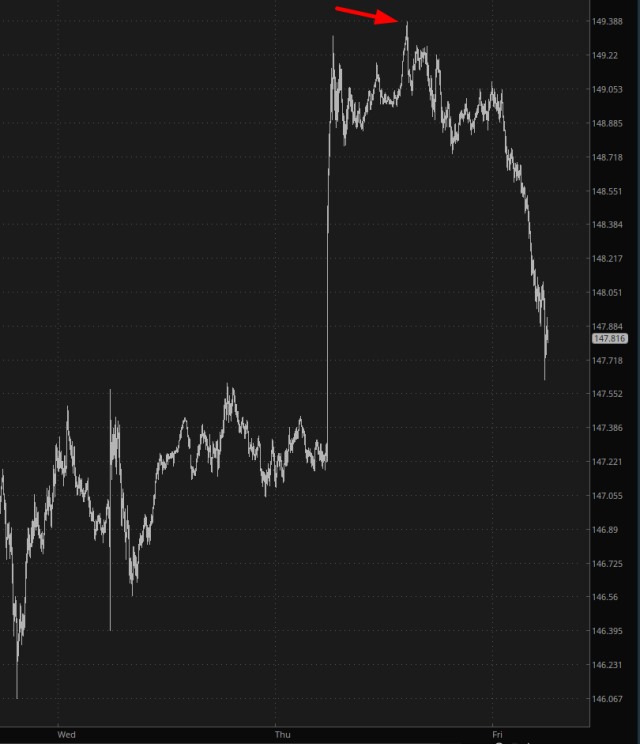

There have been many instances at 5 a.m. when I’ve reached down to grab my iPad off the side of the bed, nervous about what I’d see once I fired up the quotes, but this morning had to be one of the three hold-your-breath occasions. I’ve never been so happy to see red in my life, and the ES, NQ, and RTY were all solidly down, prompted, at long last, by the reversal in the USD/JPY juggernaut.

The thing is, /NKD didn’t get the memo until a full nine hours later. I have no idea why, but the /NKD kept climbing all the way through midnight (my time), dragging every single equity in the world along with it.

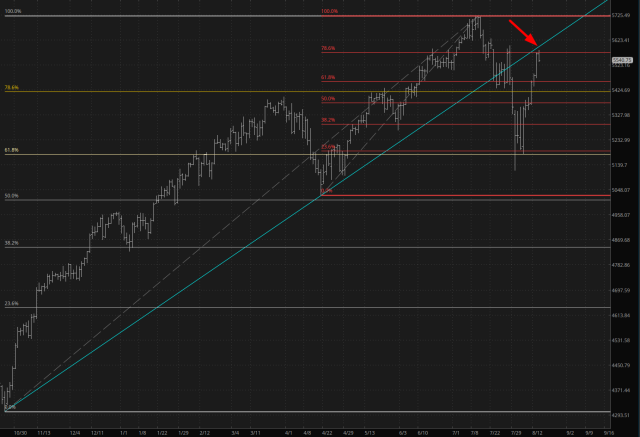

In any case, the /ES mashed itself right up against two lines which were The Last Lines In the Sand and, thank GOD, got stopped. I cannot emphasize how crucial it was for the /ES to get repelled by that teal line.

I can, however, show you………..see, that teal line is the trendline anchored all the way back to the Halloween 2023 low. We had first cracked in on August 1st and, over the past two days, plunged beneath it. Over the next nine trading days, the damned thing kept flying higher without even having to catch its breath, mashed right up against it at yesterday’s close. The line SHOULD have stopped this ascent and, evidently, it did.

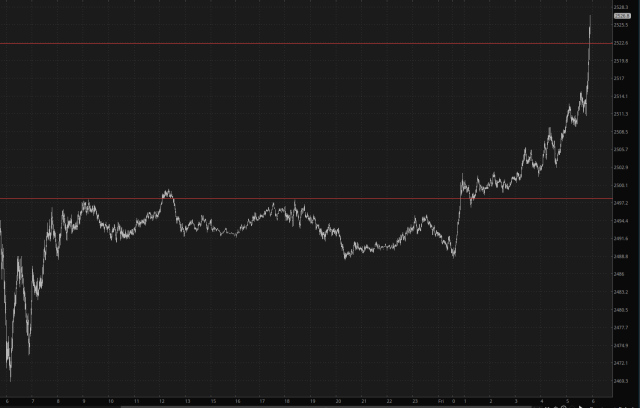

Simultaneously, my “short equities/long precious metals” declaration feels extra spicy this morning since gold has decided to strap on its rocket boots.

In fact, I’d like to close with a quick insight I finally had yesterday: I need to stop talking about “precious metals“. It’s really about GOLD. It finally dawned on me yesterday that silver futures, /SI, are moving almost tick-for-tick for small cap futures, /RTY. And, folks, I do NOT want to be long small caps.

It therefore makes a lot more sense that, as you look at the relative performance below of silver (black line) and gold (blue line), silver kind of sucks.