I haven’t posted the full set of charts that I do every morning for a while and these are the companion charts that I use in my premarket videos for Daily Video Service subscribers at theartofchart.net. I posted that on twitter before the open today (@shjackcharts), but if you missed that you can see that here.

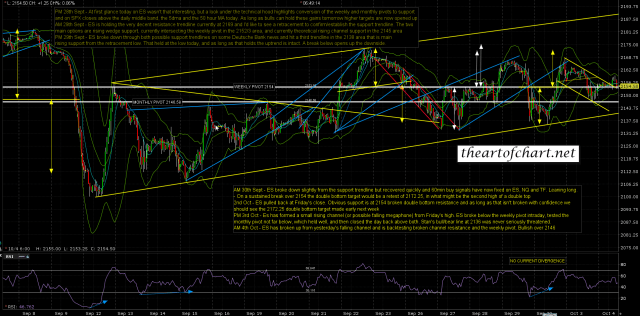

On ES I was saying that the outlook remains bullish as long as 2146 remains unbroken, and the LOD so far is 2147.75. If that remains the LOD then the outlook still leans bullish. ES Dec 60min chart:

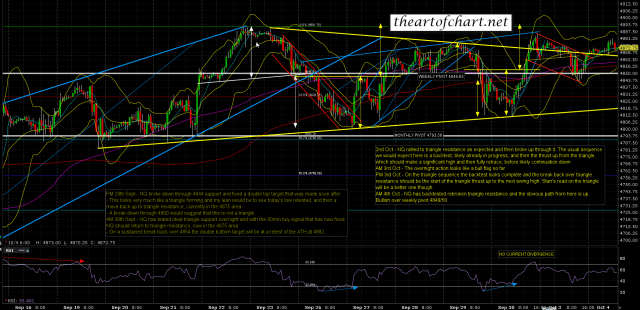

NQ Dec 60min chart:

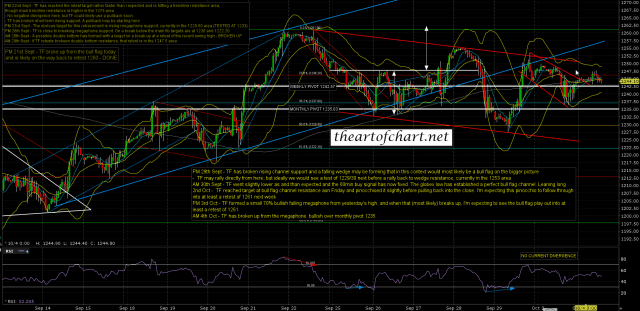

TF Dec 60min chart:

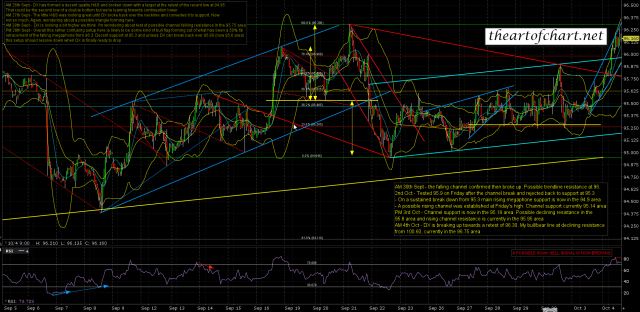

DX Dec 60min chart:

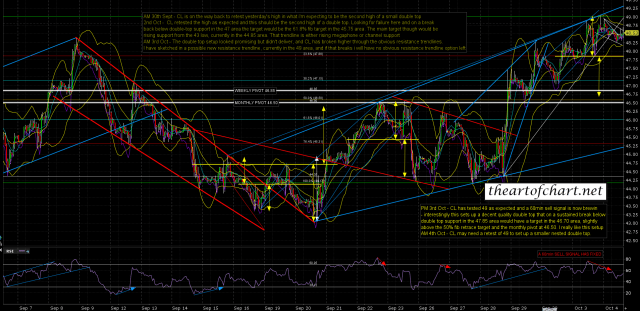

CL Nov 60min chart:

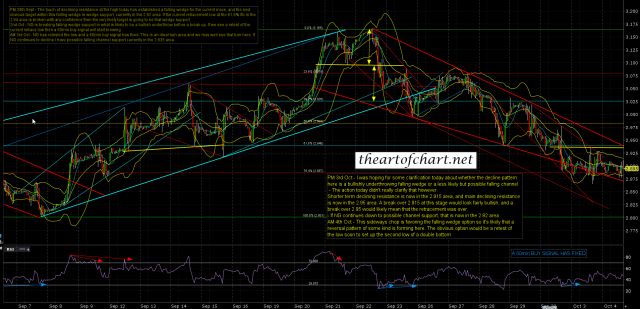

NG Nov 60min chart:

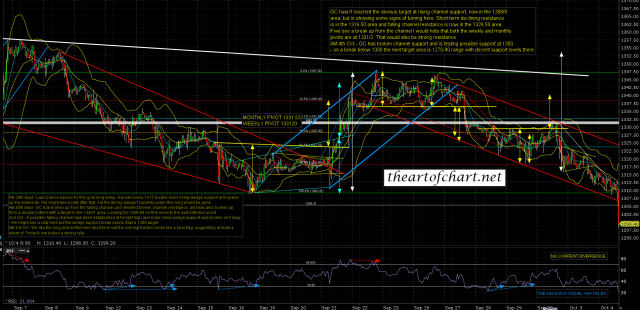

GC Dec 60min chart:

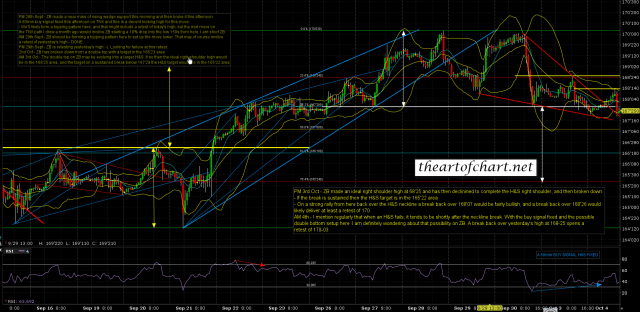

ZB Dec 60min chart:

I’m rooting for the bulls today, mainly because I’d love to be looking at 2200 as a possible short entry level. They may not have the juice to deliver that, but as long as that 2146 ES support holds (approx 2153/4 SPX), the bulls still have the short term technical edge here.

I was stopped out of the GC long the other day when my rising wedge support trendline on gold was broken, and the reason I didn’t re-enter was because of the increased risk of a hard support break, which we saw overnight. I am starting to look for another possible long entry here, and if it’s nice I’ll be tweeting that.

There was a nasty looking bull scenario forming on ZB overnight and I tweeted out that I had put my stop at 168’10, slightly over the 168’07 fib level at yesterday’s high. ZB stopped me out, ran up another couple of ticks, and then dropped a buck to kill off the bull scenario. That’s trading of course, and I exited with a profit of 1’22, which was a decent consolation prize. I’ll be watching for another decent short re-entry setup there as well.