One thing that Stan and I are both bad at is drawing attention to our successes, as that feels like bragging, and we both know that good technical analysts are very prone to getting delusions of grandeur, which has a very negative (and often fatal) effect on the future quality of their work. We have no intention of going down that road ourselves.

However a certain degree of self-congratulation seems necessary for marketing purposes, so with some reluctance I’m going to be mentioning some current and past successes along with my equity index analysis today just to demonstrate what it is that we do at theartofchart.net. I’m going to be doing a post there later showing some seriously nice past calls on AAPL to promote our new Big Five (AAPL, AMZN, FB, NFLX, TSLA) chart service that we are launching at the moment, and if you’d like to attend the free public webinar that we are doing on Monday after the RTH close to promote that service then you can register for that here. We will be looking at the charts for all five in that free webinar.

I posted this NQ chart last night as one of my nightly bonus charts for theartofchart.net subscribers saying that the pattern setup on NQ was favoring a retest of the new all time high and then a fail that on a sustained break below 4810 would target the 4780 area and very possibly the NQ monthly pivot not far below that target in the 4763 area. NQ retested the new ATH overnight and has been trading around the 4810 area for most of the morning so far. NQ Sep 60min chart (from Wednesday night):

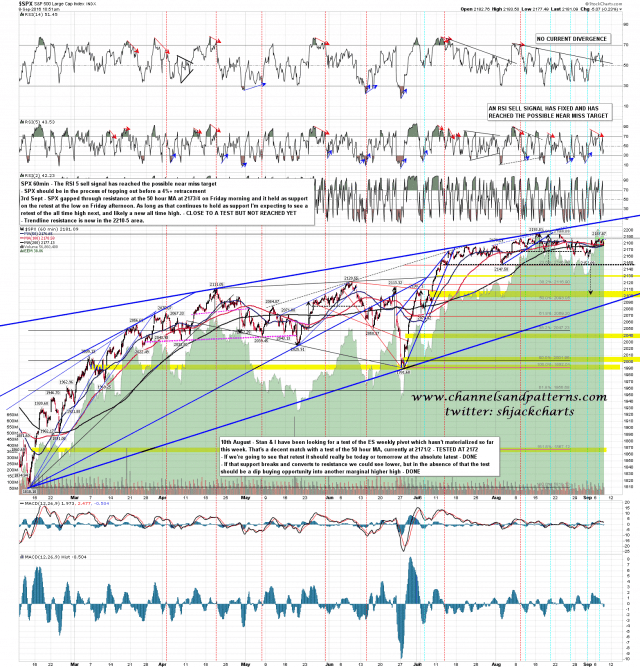

Support so far this morning is at the 50 hour MA on SPX at 2176. That needs to break down to open the main backtest targets on ES which are the weekly pivot at 2172 (2172/3 area on SPX) and the monthly pivot at 2168 (2168/9 area on SPX). If seen at all, the equity index bears not having been that impressive lately, then I’d be expecting one or the other to hold as support for a decent dip to buy. SPX 60min chart:

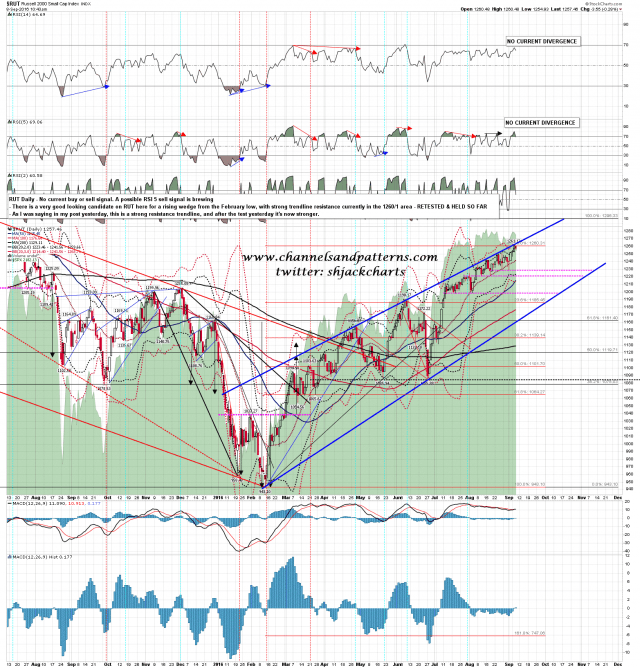

I was talking about the strong resistance trendline on RUT yesterday, and this morning’s retracement is coming after RUT closed at the test of that trendline last night. I’m not expecting the trendline to hold as resistance that much longer, but until that breaks it is very much a strong resistance trendline, and all the stronger this morning for yesterday’s test and fail there. RUT daily chart:

