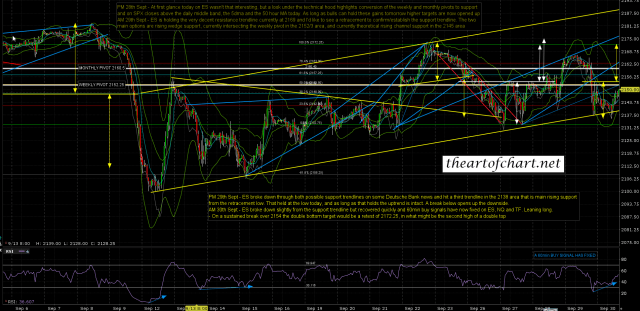

The bears didn’t have a good day yesterday, with a larger than expected decline on the indices, and clear breaks at the RTH on SPX close back below the daily middle band, the 50 hour MA and the 5dma, and ES losing the key weekly pivot area at 2152.25 that I highlighted as a key close area on a tweet yesterday afternoon. With the historical stats for the last day of September leaning 75% bearish, and the indices resting on key support levels the odds of the ATH retest on SPX that Stan and I have been looking for definitely looking lower, and you can see that reflected in the tone of my comments last night on the charts below.

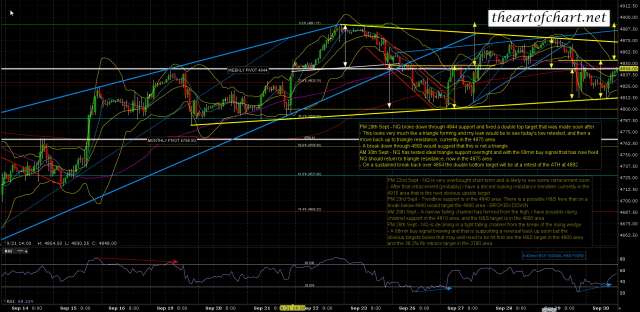

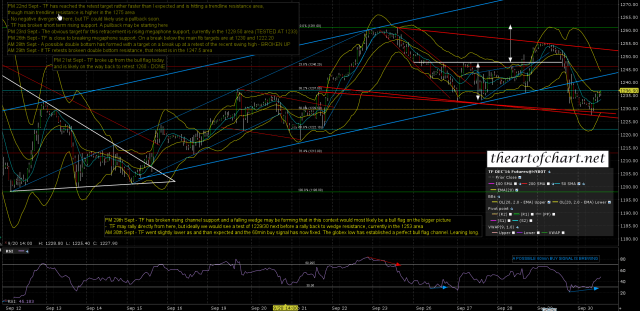

Overnight though the picture changed entirely, with marginal new lows and 60min buy signals fixing on ES, NQ and TF, and with a triangle confirmed on NQ and a perfect bull flag channel established on TF. On my premarket video for subscribers to the Daily Video Service at theartofchart.net today I was leaning strongly bullish, and I’ve not seen anything since then to change that view. I’m thinking 50% odds or better that SPX trends up today. The direct link to that video is here. Hopefully some of you saw that when I posted that link on twitter before the open today.

60min buy signal fixed. ES Dec 60min chart:

60min buy signal fixed. Likely bull triangle forming. NQ Dec 60min chart:

60min buy signal fixed. Clear bull flag channel established. TF Dec 60min chart:

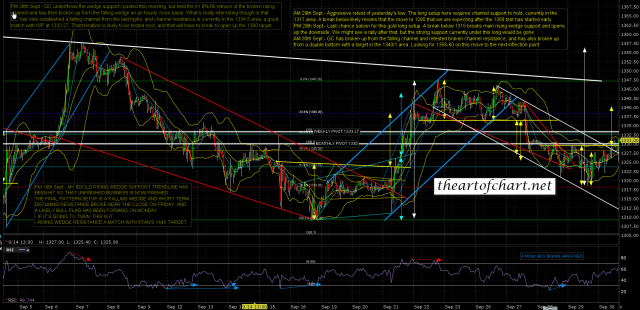

The action on GC overnight was strongly supportive of the expected move to the 1355-60 area. Unless GC breaks below yesterday’s low at 1317 this morning I’m expecting to see that made. For anyone trading this with me I have a hard stop just under yesterday’s low, as a break below opens a possible test of 1280. GC Dec 60min chart:

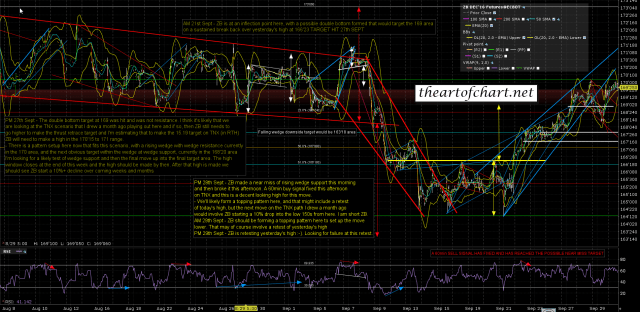

ZB retested Wednesday’s high as I suggested in yesterday morning’s video. I have initiated a short at 170 looking for a 10%+ decline in ZB from here to 153 or lower. I’ll be taking some profits on the way down of course and the move is likely to take several weeks at least. ZB Dec 60min chart:

Everything going as planned so far today. I’m expecting that to remain the case. We’ll see. Just a reminder to all that Stan and I are doing our monthly public Chart Chat on Sunday looking at the usual 35 or so instruments across a wide range of equity, commodity, forex and metals markets. If you’d like to attend you can register for that on this page here. If you dislike seeing top quality technical analysis in action, or you prefer to trade in ignorance of the higher probability paths on price, I would suggest you not attend as our forecasts may spoil the surprises for you on price next month. Everyone have a great weekend 🙂