by Avi Gilburt, ElliottWaveTrader.net

First published Sat Oct 15 for members of ElliottWaveTrader.net: We have many analysts and commenters posting many different perspectives on the metals for years. Some view them as a terrible investment and others view it as the only reasonable investment. I am not going to discuss the merits or fallacies contained in both of their perspectives, but I would like to simplify the potential in the complex for the average investor.

You see, this complex is not that complex at all. Sentiment is what controls this market, and when sentiment reaches an extreme, the market shifts in the opposite direction. That is what we are patiently awaiting at this time.

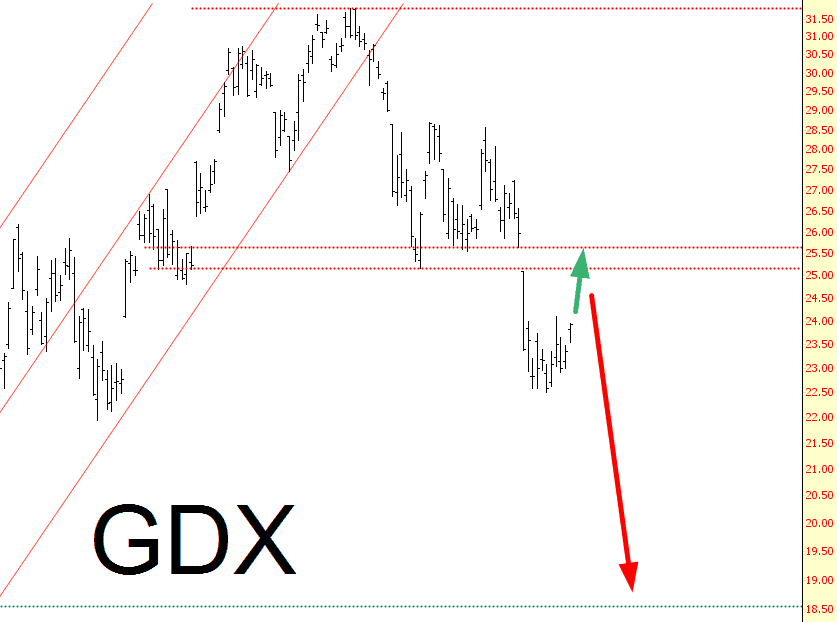

Currently, our wave structure suggests that we can see one more lower low to complete a 5th wave in a c-wave of this wave ii pullback. While I certainly can be wrong in this assessment, this is my higher probability wave count at this time. And, as long as we remain over support, I will maintain this count and expectation.