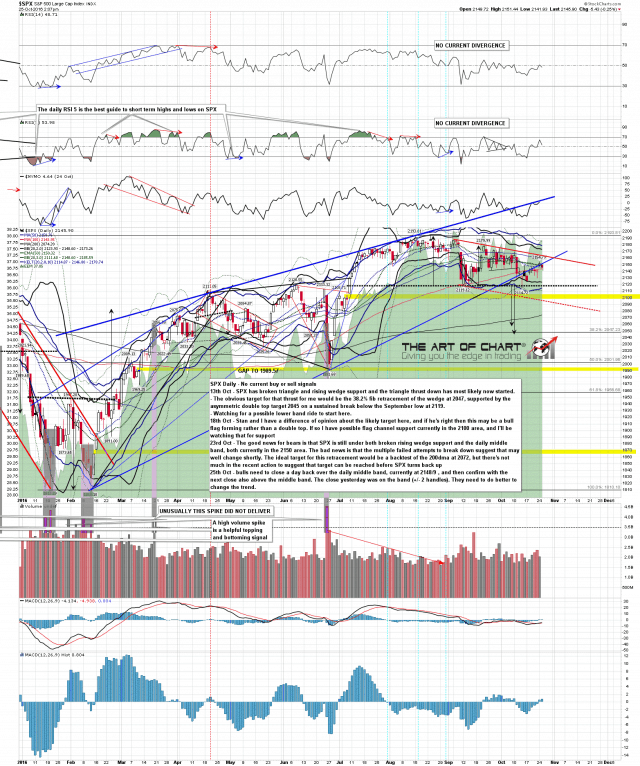

With the state of post-Op/Twist systemic dysfunction, there are no absolutes, but…

Generally, a rising yield curve (after years of Goldilocks and her favored declining curve) would signal changes in financial markets. But it is not as simple as stating ‘the curve is rising… it’s bearish!’ or ‘the curve is rising… it’s bullish!’. It is potentially both of those things and it will have different implications for different markets and asset classes.

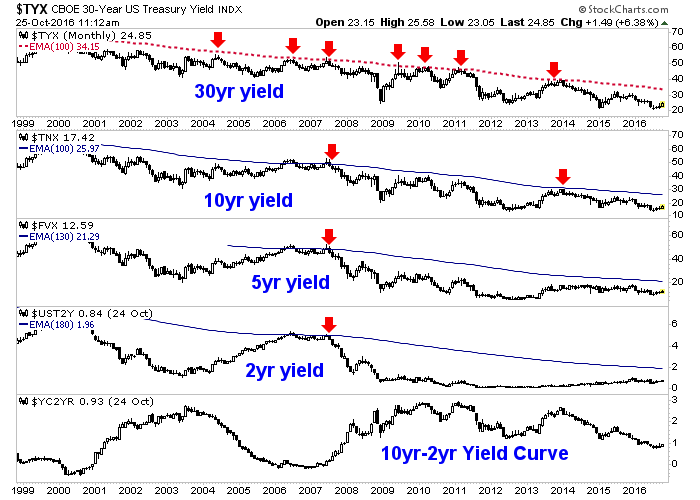

First, here is the state of yields and the yield curve currently, on the big picture view. Trends are down in the deflationary continuum on the biggest picture for all items, but have been neutral on the 5yr and somewhat up on the 2yr ever since Goldilocks gulped the bears’ porridge in 2013. The yield curve is in a downtrend.