Here Comes Another Lesson

“Hey, Professor!” Charles turns around to see a very short, very wide man stamping and scraping his feet on the cinders. His blunt, wide head is lowered beneath his mountainous shoulders, and a massive nose ring loops between his snorting nostrils. “Who are you? asks Charles. “I’m a real angel,” says the man. “Then where are your wings?” “Don’t be stupid! That’s just a cliche.” Even before these words are out of his mouth, the man has begun running toward Charles, ramming his blunt forehead into Charles’s solar plexus and knocking him onto his bewinged back. It is a moment before Charles can catch his breath. He sits up and asks, “What did you do that for?” “To teach you a lesson.” “What kind of lesson is that?” “What other kind of lesson is there?”

– Stephen O’Connor, “Here Comes Another Lesson”

Streaming TV company Roku, Inc. (ROKU) released an awful Q2 report after the close on Thursday, posting a wider-than-expected loss and issuing weak guidance going forward. Wall Street analysts, helpful as always, downgraded the stock after the earnings miss. ROKU subsequently lost nearly a quarter of its value overnight.

Here’s the lesson: stop-limit orders don’t limit your risk when a stock gaps down after hours.

Look at the chart below. Say you that when ROKU hit $85 on Thursday, you placed a stop-limit order on it with a limit price of $76.50, 10% below the then-current market price. That stop-limit order wouldn’t have gotten executed, because ROKU never traded at $76.50. It only traded as high as $66.46 during market hours on Friday.

A stop-loss order would have gotten executed, but it wouldn’t have limited your risk to a 10% decline either, for the same reason. It would have converted to a market order on Friday morning, and you would have likely gotten out at closer to day’s low of $62 than its high of $66.46.

What If ROKU Longs Had Hedged?

Let’s look at a couple of ways ROKU longs could have hedged before earnings on Thursday and how that would have limited their downside on Friday.

First Hedge

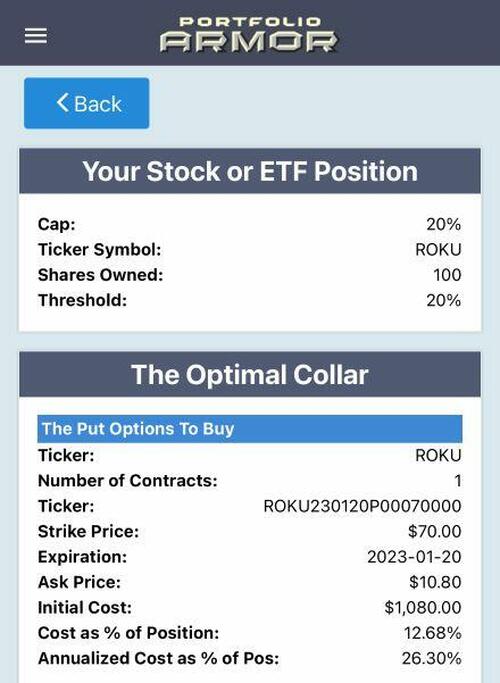

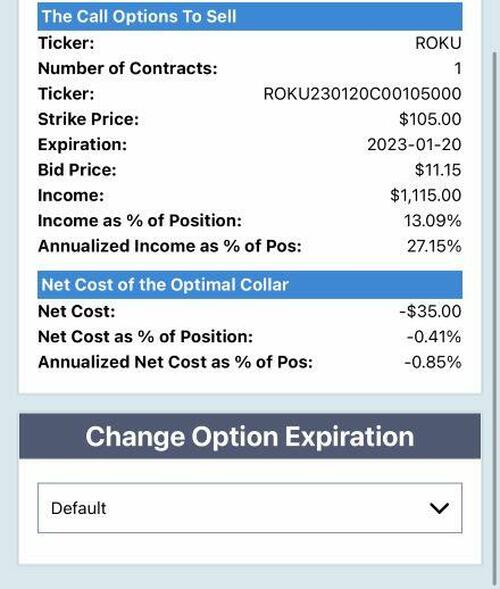

This was the optimal collar, as of Thursday’s close, to hedge 100 shares of ROKU against a greater-than-20% drop by January, while not capping your upside at less than 20% by then.

