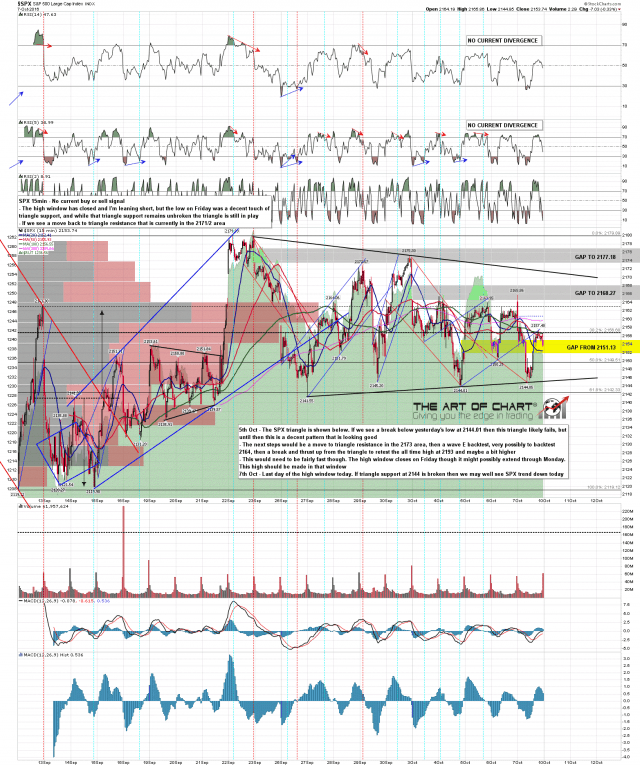

The high window ended at the close on Friday and I’m leaning short into the end of October. Does this mean that SPX cannot make a new all time high in the next few days? No. Bears need to do some damage to support to open up the downside and the Friday low at triangle support wasn’t good enough. That is the key support that needs to be broken, as until that is broken, a triangle may well still be forming. The high so far today on SPX is not far away from triangle resistance. SPX 15min chart:

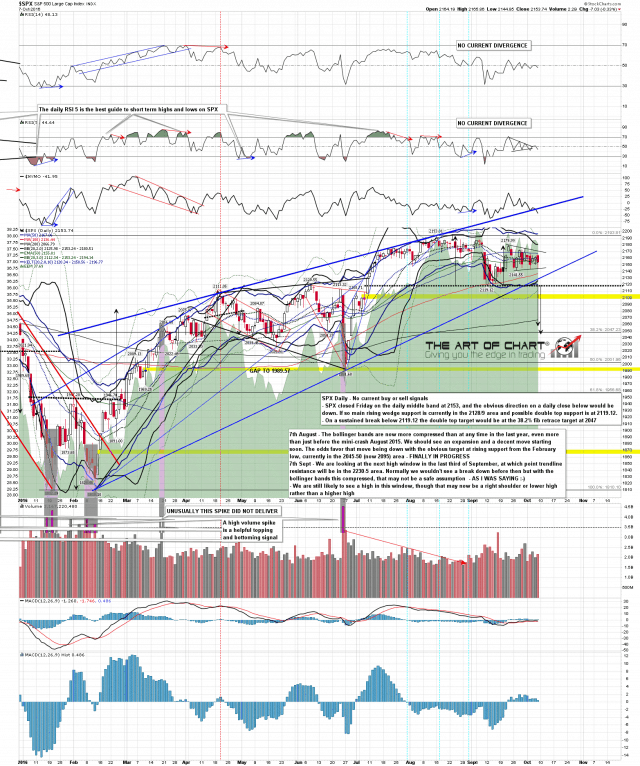

While triangle support held, rising channel support broke on both ES and SPX. That’s cautiously bearish. SPX 60min chart:

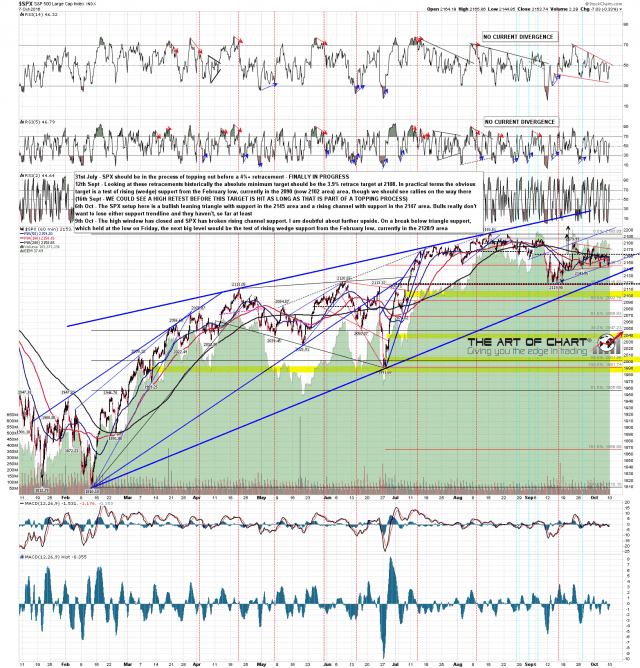

SPX closed Friday on the daily middle band at 2153. That support needs to be broken on a daily close basis, and then not reversed the next day. SPX daily chart:

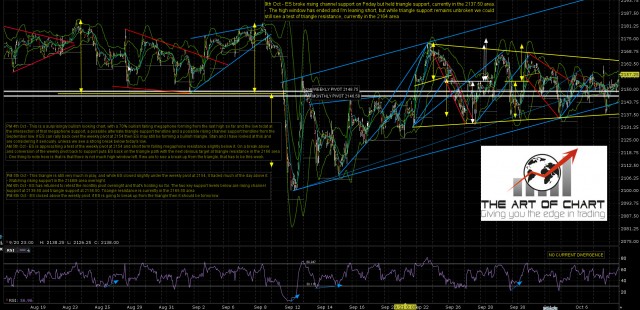

On the ES chart again the channel broke and the triangle support held. The high today was a touch of triangle resistance at 2164. This could therefore be the last wave E of the triangle now in progress before a break up to complete the triangle sequence. ES Dec 60min chart:

If there is a break up from the triangle I’m not expecting anything that impressive, but I am hoping that the very nice looking double top setups on NDX and RUT aren’t messed up by new highs made with any confidence. We’ll see what happens when volume returns to the markets tomorrow.