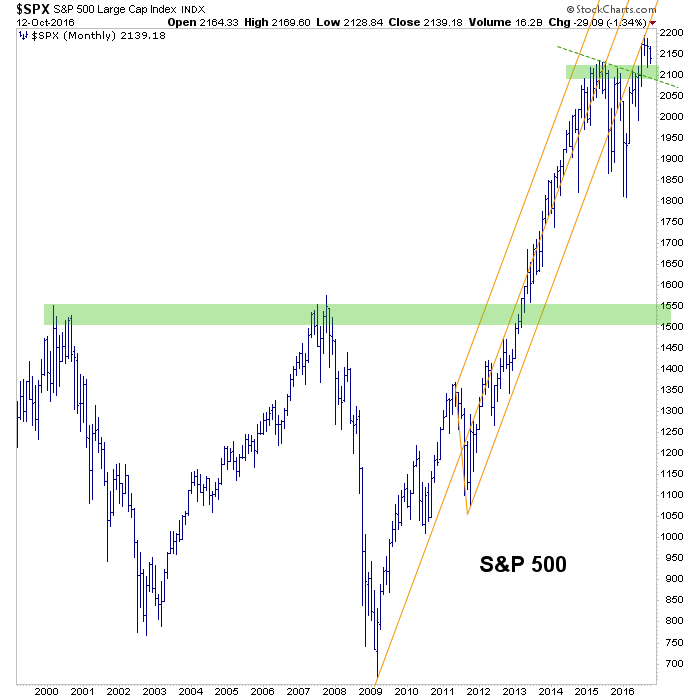

Because perspective is everything, let’s once again get some big picture perspective…

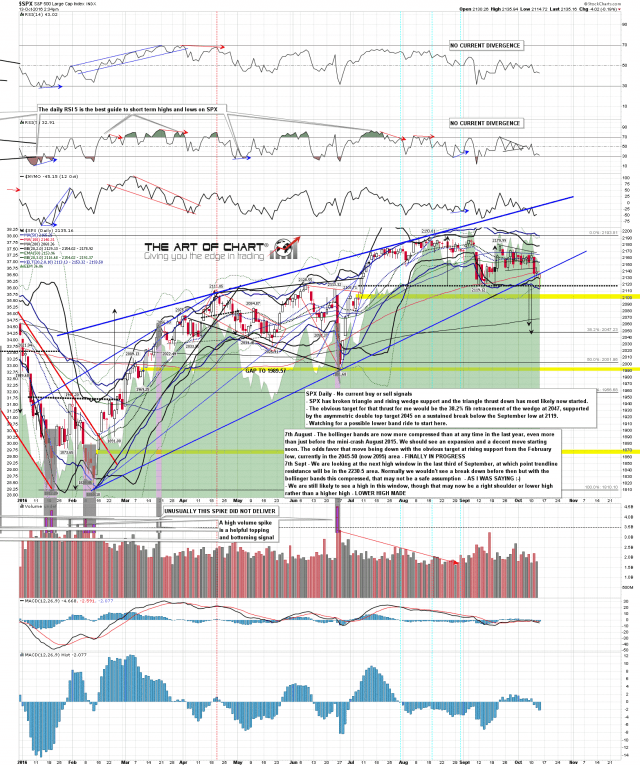

S&P 500 is outside the lower fork line (again the Fork being a novelty, but the line being real) but above critical support. Bears would call this an overthrow to the upside and massive bull trap. We can call it an intact bull market above support and a very bearish market should that support be lost.