Hello from seven miles above Colorado, as I am winging my way to MoTown. Instead of my usual griping and moaning, I’ll take on a hopeful tone about next week and say that we bears could finally get our day in the sun.

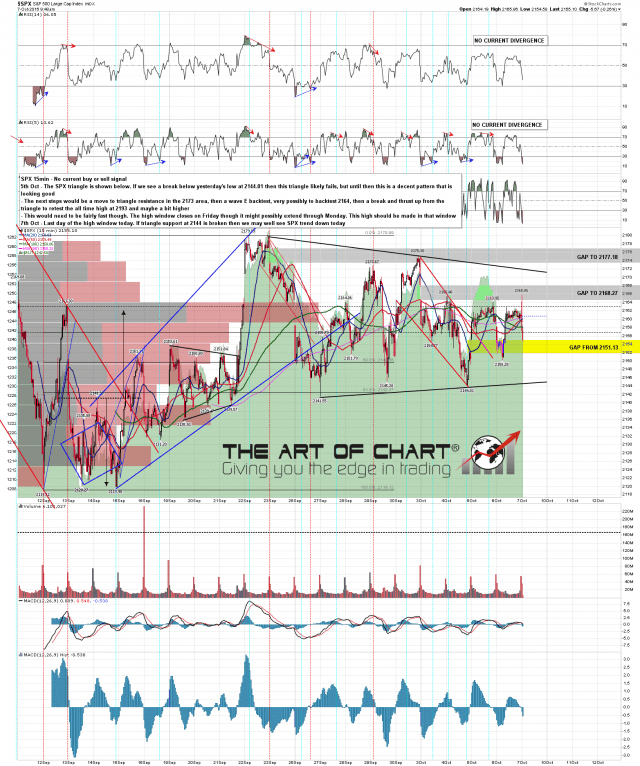

Chart after chart all shows the same thing: there is a trendline in place since February 11 of this year which is right at the cusp of failing. (In a few cases, like the Dow 30, it has already failed). What I’m watching most closely is the ES. A drop beneath the level I’ve highlighted below (about 2132) would do the trick.

I’m positioned with 57 different shorts. I still think President Pantsuit is going to win, but I’ll be watching the ES on Sunday night while the debate is going on to see if Trump can produce a performance that isn’t absolutely horrible like his first time out.