by Avi Gilburt, ElliottWaveTrader.net

First published Sat Oct 8 for members of ElliottWaveTrader.net: I am going to begin this update with a very simple proposition: get your shopping list in gear, as the time to buy is upon us.

Last weekend, I noted the following:

As far as the actual charts are concerned, I still see nothing that suggests this correction has run its course. Yet, every time the market provides even the slightest rally, many in the market begin getting overly bullish. Yet, many of the sentiment readings I have been seeing in the metals are dropping to levels approaching that which can propel us into the heart of the 3rd wave higher. But, I still think there is room lower in those sentiment readings before a final bottom is struck.

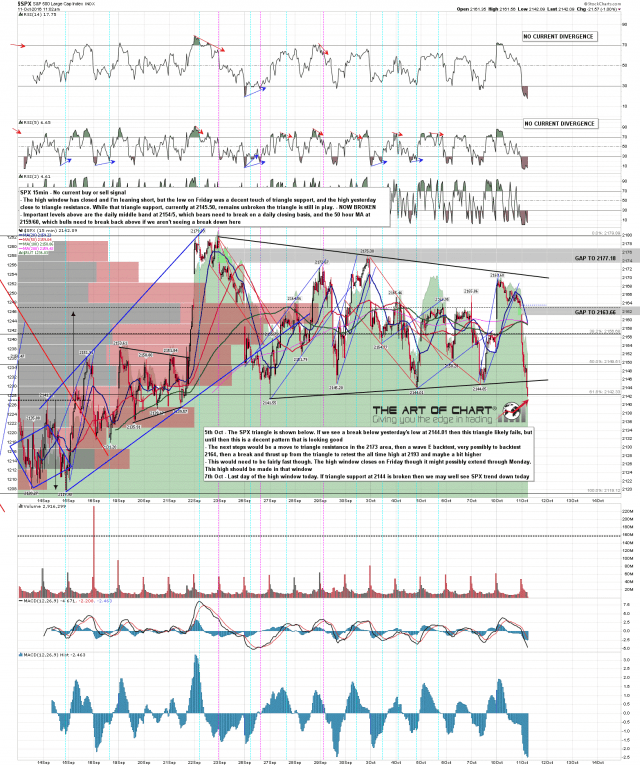

As far as immediate support levels to watch, last week’s low in GDX and silver are quite important to the continuation of the b-wave triangle. But, ultimately, the line in the sand for me resides at 123.75 in GLD, 25.35 in GDX, and 18.60 in silver. A break below these levels provide us with a high probability signal that we are within our final drop to complete this correction in the metals complex. But, as long as we remain over those levels, we may continue to see whipsaw before those final lows are struck in the coming weeks.

The market resoundingly broke all those levels as we have been expecting, and dropped in the heart of a 3rd wave in the c-wave down this past week. And, when the market completes the heart of a 3rd wave in a c-wave down, it tells us that what remains in this correction are only 4th and 5th micro waves. That is what we view as a bottoming process, wherein the market develops the positive divergences we need to see at lower lows to set us up for the next rally phase. But, it also represents the point in time when most begin to really turn bearish the complex, and begin to believe that we will break below the January 2016 lows. Bearish sentiment will likely be extreme, and that is further confirmation of the bottoming process we want to see.

This now has me turning to my 144-minute silver chart. This chart has been the best bottoming indicator in the complex. We have caught every smaller degree and larger degree bottom in the market using this chart. What we are looking for is the completion of a 3rd wave down, and the start of the positive divergence set ups as the market strikes lower price levels. For now, this chart suggests we “should” see at least one more lower low before this correction has run its course. And, I believe that the next lower low on a positive divergent bottom is a strong buy signal for our next major rally phase that we are expecting. But, as a caveat, I do have to note that Friday’s slightly lower low was made on a positive divergence, but the pattern to the downside just does not look complete.

Now, onto the bigger degree charts. There is a change I have decided to make in the larger degree silver and gold charts. I have decided to align those counts with the one in the GDX. That means I have modified the counts to align as i-ii set ups in wave (1) of a much larger degree 3rd wave in the complex. And, in silver, it means I am counting the rally off the lows as a leading diagonal. While this does not really change our upside expectations into 2017 (as long as we hold support), it just slightly changes the wave degree I have designated to the current chart action.

(more…)