Ryan Cohen Cashes In And Roaring Kitty Cashes Out

How We Got Here

“Roaring Kitty”, as the meme stock investor Keith Gill calls himself, returned to X after an absence of three years last month, and posted a few memes, with no specific stock commentary. On the basis of that alone, GameStop Corp. (GME) shares spiked from $17.46 on May 10th, to $55.69 on May 14th, before giving back those gains. That was his first GME pump this year.

The weekend before last, Gill returned to Reddit, posting a screen shot, purportedly of his account, showing a $116 million position in GameStop, and 120,000 call options on it. As a result the stock spiked over 64% in early trading the Monday before last. That was his second GME pump.

Finally, last Thursday, Gill promised to do a YouTube livestream about the stock on Friday. On that bit of non-news, the stock spiked 47.45% on the day, before climbing another 31.62% after hours. GameStop opened at $31.28 on Thursday morning, and ended the after hours session at $61.27, before giving all back after GameStop CEO Ryan Cohen’s pre-release of GameStop’s earnings and Gill’s desultory livestream, closing Friday at $28.22.

Ryan Cohen And Keith Gill Clean Up

For some reason, we had rally in GameStop shares ahead of its official earnings release on Tuesday, with the stock climbing from $24.40 at the open to $30.44 at the close, but the only real news that day was that GameStop completed its at the market secondary offering, fortifying its balance sheet with more than $4 billion in cash.

And now it looks like Roaring Kitty has cashed out his call options on GameStop.

That “FlowSeidon” post about the options flow generated some skepticism from diehard GameStop bulls, but as another commenter pointed out, Roaring Kitty owned about 80% of the open interest on those $20 strike GME calls, and as FlowSeidon noted, those call positions weren’t being rolled, so odds are Roaring Kitty was taking profits there. Let’s recap how we traded GameStop, and then we’ll close with a picks & shovels play on a company positioned to profit from both meme stocks and crypto.

How We Traded GameStop

We Were Bullish Below $20

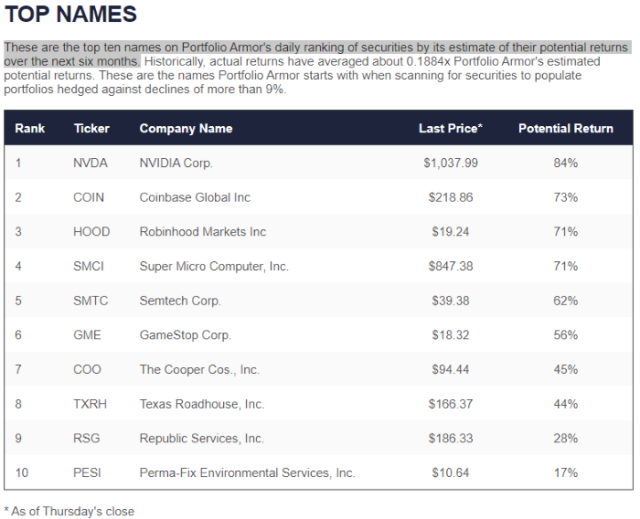

As regular readers know, each day the market is open, our system ranks every security with options traded on it in the U.S. by its potential return over the next six months. Since we started our Substack in December of 2022, our weekly top ten names have returned 22.73% over the next six months, on average, versus 12.63% for the SPDR S&P 500 Trust (SPY). On May 23rd, GameStop hit our top ten when it was trading at $18.32.

Screen capture via Portfolio Armor on 5/23/2024

We tried to place a bullish options trade the next day, but didn’t get a fill.

We Were Neutral At $30

With GameStop trading around $30 earlier this week, we took a neutral approach to it, betting on volatility after its earnings next week. Specifically, we placed two split-strike butterflies, one bullish, and one bearish, where we would make money, on net, as long as the stock moved strongly up or down after its earnings.

Click on the cat to go to that post.

We Were Bearish At $60

As we wrote last Thursday night:

Frankly, we were bearish at $40 too. At Thursday’s 4pm closing price of $46.55, GME was trading at a forward P/E of 4,609, according to Chartmill data. Above $60, its valuation is even more ludicrous. We can’t imagine anything Roaring Kitty can say in Friday’s livestream that will make GameStop worth more, and we don’t expect the company’s management to pull a rabbit of a hat during next week’s earnings release either. GameStop missed on both top and bottom lines last quarter, and the only positive thing we can think of that has come out of Roaring Kitty’s current pump is that the company was able to issue a secondary offering enabling it to shore up its balance sheet (albeit, at the cost of dilution of shareholders.

GameStop fell to fast on Friday for us to get a fill on our bearish bet against it.

Exiting Our Neutral GameStop Trades

As it happened, we made (modest) profits on both our bullish and bearish split strike butterflies on Wednesday, exiting the bullish one at a net credit of $0.60 (we got in for a net debit of $0.50) and exiting the bearish one at a net credit of $0.78 (we got in that one for a net debit of $0.65), for a gain of 20% on both sides.

Had we sat in front of our screen all day, we might have made a >100% profit on our bearish butterfly, but we set conservative limit orders to exit.

In hindsight, the stock proved too volatile for the strategy we used here, but we’ll live with 20% profits on both sides. Another trade of ours is on track to do well from this though.

A Picks & Shovels Play On Meme Stock (And Crypto) Frenzy

One company that has benefited from the GameStop frenzy (and will benefit if Bitcoin makes a new high) is Robinhood Markets, Inc. (HOOD). Its assets under custody have been climbing.

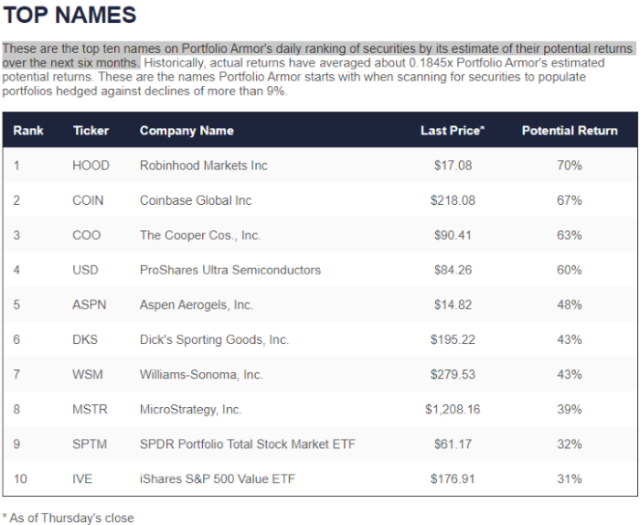

Robinhood was our #1 stock on April 18th,

Screen capture via Portfolio Armor as of 4/18/2024.

And we bought the stock as part of our core strategy at $16.80 the next day. We’re up about 40% on that position currently. We also placed an options trade on it last month, one which will return about 265% if HOOD is trading at $24 or higher on August 16th. HOOD closed today at $23.70.

The stock is probably still worth buying if you can get in on a dip.

If you’d like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we’re using that for our occasional emails now).