Good morning, folks. Goodness, for such a promising month, there sure isn’t much going on at the moment. That’s no big surprise. The fireworks show doesn’t start until later. So at the moment we’ve got an /ES which has been stuck inside a range for a solid week now.

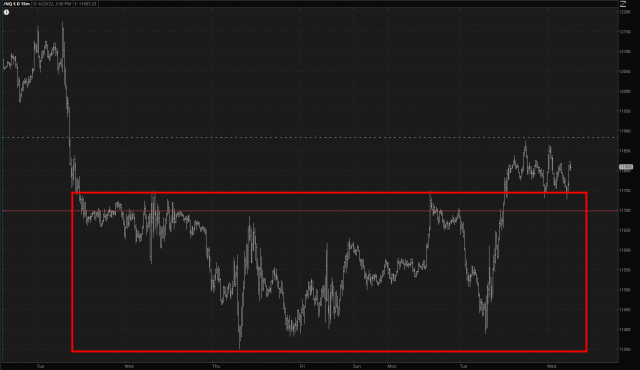

And we have an /NQ which has also been somewhat range-bound, but the bulls actually managed to pull it to a point which could plausibly be seen as a prospective launching point for (yet another) small counter-trend rally.

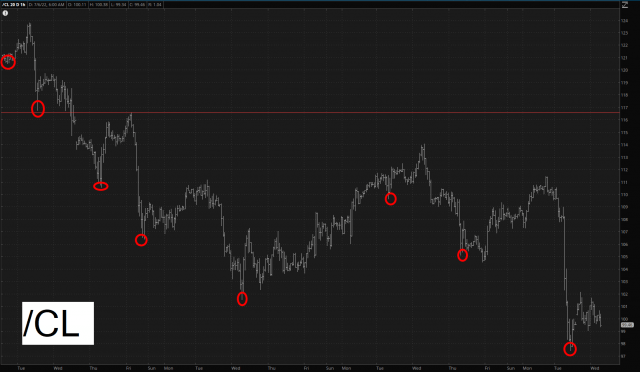

Yesterday’s superstar, crude oil, still looks relatively weak. As I’ve said many times, I think it’s got a lot lower to go.

Today’s big event is the Fed Minutes, which comes out two hours before the closing bell. And, of course, Friday pre-market is the jobs report. I am still “pure bear” but relatively conservatively positioned, with 26.8% cash (plus I extracted that big mountain of cash that was collecting dust yesterday, since I figured it was important to keep my wits about me).

Making money this month is going to require some deliberate risk-taking. It’s not going to be as easy as the laughably-high valuation from early this year. One could short just about ANYTHING in those days and make money. As things are now, it’s going to be somewhat more nerve-wracking, but, paradoxically, I believe potentially more profitable. The meat of earnings season is still two weeks off, but the gyrations of the market will be returning in short order. This range isn’t permanent.