I confess I’m getting very impatient for some downside action. This damned market cannot seem to sustain a selloff, although I suppose I’m supposed to be grateful that we’re not lurching to lifetime highs anymore.

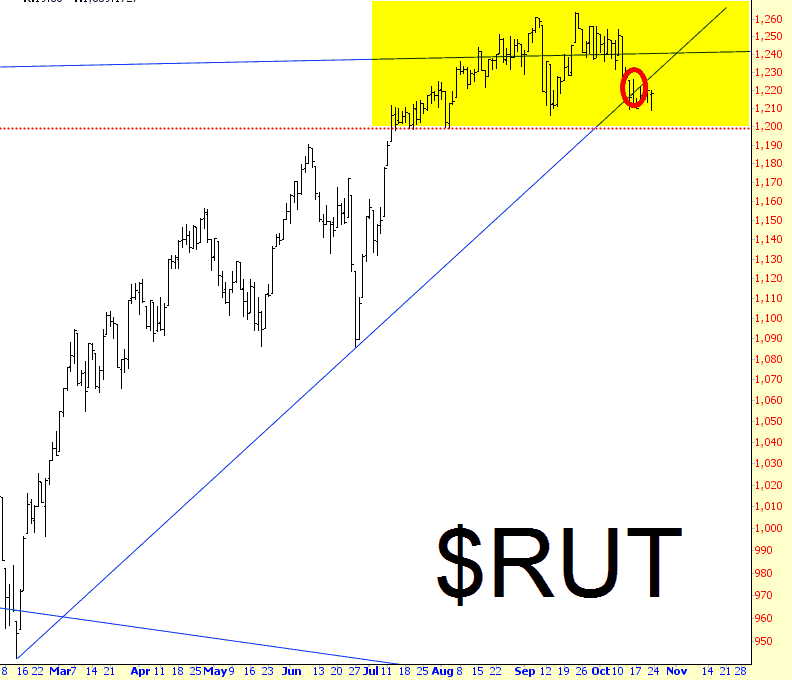

Every index is sporting the same two vital elements: (a) a broken trendline which began early this year (b) a cluster of recent activity, in some instances in the form of a triangle, which needs to be broken in order to really get things falling. Here, for instance, is the Russell 2000 showing the broken trendline (red circle) and the “stall zone” (tinted):

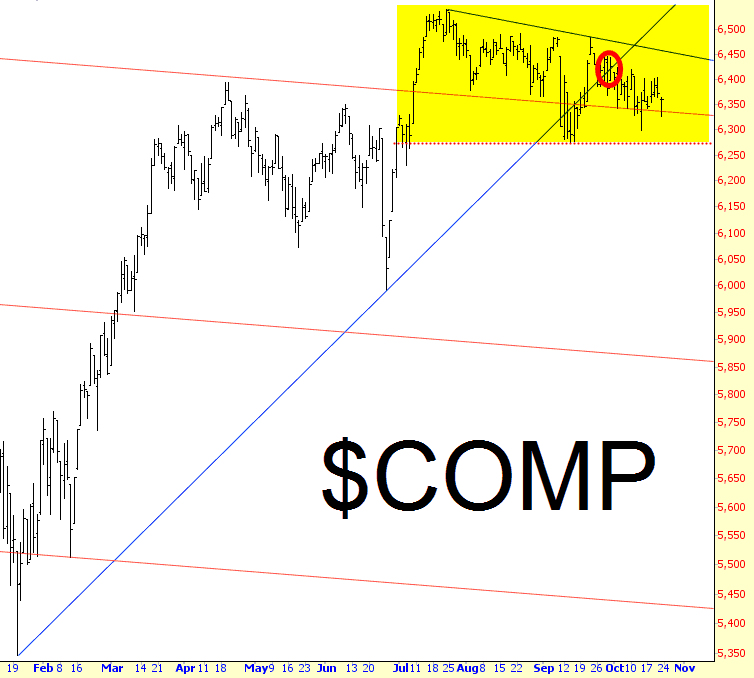

The same is shown for the Dow Composite, which has the aforementioned triangle pattern:

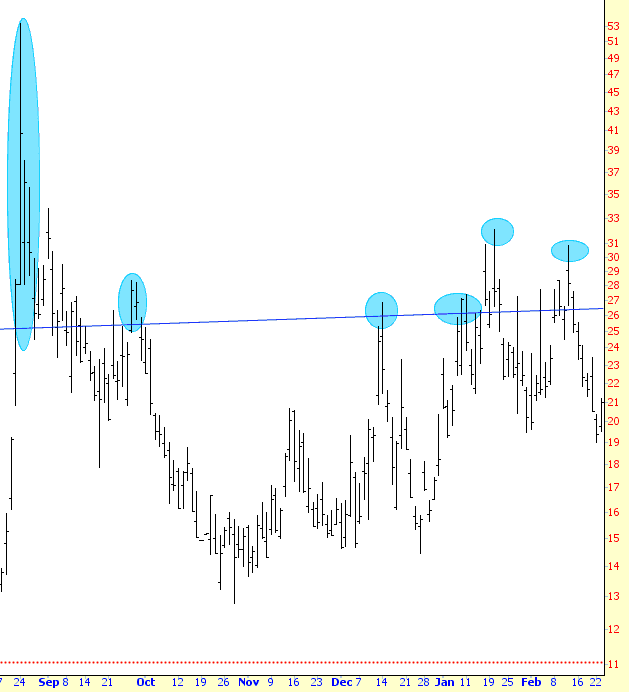

It wasn’t that long ago that mini-panics were becoming fairly regular, which you can see by way of the VIX:

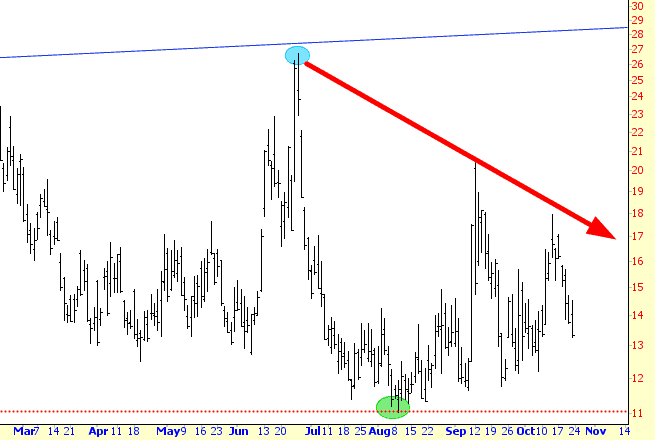

For the past nine months, however, we’ve been in a stinking dry spell, without a single instance of a VIX getting even above the 20s. Indeed, the highest we got was only about 27 when the Brexit surprised happened, and since then (red arrow) it’s just been deathly.

C’mon, planet Earth, can’t you throw Tim a terror bone? A surprise Trump victory? A nuclear attack? Give me something to work with here, people!