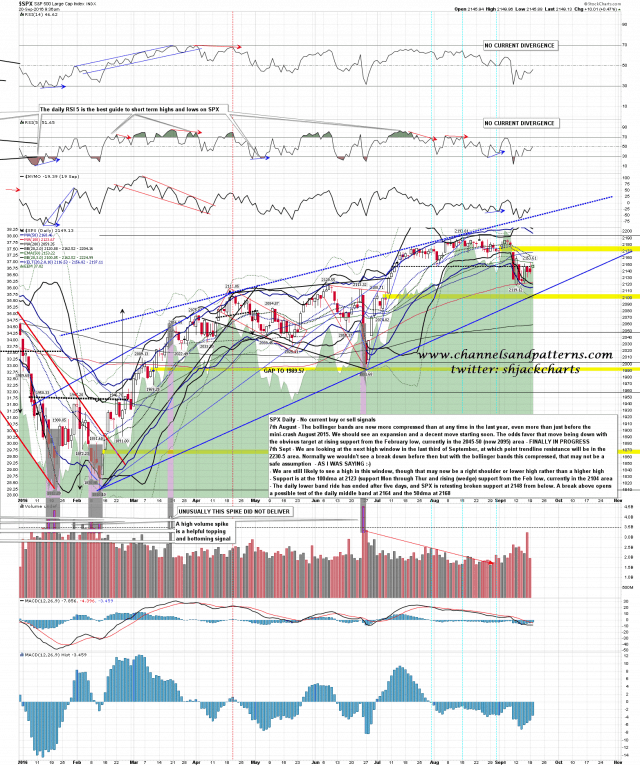

The bulls met both of the targets that I gave them yesterday morning in that the 50 hour MA was converted to support and the close was above the 5dma, so the three day rule expired without a bearish break. Somehow though they managed to do that without inspiring any confidence that this uptrend has real legs. If it has at least some legs then I’d be looking for a test of the daily middle band next, currently at 2162. SPX daily chart:

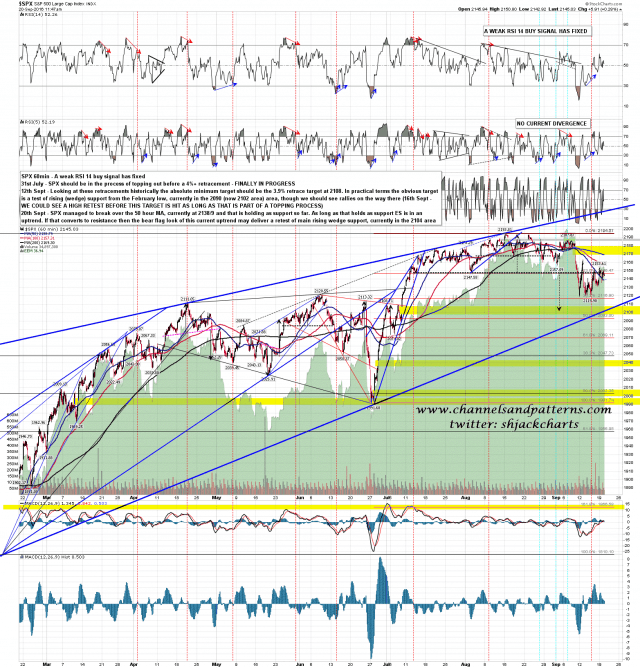

Key support here is the 50 hour MA in the 2138/9 area, supported by the ES weekly pivot at 2129.50. That support zone is the key bull/bear area for today. That’s holding so far. SPX 60min chart:

It may be that SPX is going to be something of a yawnfest until FOMC is out of the way. We’ll see.