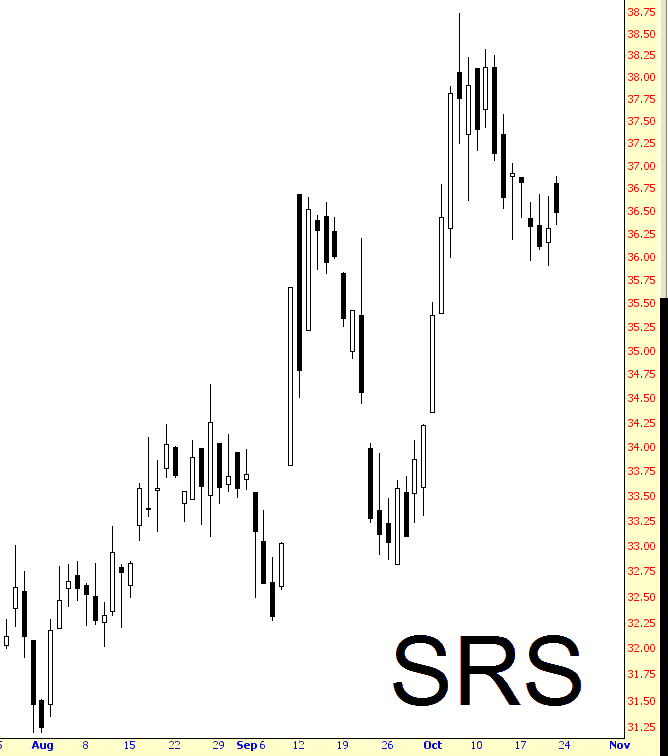

Want to see a financial instrument that’s been carving out a series of higher highs and higher lows later, and has enjoyed a 15% appreciation since early August? Believe it or not, it’s that poor old battered beast we haven’t spoken about in years, the double-bearish ETF SRS:

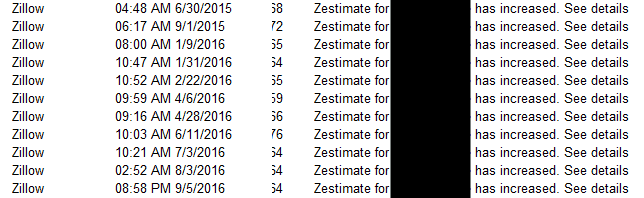

To be sure, SRS has been viciously destroyed for years now, having peaked on a split-adjusted basis at $16,408.77 (yes, I’m serious) and presently trading at a level 99.8% lower than that. All the same, as my post earlier today about softening Palo Alto house prices suggested, we may well be past the peak of this particular bubble.