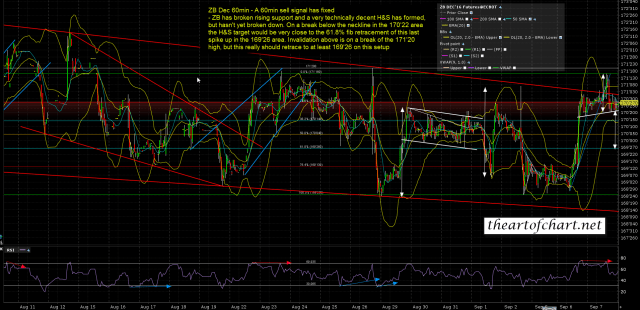

We’ve had some lovely calls in our analysis for subscribers so far this month. Just looking at mine for the last couple of days this call below last night on ZB to deliver an H&S target in the 169’26 area delivered nicely, and has continued down as Stan & I were forecasting on Sunday’s public Chart Chat of course. Stan was calling this down to 166 on his video for subscribers last night and ZB is now already halfway there. ZB Dec 60min chart (from Wednesday night):

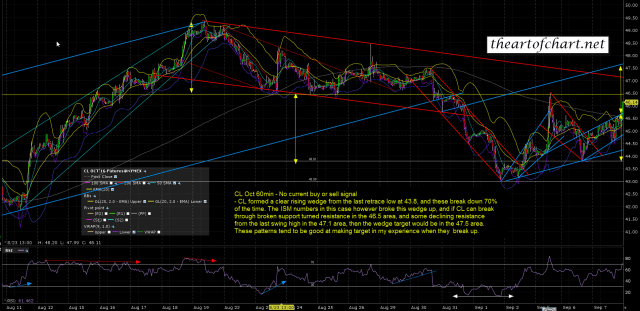

On my CL chart last night I was looking at a falling wedge that had broken up with a target in the 47.5 area & mentioning that in my experience these tend to be good performers on breaks up. CL was at 46.14 at the time and the high so far today is at 47.47. CL Oct 60min chart (from Wednesday night):

On Tuesday night I posted the NG chart below looking for the NG to test and reverse at channel support in the 2.66 area. NG made the low at that trendline test at 2.665 yesterday, has broken up from the falling wedge shown and at the time of writing has impulsed as high as the 2.817 area. We’re looking for new highs after a retracement as the larger retracement has in effect been a large bull flag. NG Oct 60min chart (from Tuesday night):

I could post more but don’t want to take up more space. If you’d like to see our call on the GC low last week I posted those charts here last Thursday and Friday I think. Are we always right? Not at all, but we’re right as much as we think is doable without actually being clairvoyant. We reckon on being on the right side of the market 70% of the time or better.

Is this service for everyone? No, we are a pure TA site and give no trade recommendations on entries or exits as we (as well as most sites that do offer these trade recommendations) are not licensed to give those. What we do is give high quality forecasts across various markets that people who know how to trade can use to set up some very nice trades. That said we do have a trading system that we teach, and an extensive training library covering a wide range of aspects of practical trading and TA. If you’re interested in finding out more then we offer a two week free trial that you can find on this page here. Payment details will be taken at the start, to prevent people taking a string of free trials under different names, but no charge will be made until the end of the free trial if the recurring payment is not cancelled.

Prices for our Daily Video and Triple Play services are going up at the end of September and we operate a policy that prices are never raised for subscribers with continuous subscriptions, so if you are interested, then I’d have a look before prices go up.

I’m seeing a friend for drinks tomorrow at the House of Commons in London so the next post here will be on Monday. She’s an honest politician, but I can’t mention her name here, as if word of her personal integrity leaks out that could finish her career in politics. Much the same in the US it seems so I’m sure you understand :-). I’ll be doing a post on AAPL this afternoon at the theartofchart.net blog, and I’ll post the link on twitter when I’ve finished that.