Moving averages are the best-known, most popular technical indicator. They represent price data in a “smoothed” fashion, showing one or more simple line graphs overlaid on the price chart based upon a specific number of days of historical price data.

What is a Moving Average?

A moving average (MA) is a technical indicator that is used to smooth out price data by creating a simplified representation of the average price over a set time period. A moving average is beneficial for traders because it can dampen the perceived effects of random, short-term fluctuations in a security’s price that may occur during the specified time-frame. The most common time-frames for MAs are the previous 15, 30, 100, or 200 days.

A Simple Moving Average is represented by the arithmetic mean of the price over the specified number of days. Arithmetic mean is simply calculated by adding the price values together and dividing by the number of price values in the set.

Moving averages can also form the basis for other technical analysis indicators, such as the moving average convergence divergence (MACD) indicator.

How To Use Moving Averages

The amount of recent data used is controlled by you: a 10-day moving average, based on very little data, would tend to be volatile and would cling closely to actual price data, whereas a longer-term study, such as the commonly-used 200-day moving average, would move more slowly and smoothly and would also lag price data far more.

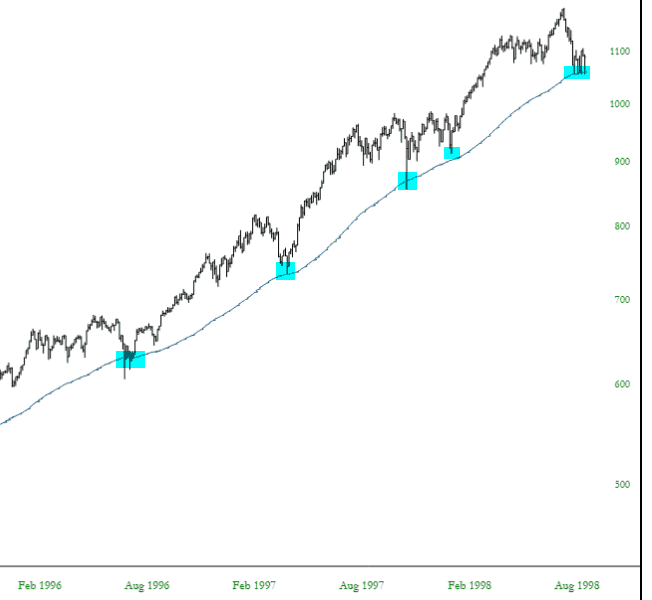

People using moving averages in different ways. One common use is to look for them as an important level of support. Here, for example, is the S&P 500 index with a 200-day moving average. Each time the market entered a period of weakness, it tended to find strong support at this average.

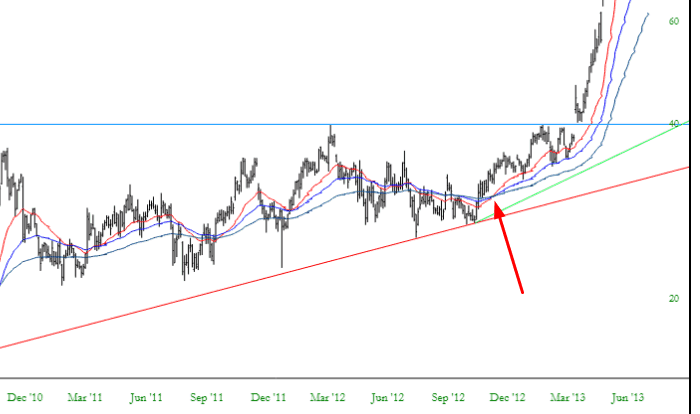

More commonly, traders look for instances of “crossover“, which can suggest a change in trend or, in the example below, an affirmation of strength.

The chart below is of Tesla Motors (TSLA), and although the stock had been directionless for years, once the moving averages did a clean crossover, with the faster averages clearly crossly above, and staying above, the slower ones, the stock began its amazing ascent.

The types of moving averages merit a mention as to their differences. Briefly stated, exponential moving averages place a greater weight on recent price data, whereas simple moving averages treat all the price points with identical weighting. Therefore, exponential averages tend to react more swiftly to recent price activity.

The weighted and Hull styles of moving average place also more emphasis on recent data, with the goal of reducing “lag”.

As the chart below illustrates, the type of moving average you choose makes a meaningful difference, as every one of these is based upon the same quantity (50 days) of price data:

SlopeCharts Moving Average Tool Guide

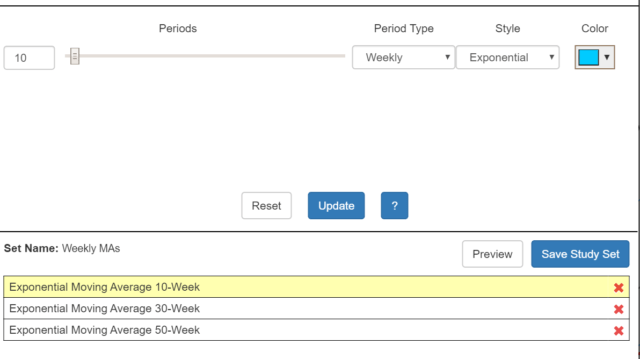

Using the SlopeCharts Moving Average, you can add as many moving averages with as many different parameters and colors as you like. The moving average study offers you a variety of parameters: (1) how many days, weeks, or months you want to use, which you can either type in manually or choose with the slider bar; (2) a dropdown of four different styles of moving average; (3) a color for each separate moving average.

