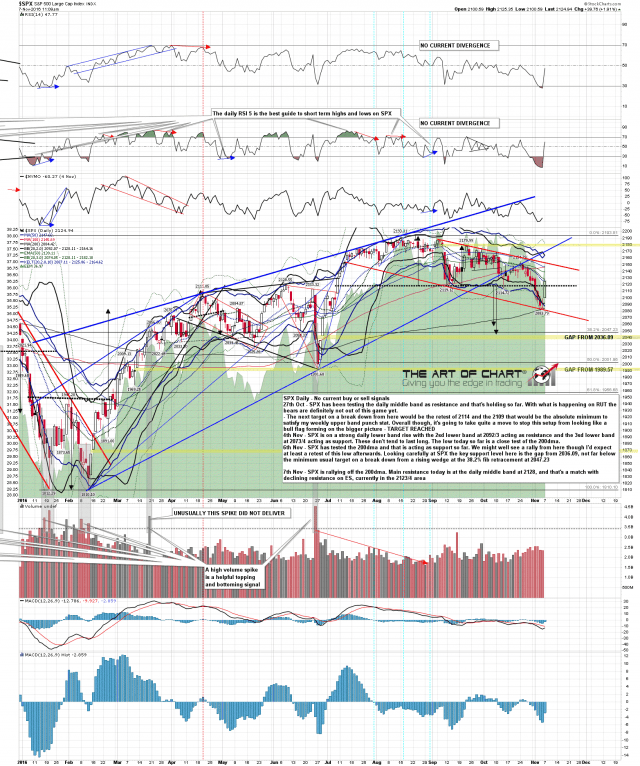

I was saying on Friday morning that the type of lower band ride that SPX was on tended to end with a powerful rally, and that an obvious place to start such a rally was at the test of the 200dma, and here we are, looking at a powerful rally off Friday’s almost perfect test of the 200dma. So far today this is a trend up day on SPX and that may well be the case all day, though SPX is now very close to testing important double resistance at the SPX daily middle band and 2128, with ES declining resistance at 2123/4. It’s possible that this rally might come to an abrupt stop there, so I’m watching that test with great interest. SPX daily chart:

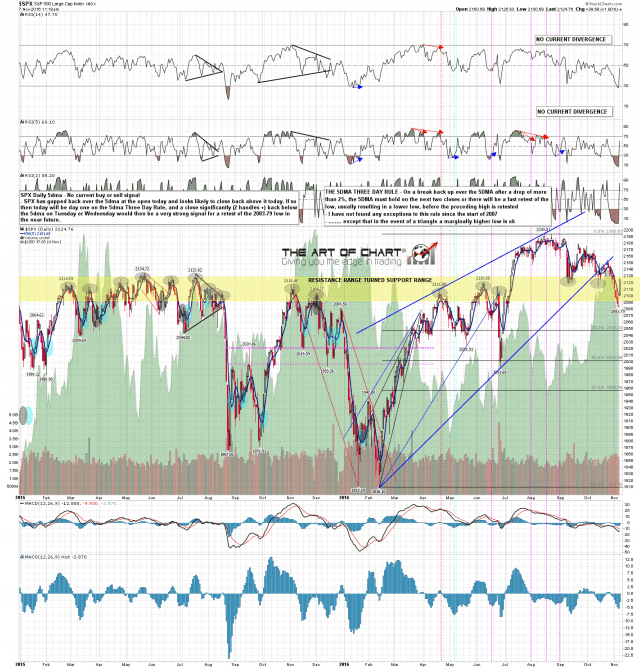

With this morning’s gap up over the 5dma at 2101/2 SPX looks very likely to go back on the 5dma Three Day Rule today, as long as it doesn’t fail to close above that today. Assuming that is the case then the rule is that if SPX closes back (2+ handles) below the 5dma on Tuesday or Wednesday this week, then we should see a retest of the 2183.79 low shortly afterwards. I think that may well be what we see, election news permitting. SPX daily 5dma chart:

There will be a lot of market moving news this week, which I’m very wary of, and if you’ve been looking for a good time to go fishing for a couple of days, then I’d suggest that this might be a good time to do that. The tape is already rough, and may well get rougher as the election news develops.

We did our monthly public Chart Chat at theartofchart.net yesterday, and if you missed that, then you can find the recording for that on this page here. This week’s Weekly Call is posted here looking at setups on the futures for Live Cattle (LE), Gold (GC) and Coffee (KC). Last week’s setups did extremely well, and that happens a lot on this free to all service, so if you can trade a variety of instruments then I’d suggest taking a look.

We’ve also been killing it on our new Big Five service covering AAPL, AMZN, FB, TSLA & NFLX since we launched it a few weeks ago & did particularly well with it last week with the big declines on AMZN & FB that we were expecting it. Killing it so far this week too. Stan’s working up a promo on that this week & I’ll be posting that as soon as it’s ready.