The tape on ES/SPX has been really dull for a few months now. Usually when this kind of volatility compression happens we get a proportionate expansion in one direction or the other afterwards which restores the balance, but we haven’t seen that yet and I’m considering the possibility that may not have happened so far because it’s not going to happen at all. If I struggled with insomnia I’m sure I would appreciate the tape we’ve been seeing in the afternoons lately, but I don’t, so these have been wasted on me.

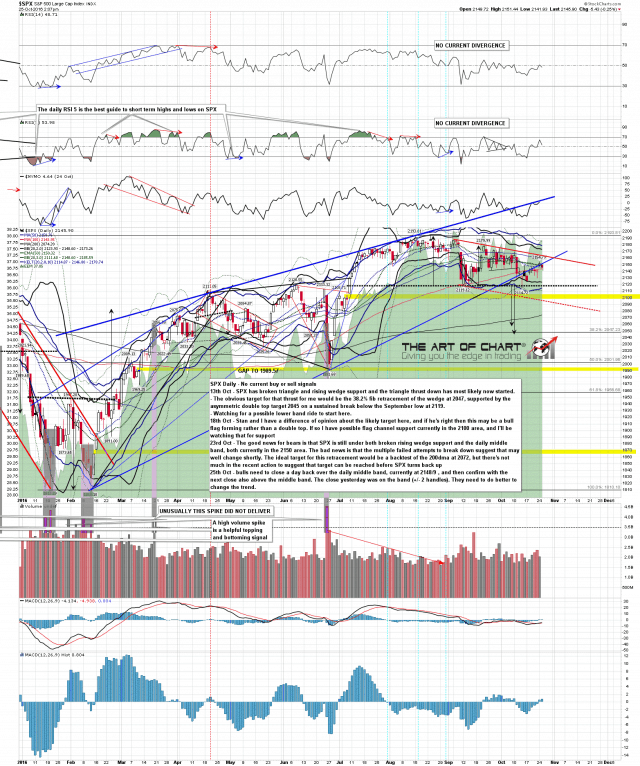

In order to flip the trend back to bullish the bulls need to wake up enough buyers to deliver a definite close over the daily middle band. They failed to manage that yesterday, and at the time of writing I’m not optimistic about their chances of managing it today. If they do manage a close back above the middle band in coming days they will then need a confirming close above on the following day. SPX daily chart:

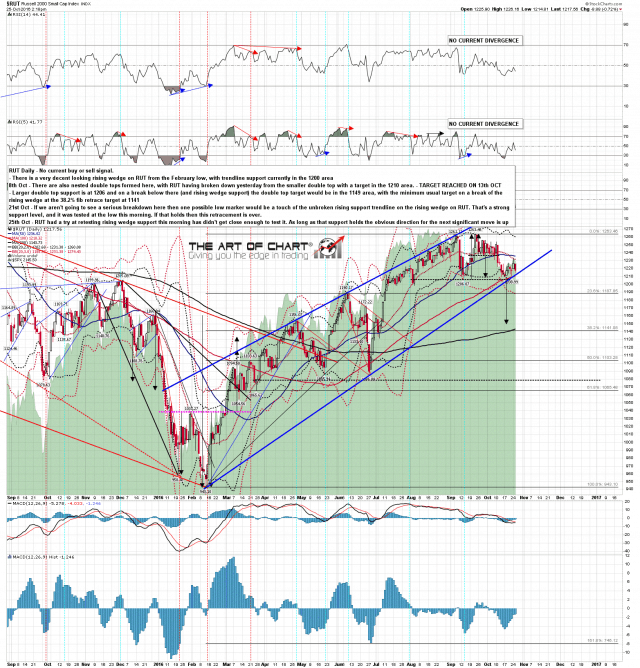

In order to open up the downside the bears need to wake up enough sellers to break rising wedge support on RUT, as if the low there last Friday holds the options for further downside are very limited. That was almost retested at the lows this morning, but not quite, so they failed to manage that today, though I was starting to wonder if they might manage it. RUT daily charts:

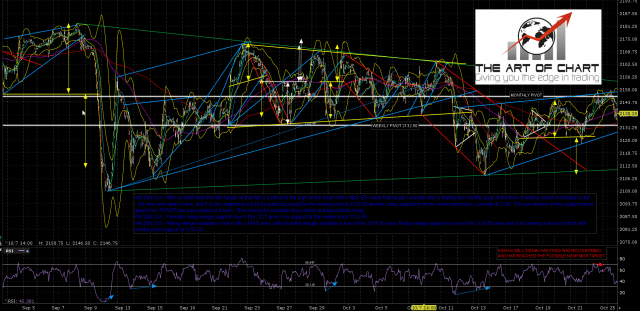

On the ES chart the move up from the retracement low is a pretty clear rising wedge, and at the time of writing wedge support is at 2129.50. That’s going to be a decent match with the weekly pivot at 2132.50 (approx 2127.50 SPX) tomorrow morning and may need a test. ES Dec 60min chart:

Hopefully at some point in the next few days somebody will manage to do something interesting on equity indices. The cycle charts are favoring the bulls for the next move.