Apologies for the late post again today but I have been battling a host of technical issues with Stockcharts, our web hosts at theartofchart.net, and sundry other issues. All sorted out or mostly but all very time consuming.

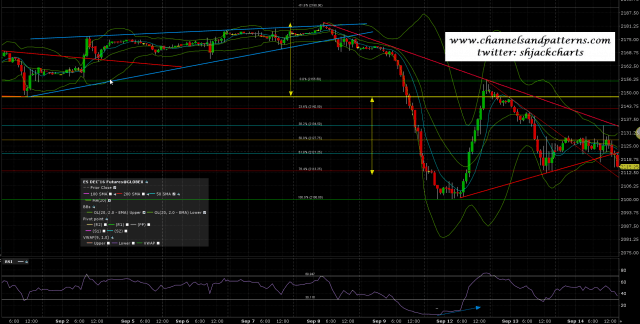

Not much to say on ES and SPX here. Volatility is definitely back, and they have been consolidating before what should soon be a push down into the obvious target area. Looking at ES that move may well have now started. ES Sep 60min chart:

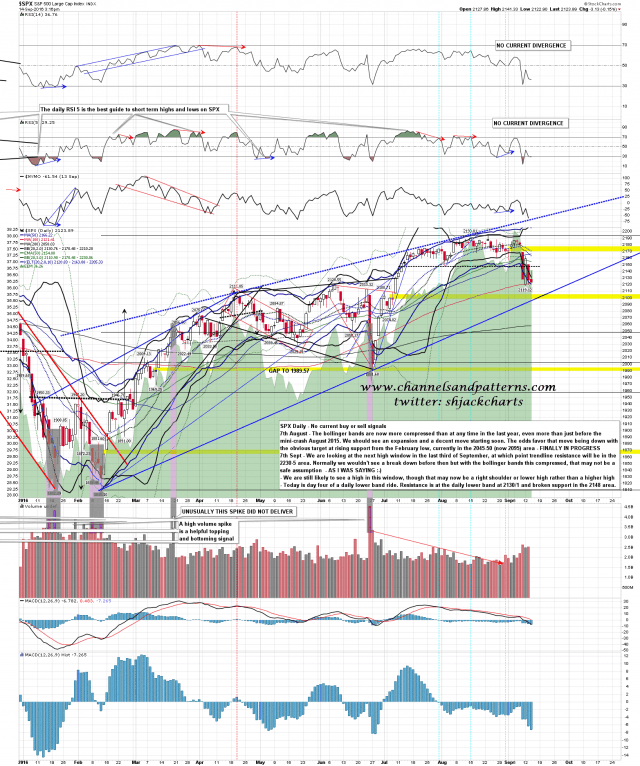

The obvious main target is rising wedge support on SPX, currently in the 2090-5 area. That really should be tested, and I’m expecting that to hold, but there might be a break below it. Even on a break though I’d be looking for a big rally soon after. SPX daily chart:

There are a lot of people looking for a big decline to start directly from here. I’m not one of them as I don’t think this topping setup is cooked yet. If SPX rising wedge support is respected then Stan and I are looking for a new all time high ideally in the 2210 area in a couple of weeks before a larger decline gets started. I’d suggest not being short through that move as that could get uncomfortable. 🙂