That was a strong retracement yesterday and the H&S targets that I was talking about on ES and NQ yesterday morning slightly sceptically have been made. What happens today is very important as the scenario that Stan and I are running here is that ES has broken up from a triangle into last week’s high, and the sequence after this kind of triangle break is a backtest of the triangle, which is happening now, and then the main triangle thrust up begins. Ideally that means we see a low on ES this morning, very possibly reverse yesterday’s move entirely over the rest of the day, and then thrust up to a retest of the all time high over the rest of the week. After that triangle thrust ends we should see a full retracement back to the level of this morning’s low and then we’d expect that to be the start of the larger retracement down that I’ve been talking about.

If you’re wondering how that looks then this is almost exactly the setup I was projecting on TNX a month ago and I show that example on the video below, so you can have a look at that to see a very nice example there playing out.

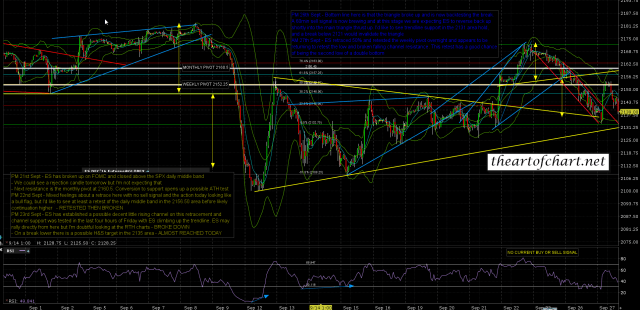

Assuming that the triangle scenario delivers, I’d like to see rising support in the 2131 hold, and invalidation of the triangle scenario comes on a break below 2121. ES Dec 60min:

Pre Market Video for Daily Video Service subscribers at theartofchart.net – I’m posting these publicly every day for the remainder of September as a promo. The direct link to that is here. Any of you in the GC trade should watch it and any of you trading bonds should really watch the last part of the video where I’m looking at ZB and TNX:

If you watch the video you may wonder why I’m outlining a scenario where it looks as though I’m saying that ZB is about to drop 10% from a likely high today. The reason for that is that my main scenario on ZB has that happening here and starting about now. If you look at the TNX chart I show in the video I drew those arrows a month ago, with the note that I wasn’t paying close attention to timing. The timing is a little off but TNX has followed the path I laid out then almost exactly in terms of price. ZB may need a test of 170 today but after that it’s likely time to look out below. That’s the trade I’ll be watching most closely today, though there are interesting long setups forming on CL, GC and NG as well at the time of writing.