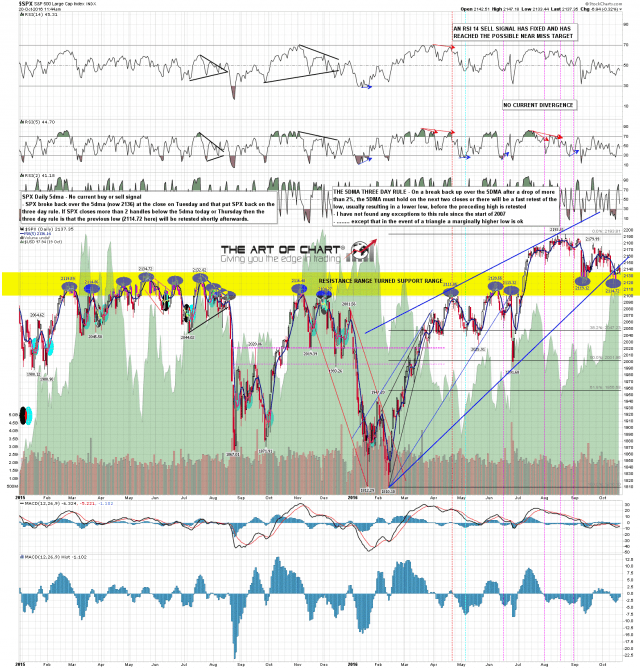

Today is the third day on the three day rule and bears can trigger the rule with a close today at 2134 or below, approximately 2168 on ES. That was tested at the low today and is holding as support so far. Bears have dominated the closes recently, so we may not know for sure until the close. If the rule triggers then a lower low on this retracement before a new ATH is almost certain. If the rule doesn’t trigger I’ll be getting significantly more doubtful about lower lows. With ES at 2135.50 at the time of writing I’m leaning 65/35 in favor of the bear side. SPX daily 5dma chart:

On ES this is a setup that really should resolve into at least a retracement low retest. The rising wedge from last Thursday’s low should deliver that, and likely still will. ES Dec 60min chart:

One thing to mention is that this low window only runs through next Tuesday 25th October. If bears can’t deliver a break today then the odds against reaching that 2047 target (38.2% fib retracement of broken rising wedge) will lengthen significantly. As it is I’m already sceptical about breaking under 2100 SPX on this retracement. This has been taking too long.