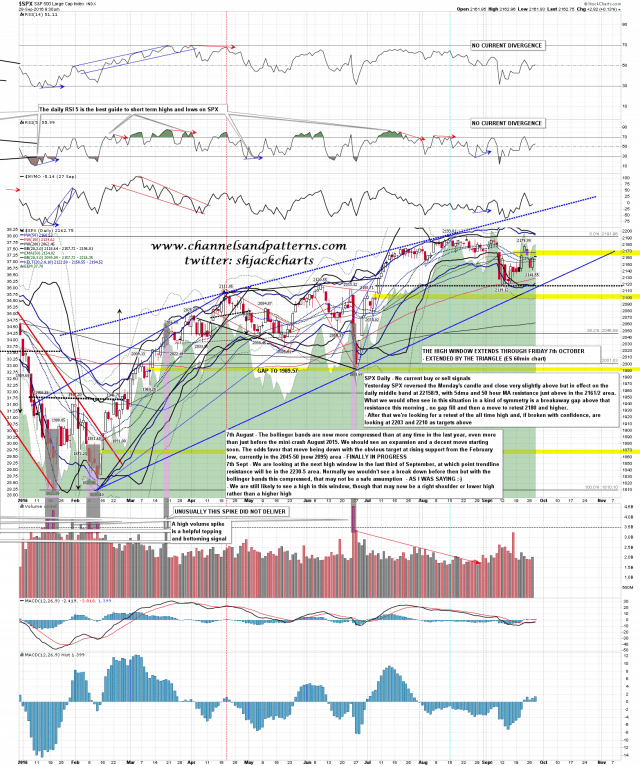

SPX made a marginal lower low yesterday as expected and then rallied back into main resistance at the daily middle band, which closed yesterday at 2158/9, with the 5dma and 50 hour MA slightly above in the 2161/2 area. SPX closed a handle above the middle band but in practical terms I count a close less than two handles away from the band as a close on it.

One thing you often see in this kind of situation is a kind of symmetry where unusual setups can repeat several times in a short period and we might have a situation like that here. The last two times that the middle band was tested SPX gapped through it and at the open today SPX has gapped through it again. Both of the last two gaps were breakaway gaps that did not fill that day or the day after. We may see that again today and, if so, that would be a strong start to the ATH retest that we are expecting. SPX daily chart:

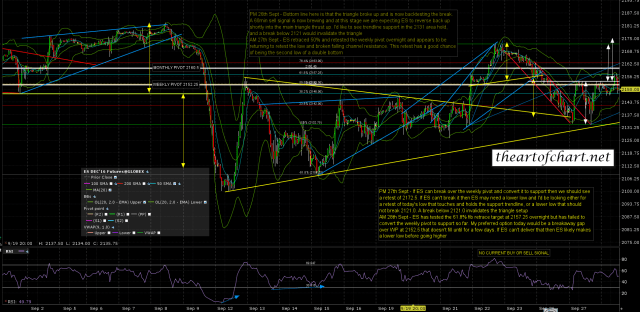

The key level on ES today is the weekly pivot at 2152.25, and ES has gapped over that this morning. If that can be converted into support this morning then the upside is wide open. If that can’t be converted to support then we could still see another test of yesterday’s low. ES Dec 60min chart:

SPX has filled the gap so the breakaway gap up option is off the table. The main options for today and tomorrow are either an AM low today, conversion of overhead resistance to support, and then a direct move up, or a hard fail here that delivers a retest of yesterday’s lows and possibly a marginal lower low. If we see that option then I have some trendline support in the 1331 ES area (approx 1338 SPX), and ES must not break below 2121 ES as that would invalidate the triangle and possibly kill off the ATH retest option in this high window.

The gold trade is looked at in detail in the video and at this test of 1325 this morning I now have a 60min buy signal brewing on GC. We are looking for a reversal back up in this area to the 1360 area, and there is an inflection area there to either fail down to the 1280 area or continue on to wedge resistance in the 1450 area, I’ll be looking at the inflection setup in detail at that test.

I’m posting the premarket video that I do every morning for Daily Video Subscribers at theartofchart.net, as a promo this week, as we are raising the charges at the end of this month and anyone subscribing before then can do so at the current lower price. The direct link to that is here. If you’re interested in subscribing then the subscriptions page is here. The daily video service is comprised of my morning video with the futures charts posted with the video and Stan’s post market video in the evening. For any one of the surprising number of traders looking for the certainty of genuine clairvoyance we are sadly unable to provide that at the moment, but we do a pretty impressive job nonetheless just using math.

Next Sunday is the first Sunday of October and we are doing our usual monthly public Chart Chat which is free to all, and if you are interested in price direction on the 35 or so instruments we cover there, or just enjoy top quality TA, then you can register for that here.