My apologies for the lack of a post yesterday and the late post today. Yesterday sort of ran away on me and I badly overslept this morning having been working much of the night. Hopefully some of you caught the premarket video that I tweeted yesterday morning, and the tweet I sent close to the globex lows noting that the double top targets on both NQ & TF has been reached, and that I had no open pattern targets looking lower. If you aren’t following me on twitter and you’d like to, my twitter handle is shjackcharts.

The overnight action was wild, but was almost entirely confined to globex, leaving a very strange situation where I have open double top targets on NDX and RUT that have not been made, but my lower double top targets on NQ and TF have been made. Equally the broken rising wedges on SPX and RUT have not yet come close to the usual minimum target at the 38.2% fib, but on ES and TF that target was tested overnight and there was a strong reversal back up there. Given that I generally take the RTH indices as the primary setups this is a very unusual and interesting conundrum which is definitely giving me something to think about here.

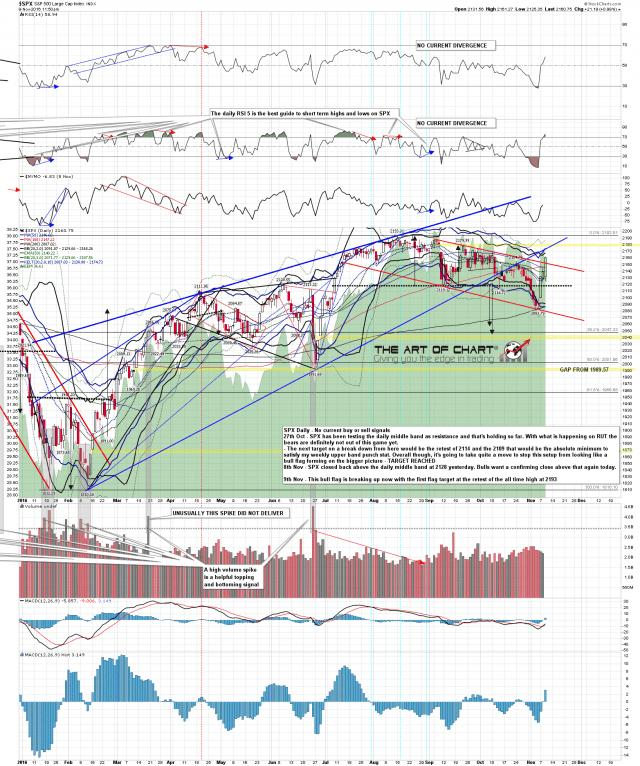

What are the RTH indices telling us today? Well I was saying in late October that any move down on SPX would need to be impressive to stop the setup here looking like a bull flag. That flag falling megaphone has broken up today with the obvious target at the retest of the all time high at 2193/4, though as I’ll mention later that target is a bit suspect. SPX daily chart:

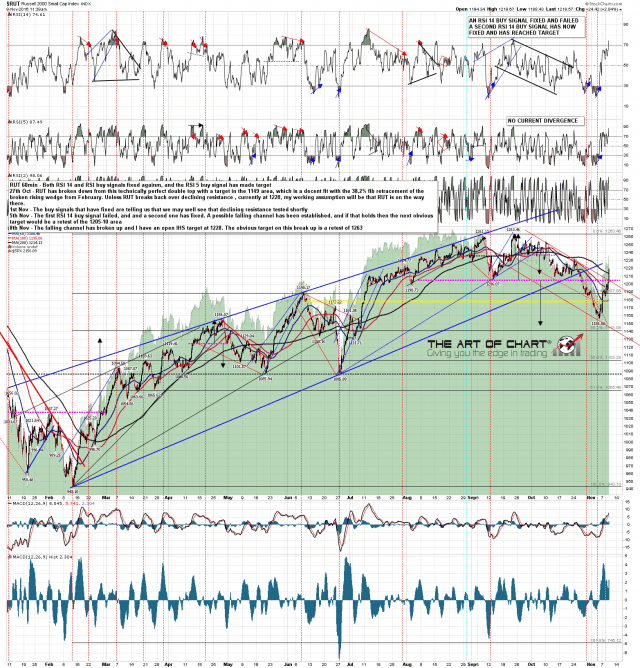

There is another bull flag setup on RUT, and my upside target for a rally here was a test of that falling channel resistance with broken double top support at 1203/4. That test was made today and RUT broke up through it. As I mention on the chart that confirms a small IHS target in the 1228 area and the first flag target is obviously a retest of 1263. RUT 60min chart:

Stan however takes his lead from the futures charts rather than the RTH charts, and what he is seeing here is a wave B rally with an ideal target in the 2175 ES area (about 2079 SPX) before a hard reversal back down in wave C. Given that Stan called the likely rally target at 2151 ES on Monday, with the high last night at 2152, and called the decline from there back to the 2060s in his video last night (for Daily Video Service subscribers at theartofchart.net) before the 2152 high, I’m taking that very seriously, though that move likely happened a bit faster than expected and overshot a bit to make those double top targets on NQ and TF. I’ll be looking for possible resistance there.