I confess I’m getting very impatient for some downside action. This damned market cannot seem to sustain a selloff, although I suppose I’m supposed to be grateful that we’re not lurching to lifetime highs anymore.

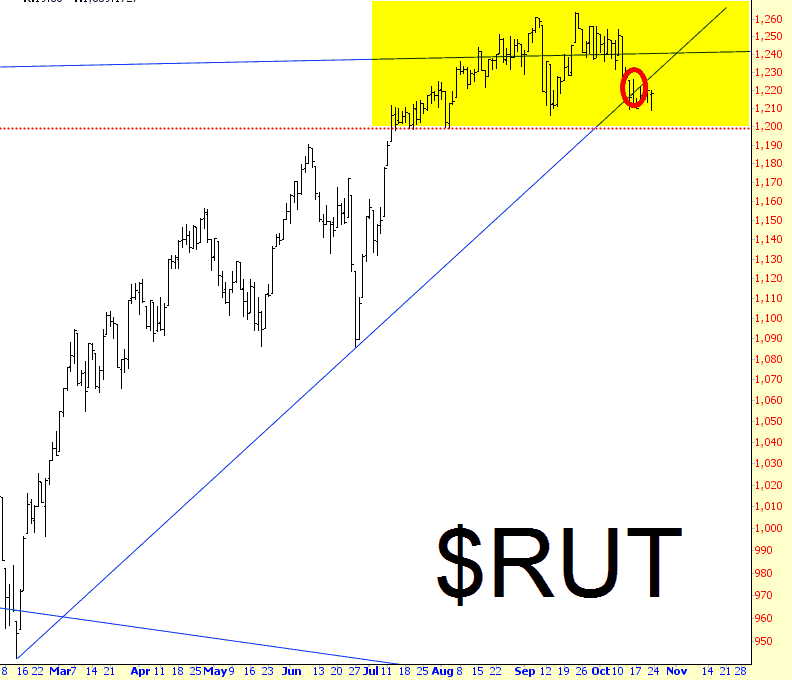

Every index is sporting the same two vital elements: (a) a broken trendline which began early this year (b) a cluster of recent activity, in some instances in the form of a triangle, which needs to be broken in order to really get things falling. Here, for instance, is the Russell 2000 showing the broken trendline (red circle) and the “stall zone” (tinted):