Note from Tim: in the name of balance, here’s a contribution from New Guy:

I wanted to make a quick case for why I believe the market is offering a favorable buying opportunity today. While some are approaching this recent price weakness as the beginning of a meaningful move lower, I think it is more likely that this is the end of a very mild dip.

My basic argument is that we are in the midst of a very healthy bull market. In a healthy bull market, we should keep taking advantage of oversold, low-risk opportunities until they stop working.

Healthy Bull Market

While major indices hover underneath their all-time highs, the stock market has been even stronger under the surface. This is evident from breadth:

Breadth has been clearly making higher highs and leading price. Breadth measures advancers-decliners and gives a complementary picture of overall market health.

Confirmation in breadth is one necessary ingredient of a healthy bull market. Even as prices have meandered sideways since late September, advances have continued to outpace outflows.

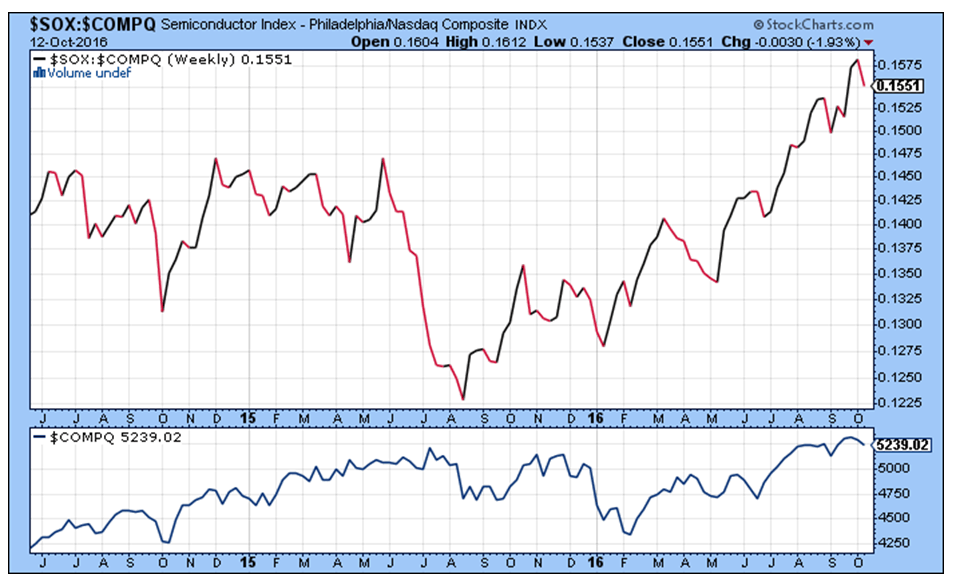

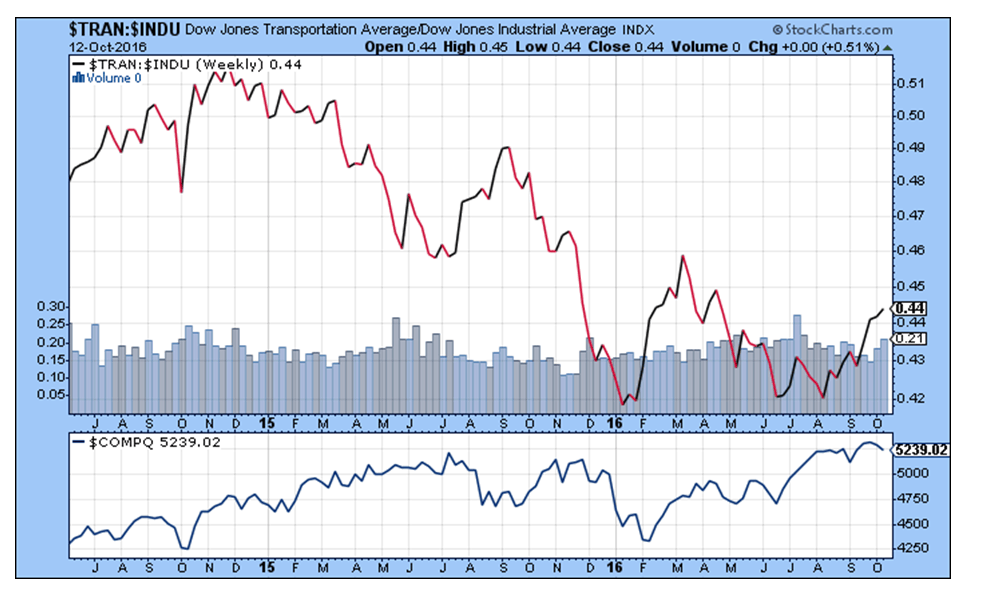

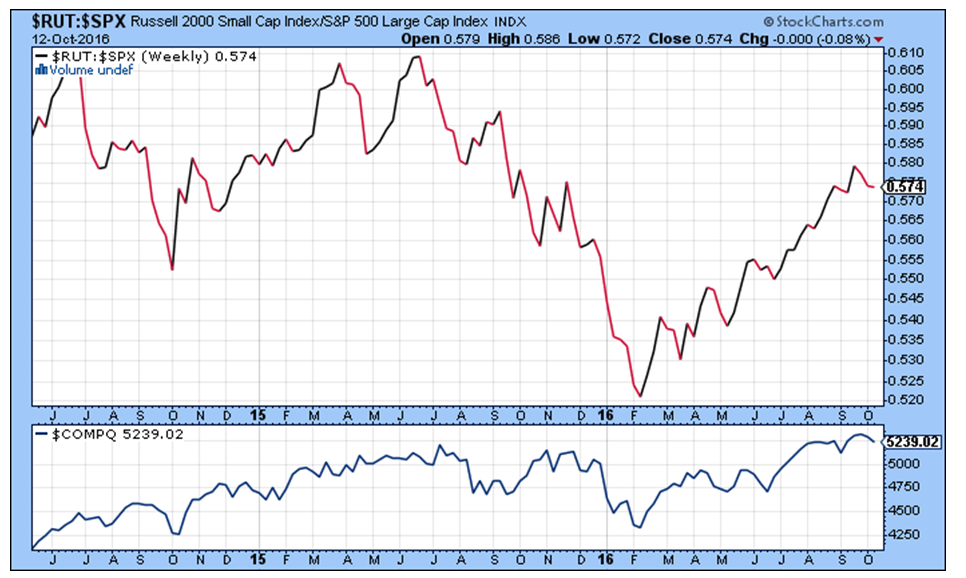

