For once in my life, I actually did the right thing. You’ll recall a couple of days ago when I was bemoaning the obscene amount of buying power that was collecting dust, and ultimately I decided just to yank it out of my account and put back into the bank. Turns out that was smart. It was NOT the time to be aggressive.

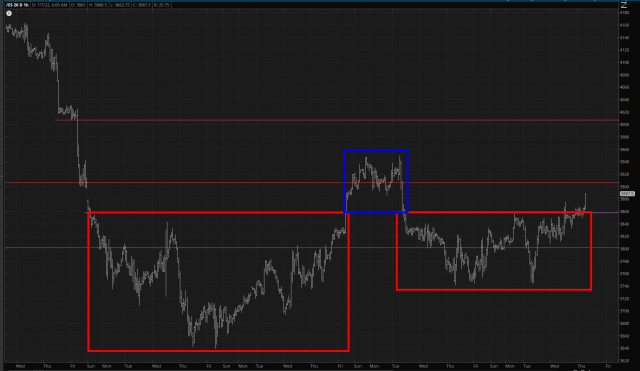

It’s interesting what’s going on now; we have BROKEN OUT of the basing pattern, but I would caution you to take note of what happened last time on the /ES:

And the exact same thing is happening with the /RTY .I mean, look, the Russell futures were up over 3% within moments of the opening bell, so I’m sure all the Cathie Woods of the world are slapping each other on the back. But I think they’re in for a surprise very soon.

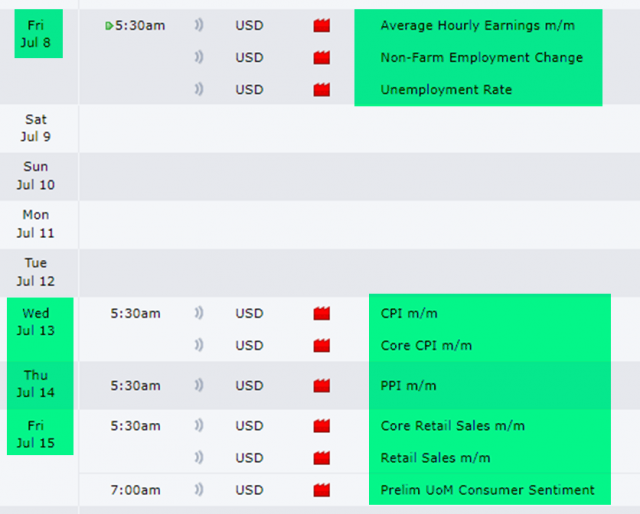

I want to be emphatic about the importance of the economic events over the next week. Remember the CPI number last month that blew the hell out of worldwide assets? Well, the latest figure comes out next Wednesday, and that is going to be VERY closely-watched. Tomorrow is the jobs report, and next week is absolutely packed with events. So there’s going to be plenty of fodder for market motion.

As for the title of this post: I have too MUCH buying power (a nice problem, I know, and I’m glad I sat on it) and too LITTLE patience (a lifelong obstacle). I’m trying my hardest on that second portion, which helps bring good sense to the first. As it is now, I have about 25% cash and will, as always, thumb through all my charts and only take the plays that make sense. As always, I play it safe with respect to time, and the average expiration date for my dozens of options positions is a hearty 144 days into the future.