Natural Gas Climbs Back

After crashing by about 25% at the end of last month, natural gas has regained momentum this month.

In my personal account, I bought at-the-money puts on the ProShares UltraShort Bloomberg Natural Gas ETF (KOLD) when it hit $40, and then sold them (too soon) for a 25% gain about a week later (had I held them until Friday, I would have been up about 100% instead). But here’s another way to play the natural gas rollercoaster.

A Leveraged Bet On U.S. Natural Gas

The ProShares Ultra Bloomberg Natural Gas ETF (BOIL), a 3x leveraged bet on American natural gas, has been recent top name in our system, including on Friday, when it appeared along with the un-leveraged United States Natural Gas Fund, LP (UNG), and Warren Buffett’s new favorite energy name, Occidental Petroleum Corporation (OXY).

Screen capture via Portfolio Armor on 7/15/2022.

A Hedged Bet On Natural Gas Prices Going Even Higher

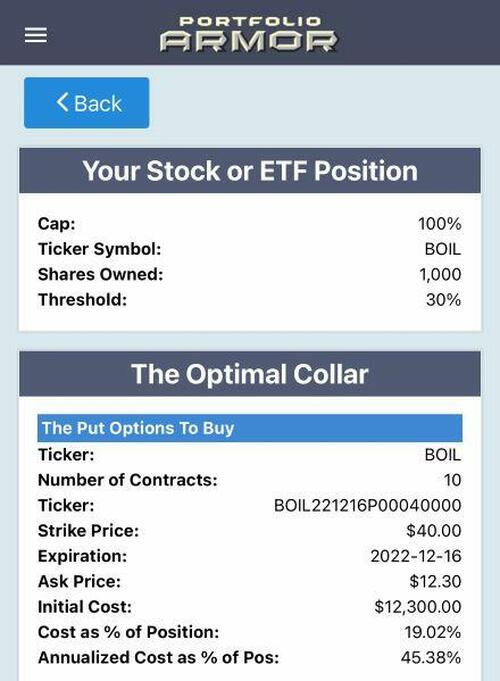

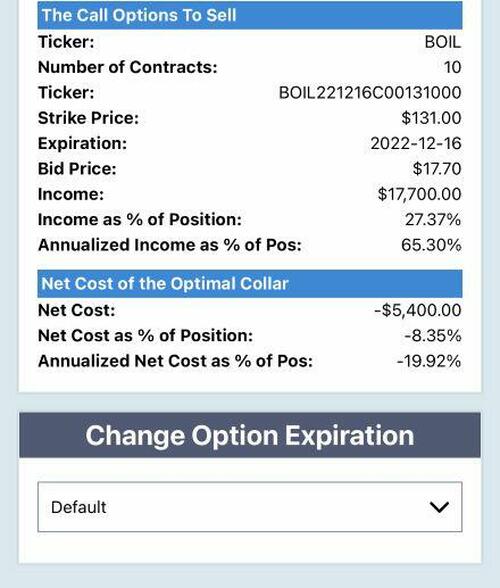

Triple-leveraged ETFs can be extremely volatile, but here’s a way to use that volatility to your advantage. This was the optimal collar, as of Friday’s close, to hedge 1,000 shares of BOIL against a greater-than-30% drop by mid-December, while not capping your possible upside at less than 100% over the same time frame.

Screen captures via the Portfolio Armor iPhone app.

Note that the net cost of this collar was negative, meaning you would have collected a net credit of $5,400, or nearly 8.31% of position value when opening it. So your maximum upside here would be a gain of more than 108% by December (100% + the 8.31% upside cap), and your maximum drawdown would be a decline of 30%.