The latest data from Obama’s limp, flaccid, faux-recovery just tumbled off the presses, and unemployment is back to 5% (which, let’s face it, is a miracle, since the Labor Participation Rate is 62.9%), so the BLS might as well just say unemployment is 0% and be done with the charade. Tens of millions of people are out of work and will remain so.

The market doesn’t know what to do with this data. In the few minutes I’ve been standing here watching, the ES and NQ have whipped from red to green several times. ZeroHedge has a series of graphics showing that, month after month, the market closes up green whether the numbers are a “miss” or a “beat”, so maybe this is just an algo-circle jerk until the day’s steady gains kick in. Hope springs eternal in the bearish breast, so obviously I’m hoping the obviously weakening economic data could actually create a few red numbers today.

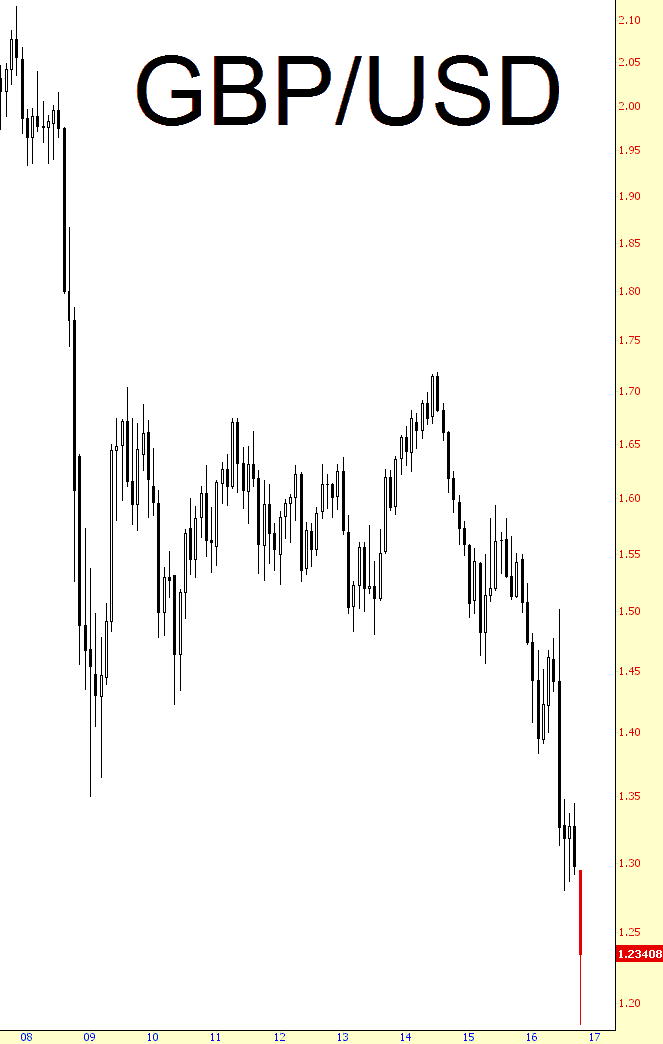

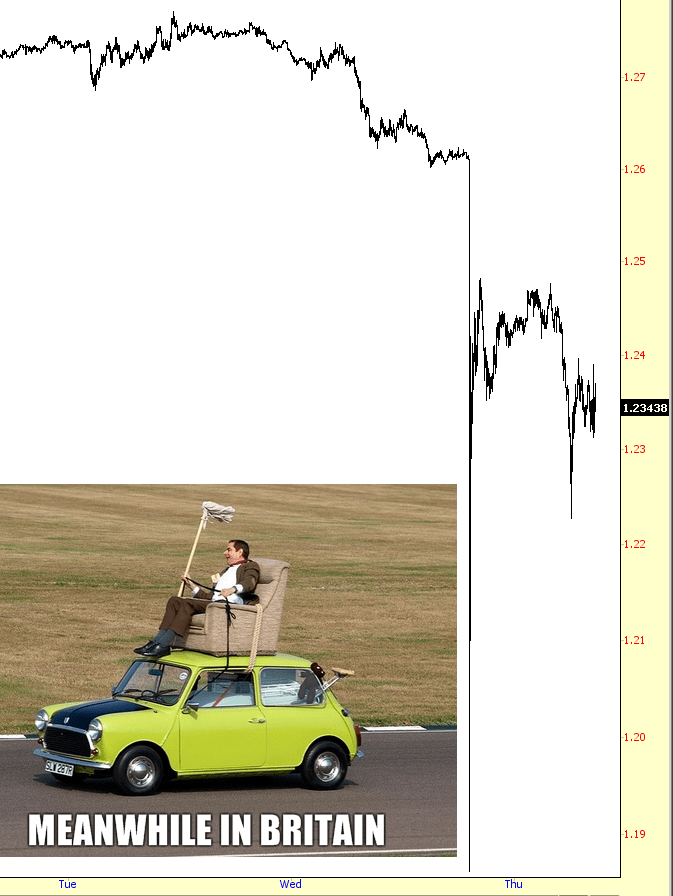

Last night, the British Pound flash-crashed, and it’s quite a sight on the intraday chart. This is not a data spike. This is the real McCoy. One wonders how many FX accounts were blown up in the blink of an eye.

Looking at the pound (which is an appropriate moniker) over the past decades, one can only suggest the wisdom of dashing off to London whenever one has the urge and grabbing some really good fish & chips. At this rate, Americans will be able to purchase anything in the United Kingdom for a song.