To get away from all this “top this” and “top that“, let me turn my attention to the two assets I’ve been persistently bullish about: gold and bonds. Those have been doing great! Aided by the prospect of lower interest rates, bonds have strengthening nicely, and as I’ve shown in prior posts, I think they’ve got months of strength ahead. And why? Because the Fed is going to have to cut, and cut, and cut, to try to goose an economy that is in a free-fall recession.

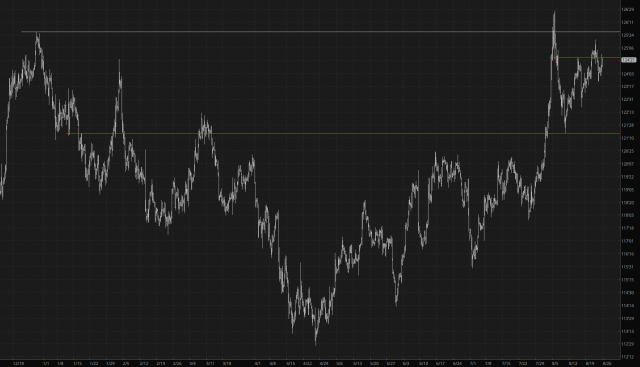

As for gold, it is Lifetime High City. It’s clear that the Fed is willing to tolerate way more inflation than they’ve let on, and precious metals are going to keep chugging ahead. I fully expect $3,000/ounce next year. You can click on the Metals category here on Slope to see some longer-term projections about why I think precious metals have such a shiny future.