Why Gold Could Decline Under Trump

Conventional wisdom holds that our government would continue to spend beyond its means under Trump, fueling further inflation and extending the record rally in precious metals. That could very well happen. But there are a few proposed Trump policies that could be deflationary:

- Tariffs. Critics call this a tax on American consumers, and to the extent that it is one (and a regressive one at that), it would be deflationary, by causing consumers to spend less.

- Deportations. If Trump actually deports millions of illegal aliens, that would be deflationary, for two reasons. First, we’d have fewer people competing for the same housing and other resources. And second, it would reduce the enormous government spending, funneled through NGOs, that subsidizes housing and other costs for these aliens.

- Drilling. Expanding domestic energy production, as Trump has promised to do, would, all else equal, be deflationary.

- Peace. If Trump succeeds in his goals of ending the Ukraine War and the ending the current Mideast war, that should lower the costs of energy and other commodities transiting through the war zones, and if the peace deal is accompanied by a removal of sanctions on Russia and Iran, that would increase the supply of energy too. Peace would also lower the geopolitical risk premium component of gold’s current price.

Hedging Against A Drop In Gold

If you’re long gold, one thing you can do to lower your risk of a drop in gold is to take some profits now.

I did that myself recently, selling half of my calls on IAMGOLD (IAG -1.29%↓), which we (my subscribers and I) had bought in the trade alert below, for a 100% gain.

I also have a trailing stop on shares of Orla Mining (ORLA 0.00%↑) I still own at from selling puts on it last year.

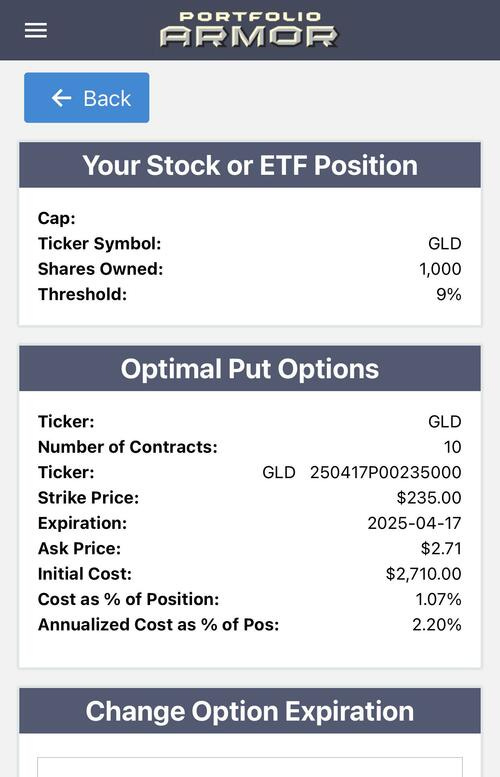

Another thing you can do to lower your risk, is to buy optimal put options on a gold-tracking ETF such as SPDR Gold Shares (GLD 0.00%↑). For example, as of Tuesday’s close, these were the optimal puts to hedge against a greater-than-9% decline in GLD over the next 6 months.

You can download our optimal hedging app by aiming your iPhone camera at the QR code below, or tapping on it, if you are reading this on your iPhone.

We’re also researching trades that might do well in a second Trump term. If you’d like a heads up when we place one of those trades, feel free to subscribe to our trading Substack/occasional email list below.

If you’d like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we’re using that for our occasional emails now).