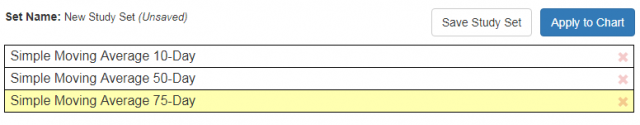

You can type in the number of days you want for the calculation directly, or you can move the slider bar left and right to dynamically observe the effect on the moving average indicator on top of the chart itself. As you choose different averages you want to add, click the Add button, and they will be appended to the study set. You can click “X” on any item you choose to delete.

If you use a different granularity of data, such as weekly, that will be reflected in the descriptions as well.

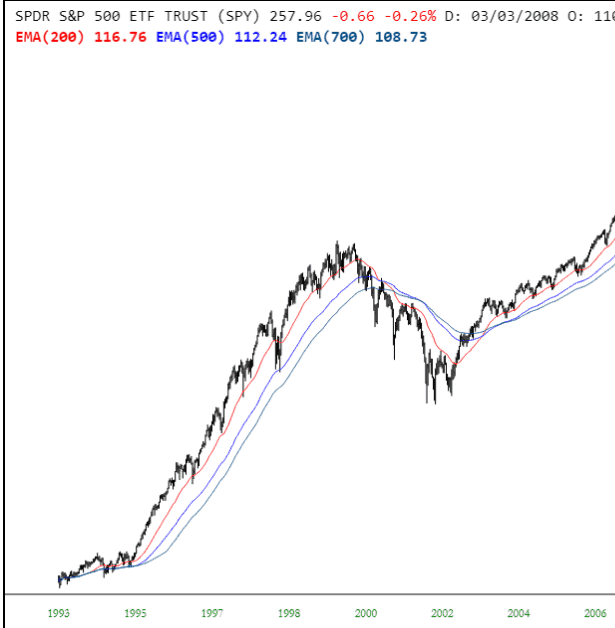

Below is an example of a chart with three simple moving averages. Although not shown here, a legend is provided in SlopeCharts showing the definition of each colored line (as to its type and how many days are used) as well as the value of each of these lines are whatever place you are pointing on the chart.

You can use any positive integer as the basis for days. Below, for instance, are some very-long term moving averages, based on 200, 500, and 700 price bars each. The legend for these, as well as the values, is shown at the top of the chart.

This is a very long-term chart of SPY, and the smooth progression of the three moving averages, coupled with the steady amount of space between them, shows what a consistent bull market there was for most of the 1990s.

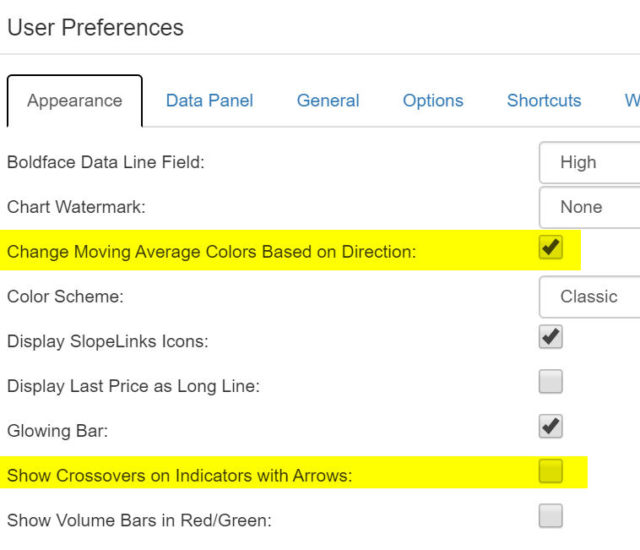

In addition, there are a couple of checkboxes in the Preferences for SlopeCharts that let you fine tune how moving averages are presented.

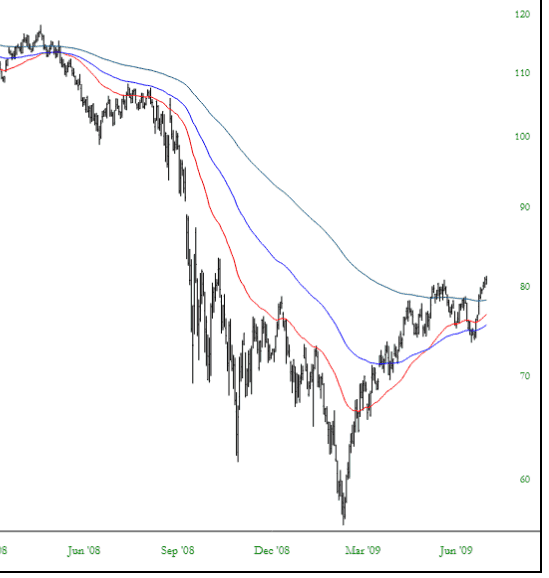

The first checkbox, if checked, will make all of the moving averages appear in green when going up and red when going down, as illustrated here:

The second checkbox, if checked, will put arrows on “crossover” points, making them easy to spot. If one moving average crosses above another, a green arrow will be displayed, and if one average crosses beneath another, a red arrow will be displayed.