The Eye of The Storm

As I type this early Monday morning, stock futures are up, after Sunday’s federal bailouts of depositors at Silicon Valley Bank and Signature Bank. The obvious weather analogy here is the sun coming out after a heavy storm, but the big question is whether that storm was a cyclonic one like a hurricane (or typhoon, for Asian readers) or not. The sun also comes out when you’re in the eye of a hurricane, but it’s followed by a second part of the storm.

Whether it’s the all-clear or the eye of the storm seems to rest on the answers to a couple of questions. First, did this cause a Fed pivot? On that question, Goldman Sachs and JP Morgan are split, as the Wall Street Journal’s Fed reporter Nick Timiraos shares below.

I think JP Morgan is closer to the mark here. I don’t think the Fed wants to be raising rates during the Presidential election next year, and be accused of interfering in the outcome, and the best way to avoid that is err on the side of tightening a bit more this year.

The second question is whether the Feds’ bailout will be sufficient to assuage the concerns of depositors, particularly of smaller, regional banks that aren’t considered too big to fail, as ZeroHedge suggests here:

Well, the US has $18 trillion in deposits, and recall that $42BN in SVB deposits were pulled in hours, not days, not weeks… hours. So, you’d have to forgive us if we are just a little skeptical that the Treasury’s $25BN mini backstop bazooka and the FDIC’s $125BN in bank run buffer will do anything to prevent a far bigger bank crisis now that the horses have fled the barn.

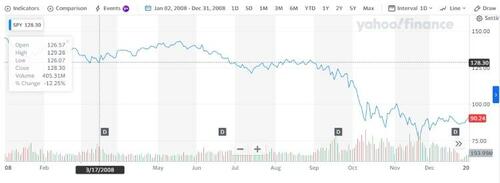

My guess is that this is the eye of the hurricane, rather than the all-clear. History doesn’t repeat itself, but it does rhyme, and if you recall the collapse of Bear Stearns in March of 2008, the market climbed for a bit afterwards, and only started its precipitous decline after the collapse of Lehman Brothers six months later.

With that in mind, I did some research this weekend looking for a bank that might be a good candidate to bet against.

Looking for a Bank to Bet Against

Banks tend to be tough to analyze, so it seems best to not rely on any one metric. I settled on four different ones in my search:

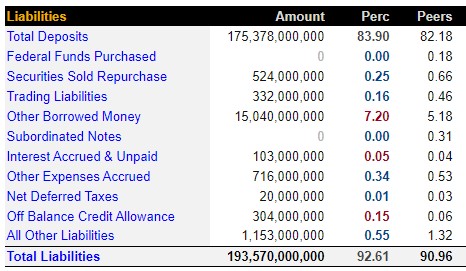

- Deposits as a percentage of total liabilities. As ZeroHedge pointed out over the weekend, having a relatively high percentage of total liabilities as deposits can make a bank more vulnerable to a run. According to BankRegData.com, Silicon Valley Bank’s deposits as a percentage of liabilities were 83.9% as of its most recent quarter.

- Tier One Leverage Ratio. That’s the ratio of a bank’s tier one capital (its core, most liquid capital) relative to its total assets. As an example of the difficulty of relying on any one metric in gauging bank risk, starting in 2018, federal regulators required a minimum tier one leverage ratio of 5% for larger banks in the U.S., and Silicon Valley Bank had a tier one leverage ratio of 7.96. That said, as the table below shows, that ratio was below that of its peers.

- Piotroski F-Score. I’ve mentioned the Altman Z-Score in previous posts, which is a measure of financial health that NYU accounting professor Edward Altman came up with in the late 1960s. One limitation of the Altman Z-Score is it was designed for manufacturing companies. Altman subsequently invented another version for non-manufacturing companies (The Altman Z”-Score), but neither was intended for financial companies. Joseph Piotroski, an acccounting professor at Stanford, developed his method in 2000. Subsequent research (such as this Indian study), demonstrated its utility in analyzing banks. The Piotroski F-Score goes from 0 to 9, with scores of 8 and 9 indicating financial strength, and scores of 2 and below indicating financial weakness. Silicon Valley Bank had a Piotroski F-Score of 2 before its collapse (Signature Bank had an F-Score of 6 though, highlighting again how you don’t want to rely on just one metric with banks).

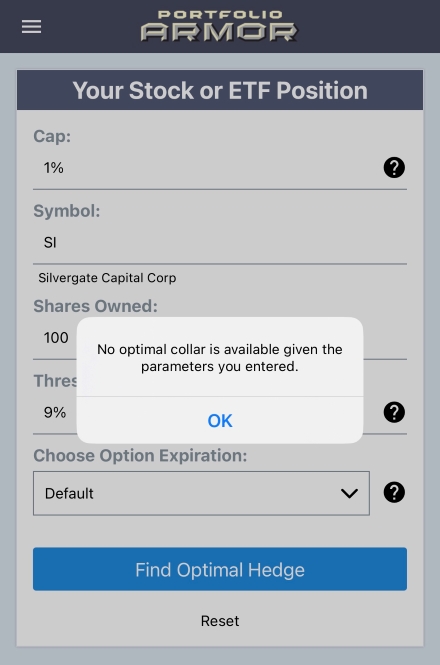

- Options market sentiment. This is a screen we developed at Portfolio Armor several years ago. It’s a test of whether it’s possible to hedge a security against a greater-than-9% decline over the next several months with an optimal collar capped at 1%. Essentially, it gauges the relative demand for out-of-the-market (OTM) call options (bullish bets on a security) to OTM put options (bearish bets). If a stock fails this screen, this error message comes up when you try to collar it that way using our app (I’ve used Silvergate Capital here, because it was still trading on Friday, unlike Silicon Valley Bank’s parent company).Screen capture via the Portfolio Armor iPhone app.We applied it to dozens of stock picks by prominent investors, and then looked at their performance six months later, and the ones that failed this test did significantly worse than the ones that passed. Again, like the other metrics, this one shouldn’t be relied on alone. Signature Bank was expensive to hedge this way on Friday, but it did pass this screen.

The Bank We Found

The bank we found has these characteristics, all as bad or worse than Silicon Valley Bank did before its collapse:

- Deposits comprise more than 87% of its liabilities (this was 83.9% for Silicon Valley Bank).

- A Tier One Leverage Ratio below 7.5% (recall Silicon Valley Bank had 7.96%).

- A Piotroski F-Score of 2 (same as Silicon Valley Bank).

- It failed our test of options market sentiment (same as Silvergate Capital).

This stock is up fractionally in premarket trading in Frankfurt as I type this, so hopefully it will be green today when U.S. trading starts. I have a limit order to buy puts on it. If you’d like an email alert with the details if and when that order gets filled, feel free to subscribe to our trading Substack/occasional email list here.