Waiting For The World To End

Since its appearance in the 2010 movie Scott Pilgrim Vs. The World, Metric’s song “Black Sheep” has been a mainstay in the band’s concerts; here’s a video of them playing it in Lima, Peru last weekend.

The first verse of that song includes a lyric about “waiting for the world to end”.

[Verse 1]

Hello again

Friend of a friend, I knew you when

Our common goal was waiting for the world to end

That came to mind today when looking at the comments on our post from earlier this week (Trading Update: Which Signals Are Strongest now?).

Trading Update: Which Signals Are The Strongest?

What our latest data says.https://t.co/MaOGeLW55u

— Portfolio Armor (@PortfolioArmor) November 28, 2023

In that post, we presented the results of analysis we had conducted showing which signals best predicted stock price movements post-earnings. In response, one bear wrote,

I’m no guru at stocks but it seems to me that the depopulation and deindustrialization of western society is a strong sell signal.

Let’s look at how trading our signals worked this week while bears were waiting for the world to end. First, a quick recap of our trading signals.

Our Ten Signals For Evaluating Earnings Trades

We use these ten signals for evaluating earnings trades:

- LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

- Portfolio Armor’s gauge of options market sentiment.

- Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

- Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

- Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

- Zacks Ranking. A number from 1 to 5 with 1 representing their 5% most bullish stocks, 2 representing their next 20%, 3 the middle 50%, and so on.

- The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

- Recent insider transactions.

- RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

- Short Interest.

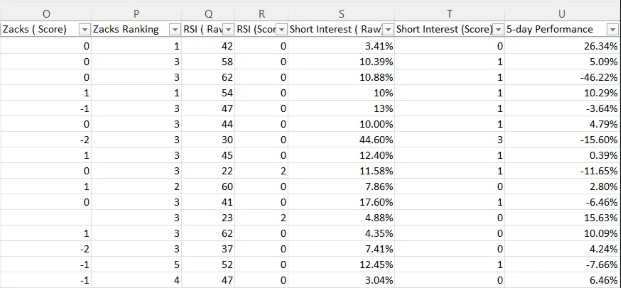

For most of those signals, we give a numerical rating from -2 (very bearish) to +2 (very bullish), and for each stock we evaluate each week (not just the ones we place trades on), we enter the data above in a spreadsheet, and at the end of the week, we record each stock’s 5-day return.

Then we use the average 5-day returns from each signal to figure out which ones are the strongest.

The Strongest Signals

After crunching the latest data, these were the strongest signals as of the beginning of this week, as measured by the average 5-day return of stocks exhibiting these signals prior to earnings. By way of comparison, the average 5-day return of all the stocks in our sample was 4.75% as last week.

Real-World Examples From This Week

We used those signals to find five stocks to trade out of the dozens reporting earnings this week.

Let’s look at two examples of them, one bullish, and one bearish.

A Stock We Were Bullish On This Week

The number in parentheses represents our composite score for a stock, based on all the metrics: higher = more bullish, and lower (more negative) = more bearish.

Ulta Beauty (ULTA) (4.4)

- Social data: +44.

- PA Options sentiment: Very Bullish.

- Setup rating: 3

- Valuation rating: 5

- F-Score: 9

- Recent insider transaction(s): Net open market sales, peaking last December.

- Zacks ESP: -0.39%

- Zacks Ranking: 3

- RSI: 70

- Short Interest: 2.54%

For this stock, the two strongest signals were social data +2 (we consider raw scores between 40 and 59 to be “very bullish”) and Portfolio Armor’s options sentiment +2. Because the average 5-day return of stocks in our sample was 4.75%, and the average 5-day return of stocks with +2 social data scores was 10.81%, we used that ratio (10.81 / 4.75 = ~2.3) in calculating our composite score.

A Stock We Were Bearish On This Week

Farfetch (FTCH) (-0.6)

- Social data: -51.

- PA Options sentiment: Very Bearish.

- Setup rating: 6

- Valuation rating: 0

- F-Score: 2

- Recent insider transaction(s): None over the last 12 months.

- Zacks ESP: 0%

- Zacks Ranking: 3

- RSI: 50

- Short Interest: 13.58%

With this one, the strongest two signals were reversed, -2 social data and -2 PA options sentiment.

How’s That Working Out For You?

As Edward Norton’s narrator character says in the famous Fight Club clip, “Great”. Following this approach last week, five of the seven trades we placed ended up being winners; this week five out of five were winners:

Options Trades

- Call spread on Kroger (KR 2.52%↑). Entered at a net debit of $0.41 on 11/29; exited at a net debit of $0.57 on 11/30. Profit: 39%.

- Call spread on Dollar Tree (DLTR 0.00%↑). Entered at a net debit of $0.45 on 11/28; exited at a net credit of $0.80 on 11/29. Profit: 78%.

- Put spread on Farfetch (FTCH 0.00%↑). Entered at a net debit of $0.29 on 11/28; exited at a net credit of $0.48 on 11/29. Profit: 68%.

- Call spread on Snowflake (SNOW -3.42%↓). Entered at a net debit of $2.30 on 11/29; exited at a net credit of $4.74 on 11/30. Profit: 106%.

- Call spread on Ulta Beauty (ULTA -0.94%↓). Entered at a net debit of $2.40 on 11/30; exited at a net credit of $4.95 on 12/1. Profit: 106%.

While we don’t expect every week to go this well, the results of the last two weeks suggest we may be on the right track. If you’d like a heads up when we place our trades next week, feel free to subscribe to our trading Substack/occasional email list below.

If You Want To Stay In Touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on Twitter here, or become a free subscriber to our trading Substack using the link below (we’re using that for our occasional emails now).