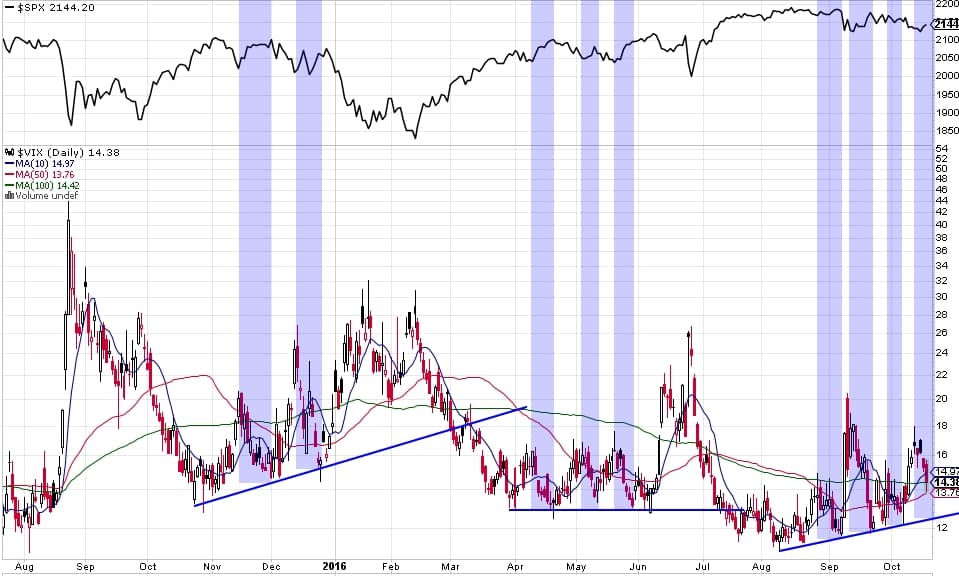

I don’t have a trade for you all in this post, but I just wanted to quickly share the VIX and its tendencies for forecasting the S&P500’s potential. First, I want to point out the uptrend line in the VIX right now. I’ve highlighted the times when VIX has returned to those trendlines in the past year. At most, price has returned to the highs during such declines, but once the VIX trendline is hit, caution is very warranted, especially since sometimes, that touch then launches actual sustained selling periods.

I made a minor mistake on the chart below. You should note to ignore the first decline in each cluster because that was the decline that established the trendline before which none existed. Before these trendlines were broken, there was always a meaningful spike in the VIX first. This doesn’t always happen, but once it does, upside is the path of least resistance.

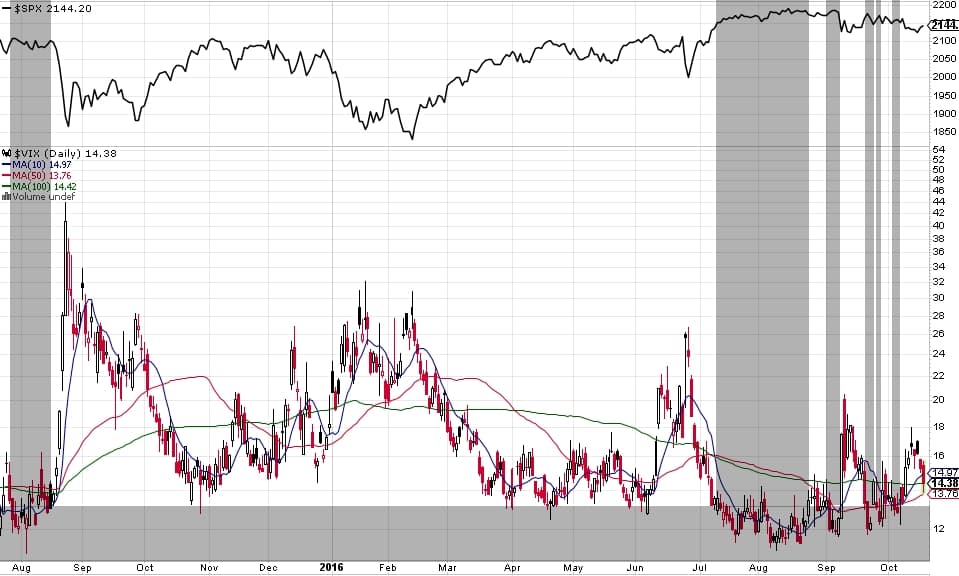

At present the uptrend line in the VIX is at just over 12. So if the trendline breaks, are we going to rocket to even newer highs? Mmmm. I doubt it and here is why. The chart below shows the times highlighted over the past year when the VIX was under 13. I’ll let you draw your own conclusions about the likelihood of meaningful upside.

Thus I retain a stance that moreless buys into very short rallies while favouring the potential for 5-10% downside (also remember that price aboslutely could just remain flat for another month as well).

Now this post in relation to the broad indices alone. For individual stocks, there is certainly potential for some to trend one way or the other so if you know how to find them and don’t mind the extra risks with investing in specific companies, then have at ‘er, but personally, I steer clear of those kinds of risks.

Happy trading!