The high window opens on SPX today and runs through to Monday 3rd October. During this period Stan and I are expecting to see a very significant high made that would then be followed by a decline that would be considerably larger than the modest retracement just completed. We are looking for a likely full retest of the all time high, with an eye on higher targets in the 2203, 2206/7 and 2210 areas.

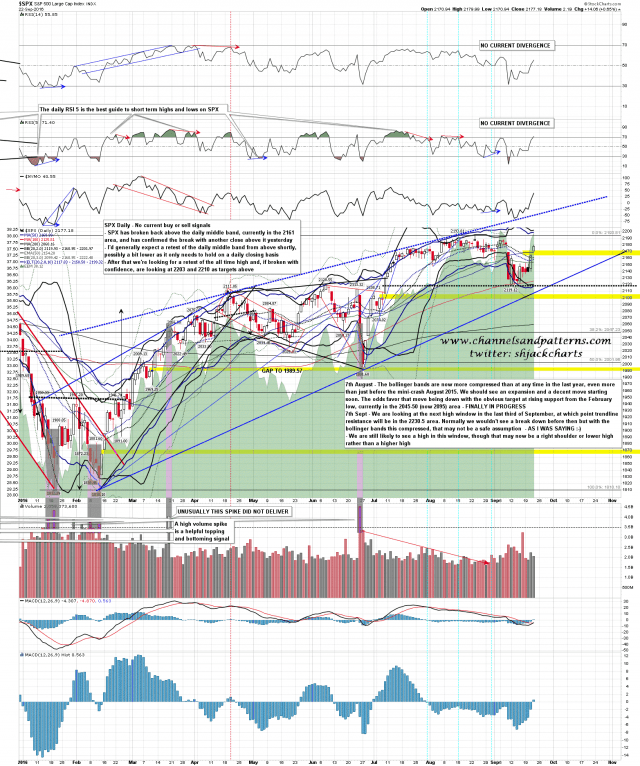

On the daily chart SPX confirmed the break back over the daily middle band with another close above it yesterday. This opens a possible test of the daily upper band, currently at 2202. I’d generally expect to see a retest of the middle band from above today or Monday, and that is currently in the 2161 area. SPX daily chart:

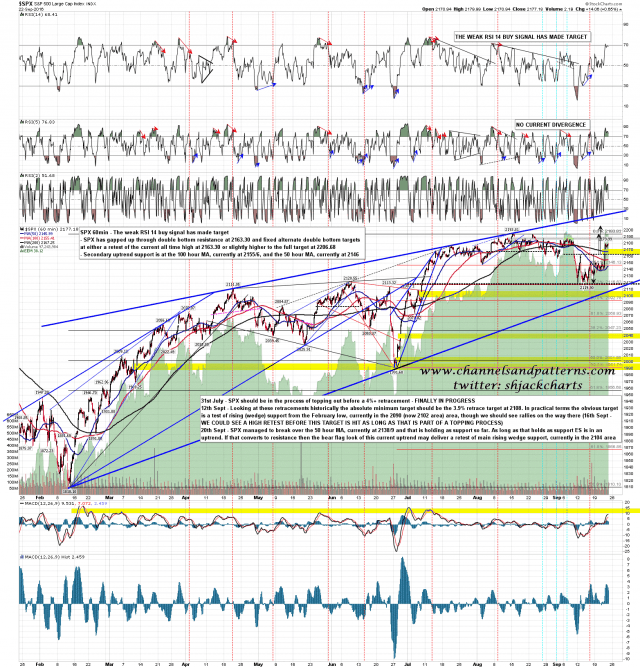

On the SPX 60min chart the weak RSI 14 buy signal has made target, and there are now alternate double bottom targets at either the retest of the all time high at 2193, or the full double bottom target at 2206. SPX 60min chart:

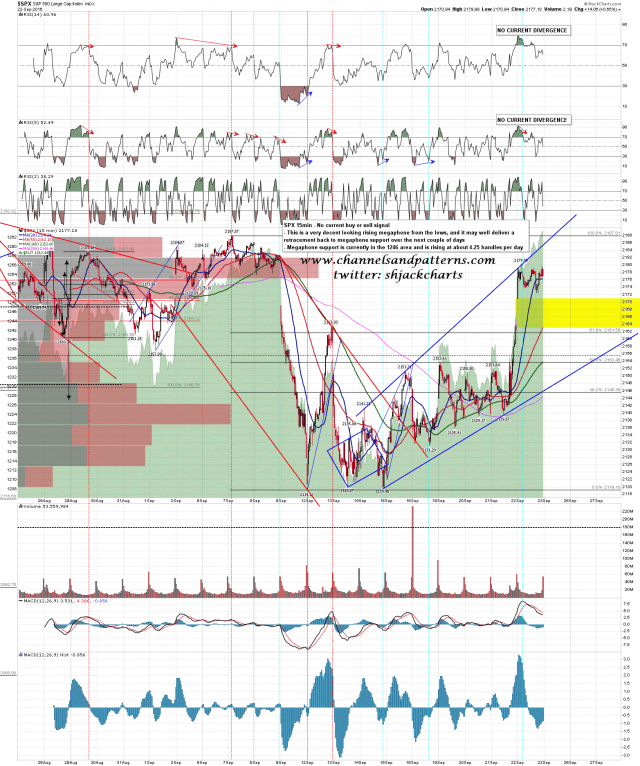

Is there a reason to think that SPX might retrace a bit here? Yes. The very nice rising megaphone on SPX shown below definitely favors some retracement here. SPX 15min chart:

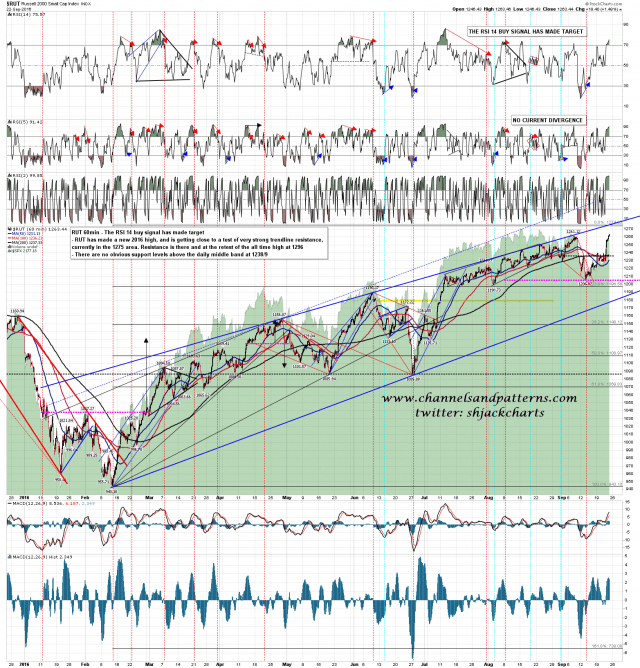

RUT has made a new high for 2016. Very strong trendline resistance is in the 1275 area. If we are to see a full retest of the all time high at 1296 in this window, then that strong resistance trendline would have to be broken. RUT 60min chart:

Pre Market Video for Daily Video Service subscribers at theartofchart.net – I’m posting these publicly every day for the remainder of September as a promo. If you are having any trouble playing this video please use the direct link here:

Everything is going to plan here on the scenario I’ve been laying out as our preferred option over the last couple of weeks. Shortly we see if SPX can make a higher high and then (this bit is important) fail hard from that high into a break down from the rising wedge from the February low. As ever, only time will tell 🙂