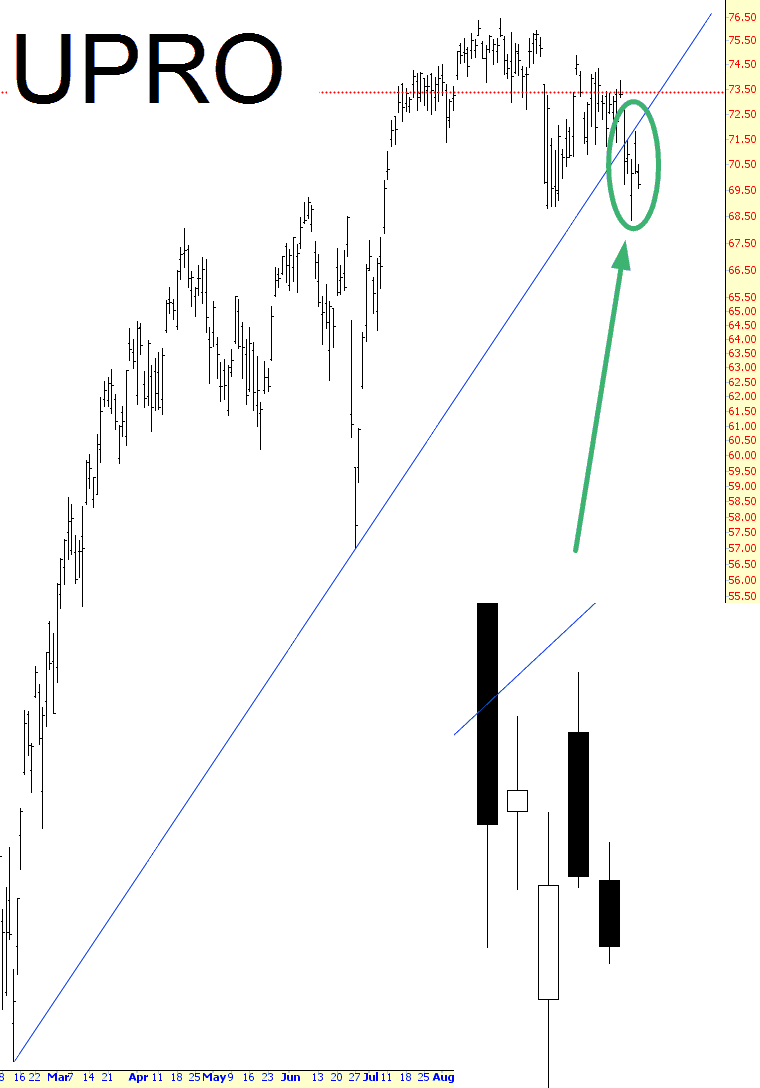

The following is an excerpt from the Market Sentiment & Internals segment of the October 16 edition of Notes From the Rabbit Hole, NFTRH 417, which also included technical analysis of US and global stock markets, precious metals, commodities and currencies and macro/market indicator analysis for an overall cohesive view on markets (which still appear in process to the favored plan of an inflationary phase after the expected market disturbance currently ongoing, plays out).

Up Volume has been draining and market breadth has been fading (ref. NYSE Advance/Decline page 10). This is a far cry from the Breadth Thrust we noted in the summer (thank you again to subscriber LN). Per LN’s analysis, the implication was for a temporary rally then further evaluation with the potential for some very bearish activity similar to 1987 (ref. Breadth Thrust: Prelude to a Crash? posted on July 12).