The time to be getting afraid was when the market ramped and sentiment was pinging to over bullish after the Brexit sentiment reset to over bearish had sprung the rally. Now it is too late to start getting the willies because we have full frontal FOMC and the most disgusting, divisive and plain sad election of my lifetime; a lifetime filled with disgusting electoral choices.

Ooh, the economy is okay and inflation signals are bumping up… the Fed’s gonna raise rates in December! Trump might win and the market is gonna hate that!

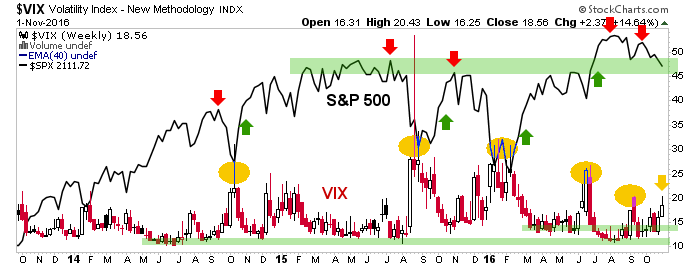

Just calm down. If you are part of the herd you are supposed to be anxious now. It’s how markets work. If you are not part of the herd then it’s all good and it’s all in line with current plans. Or as NFTRH 419 noted with respect to the following chart…

The VIX is still tame despite the slow leak down by stocks. That is not bullish. Bullish is when people panic, buy already expensive downside insurance (buying volatility, puts, etc.), things get over bearish… and then they rip the thing the other way.

Okay, so now insurance is getting more expensive…

The market is bearish in the short-term because it was supposed to be bearish in the short-term (per our plans anyway) and now people are herding bearish because they are supposed to herd bearish. Of course, there really are not any supposed to’s in a deranged entity like the stock market (driven by millions of men, women, quant machines, casino patrons and substance abusers) but still, if you don’t have plans born of consistently hard work, you don’t have much. What you’ve got is a card carrying membership in the herd.

The short-term view, which we’ve had in play for 2 months now, is playing out perfectly. But there is a part 2 and it is directly ahead. It’s going to be for all the marbles in the ‘bull vs. bear’ sweepstakes, because the thing we have now is simply a shakeout to an important test.

Subscribe to NFTRH Premium for your 30-45 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter @BiiwiiNFTRH, StockTwits or RSS.