Another component of a healthy bull market is leadership from economically sensitive areas. Semiconductors, transports and small-caps have been leading the Nasdaq, the Dow Industrials and the large-cap indices. Advances in which these are leading tend to be more favorable to bullish setups.

The strength in breadth and leading sectors confirm the strong price performance of the stock market since February. Until these falter, traders should give more focus to taking advantage of buying opportunities.

Oversold Market

Some may dispute the characterization of this market as oversold. It can only be said it is oversold through short-term measures.

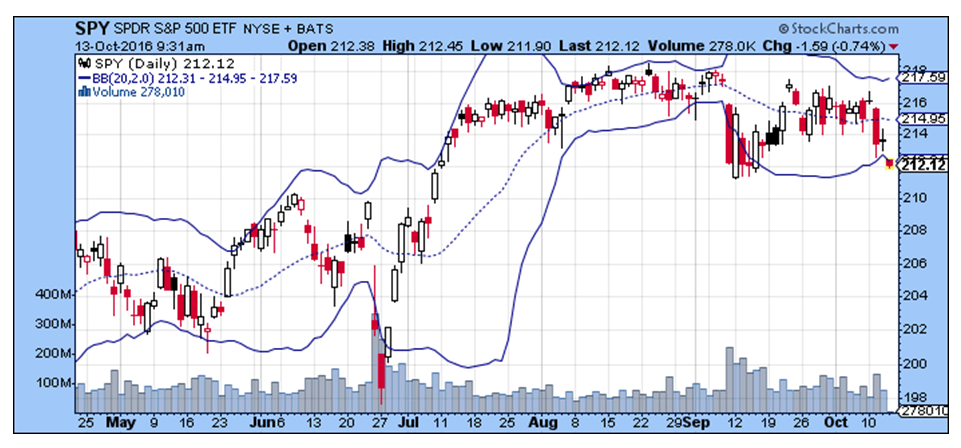

SPY has opened close to its daily Bollinger band. Sometimes, this can be an area where buyers step in and at other times, it means nothing. An implicit wager on this trade is this signal is more meaningful in healthy market conditions.

NYMO has also reached oversold territory, where a bounce should not be surprising.

Strategy

I will be aggressively bullish above 211 on SPY. I will look to add stocks with good fundamentals that are under accumulation.