Screen captures via the Portfolio Armor iPhone app.

ROKU closed at $85.17 on Thursday, so with 100 shares and the collar above, you had $8,517 in ROKU shares, $1,080 in puts, and if you wanted to buy-to-close your call leg, it would have cost you $1,115. So your net position value was ($8,517 + $1,080) – $1,115 = $8,482.

ROKU closed at $65.52 on Friday, down 23.07%. But your $70 strike January put options were worth $1,600, and your $105 strike call options were worth $353. So your net position value was ($6,552 + $1,600) – $343 = $7,809. $7,809 represents a 7.9% drop from $8,482.

So, with this hedge, you would have been down 7.9% instead of being down 23.07%.

Second Hedge

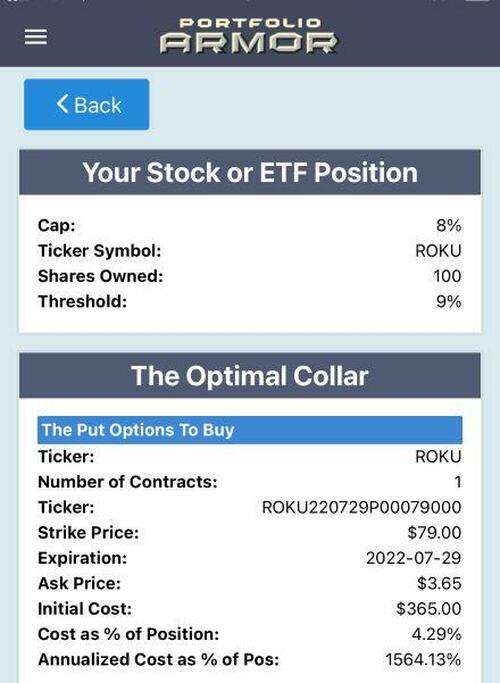

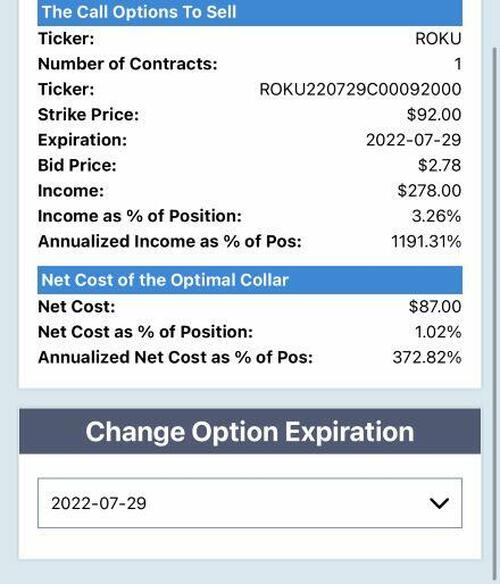

This was the optimal collar, as of Thursday’s close, to hedge against a greater-than-9% drop by Friday, while not capping your upside at less than 8% if ROKU’s earnings had been good.

With this hedge, your position value on Thursday was ($8,517 + $365) – $278 = $8,604.

On Friday, it was ($6,552 + $1,344) – $1 = $7,895. $7,895 represents a 7.3% drop from $8.517.

So, with this hedge, you would have been down 7.3% instead of being down 23.07%.

Hedging Protects When Stop Orders Don’t

If you used stop-limit orders or stop-loss orders to protect your ROKU shares on Thursday, you were down 23.07% by the end of Friday, and down worse if your stop-loss order executed closer to ROKU’s low of the day. If you hedged as above, you were down either 7.9% or 7.3%.