The low window on SPX ended on Friday, and there wasn’t much at the weekend to suggest that prices would go lower this week. With RUT testing main rising wedge support at the low on Friday and NDX retesting the all time highs today, there’s not much to cheer the bears that has happened since. If you want to see that support hit on RUT, you can see that on Friday’s post here.

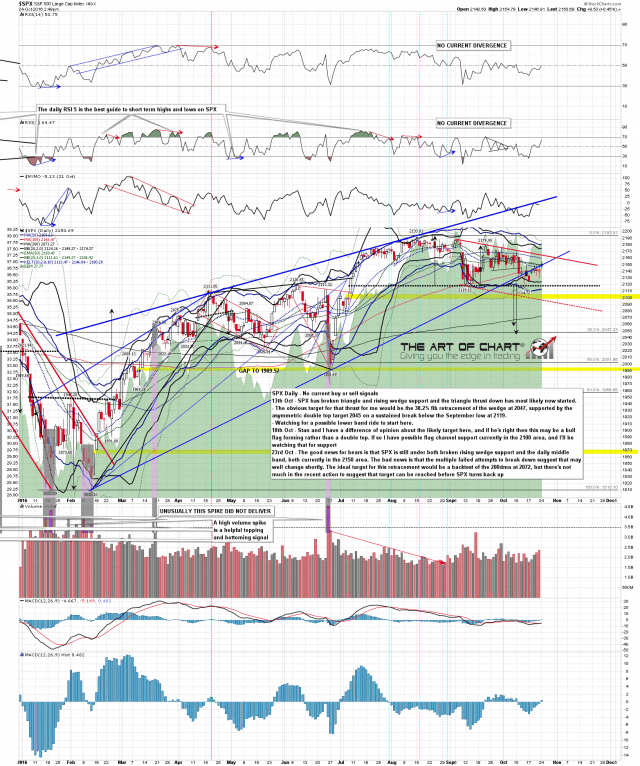

On the daily chart the key resistance level is the daily middle band at 2149, and SPX has been trading around that today. Bulls need a closing break above it and a confirming close above the next day. Bears would obviously like to avoid that if possible. The tape itself seems fairly indifferent, particularly in the afternoons in recent months. SPX daily chart:

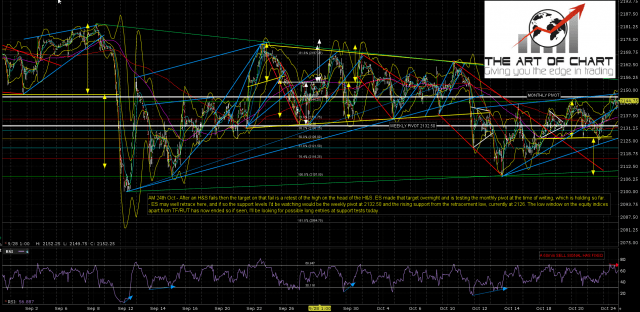

On ES the high today is a test of the monthly pivot at 2146. Again an important level and that’s held so far. I was interested to see that a sell signal has fixed on the hourly RSI 14. That might deliver a test of the weekly pivot at 2132.50, though unless the tape speeds up that would seem impossibly distant for a target in trading hours today. ES Dec 60min chart:

Overall we are leaning bullish now into Thanksgiving. We might see a retest of the current retracement low before the break back up but I won’t be holding my breath waiting. At this stage only a wedge support break on RUT would make the short side look interesting on anything more than an intraday basis.