Not Just The Momentum Stocks Got Hammered

As ZeroHedge noted, Friday’s market action was “an epic flush”:

Everything – like literally everything – and certainly anything with a high beta or even a trace of momentum, imploded with a sheer violence that made Aug 5 look like amateur hour. And unlike Aug 5, the puke was only at the beginning with stocks spiking from the first moment of trading, this time it was the other way around, with stocks pushing higher to start the day before falling apart, and ending a catastrophic week in the worst way possible: on a downtick.

While it’s true that momentum stocks got hammered, so did a number of value stocks. Chartmill‘s overall valuation rating is a good gauge of how cheap or expensive a stock is, as it incorporates multiple valuation metrics, including:

- Price/Earnings

- Price/Forward Earnings

- Price/Free Cash Flow

- Price/Book

- Price/Tangible Book

- Enterprise Value/Earnings Before Interest, Taxes, Depreciation, and Amortization

A number of stocks with overall valuation ratings of 7 or better (on a 0-to-10 scale) suffered double digit drops on Friday, including Sensus Healthcare, Inc. (SRTS), Celestica, Inc. (CLS), and AMN Healthcare Services Inc. (AMN).

So Much For The “Margin Of Safety”

The concept of the margin of safety, popularized by Warren Buffett’s mentor Benjamin Graham, suggests that buying stocks at a price significantly below their intrinsic value provides a “safety cushion.” This means that even if your analysis of a company’s value is off or if market conditions worsen, you are less likely to incur significant losses because the stock was already trading at a discount to its true worth.

In essence, the margin of safety is supposed to reduce the downside risk in investments, making value stocks safer compared to those trading at or above their perceived intrinsic value.

Of course, there’s no universal agreement in what constitutes a particular stock’s intrinsic value, but one would think that stocks with an overall valuation rating of 7 out of 10 would have some margin of safety relative to stocks trading at higher valuations, and yet that wasn’t the case on Friday.

The way to strictly limit your downside risk isn’t to buy stocks you think are cheap but to hedge.

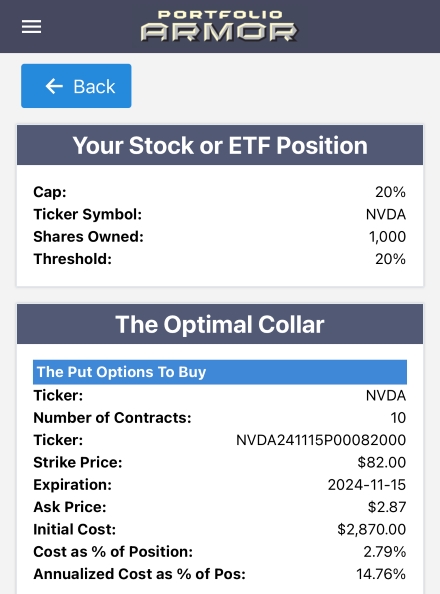

Let’s look at a couple of ways of hedging a widely-held stock that’s down from its highs now, Nvidia, Inc. (NVDA).

Two Ways Of Hedging Nvidia

The brief TikTok below shows two ways of hedging Nvidia against a >20% drop between now and mid-November, to the tune of “All Comes Crashing”. I used that expiration date to cover election risk.

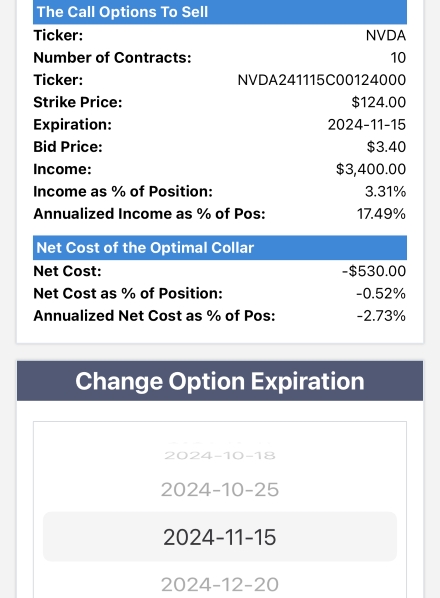

Here’s a closer look at the second hedge shown in that video, an optimal collar.

As you can see there, the net cost of the hedge was negative, meaning you would have received a net credit when opening the collar.

The optimal hedge is the one that gives you the protection you want at the lowest possible cost. Optimal hedges are what the Portfolio Armor iPhone app scans for. You can download the app here, or by aiming your iPhone camera at the QR code below.

If you’d like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website . You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we’re using that for our occasional emails now).