My expectations for the bears yesterday weren’t high, but they put in a decent showing, and they have a chance today and tomorrow to deliver some extremely overdue retracement. Tomorrow is the only day this week that leans bearish historically, in part or mainly because it is the frequently bearish last trading day of the month. Obviously Thursday leans bullish as the first day of the month.

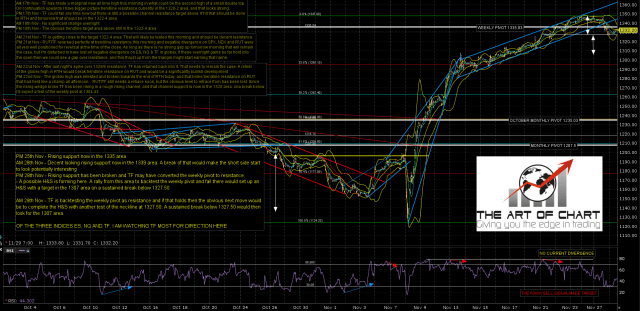

The main chart that I’m watching here is the TF chart, and a decent quality H&S has formed there looking for the 1307 area on a sustained break below yesterday’s low at 1327.50. Since I capped that chart TF has backtested the weekly pivot, completed the H&S pattern and is now testing the neckline. Unless TF breaks back over the weekly pivot at 1335.8, my working assumption is that the H&S will play out. TF Dec 60min chart:

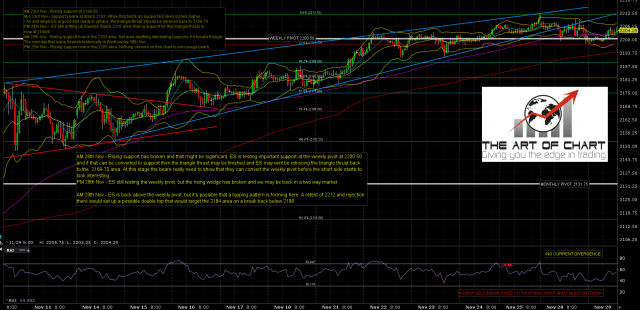

ES hasn’t retested the high as I was thinking it might. That means no high quality reversal pattern here but there is unfinished business below at 2168-70 and if the H&S on TF breaks down then that might be the target on ES. Important resistance today is at the weekly pivot at 2200.50. That was the main battleground yesterday and may be today as well. ES Dec 60min chart:

Our expectations for the move aren’t big, and we’re expecting further upside after the retracement. I’ll be watching for a decline pattern to form if we see that retrace here, and if I find one I’ll be posting that on twitter as and when it breaks up.