I’ll start off by stating that I am not trading GME. That is to say, I am not placing trades on it directly, but I am certainly watching it intently throughout the rest of the year. My reason is simple. Of all things a trader would want is a window into the mindset of their opponent (the market). And the two biggest emotions which drive the market in either direction is Hope and Fear.

In Bull markets, I was trained to watch price action and a handful of indicators for entries/exits, potential reversals etc. But I was also taught to look at the market leaders, which for the past few years had been FAANG. When looking for big moves in the broader market, one could usually look to the leaders first to see how strong they were. Big strong moves by markets leaders usually preceded and led the market on big strong days. This was all open to interpretation and sounds a bit obvious, but as you get more experienced you start to look for tells in the market versus noise .

In Bull markets, I counted on the market leaders to provide that quantifiable measure of “hope” in the market. And so here we are in this Bear market. I am still in my full short position and no longer selling premium. I think we are primed to start falling harder. But when do I start to look to cover?

While I have some target spots in mind which I will certainly take some off the table, I intend to hold the last bulk of my position until this market cries “Uncle!” But how do we know when that is? How do you measure the fear in a market? I know some may point to the VIX (certainly a great indicator providing information on Order Flow intensity), but what about measuring true psychological fear? Much like in a Bull market, I look to the Bear market “Leaders”.

While I don’t pretend to know all potential bear market leaders, I have chosen my canary and it is GME. If anything (besides NFTs of apes and Virtual Land) is indicative of the excessive exuberance in the markets over the past decade, it culminates in the story of GME.

GME is a company which at its core may be able to provide some kind of product. They sold video games. And I, in the past, purchased those video games, many times from their brick and mortar stores. But the financial world knew the tide was turning in the past few years.

Much like the story of Radio Shack (who spent their last remaining dollars on a Superbowl ad poking fun at themselves rather than rebuilding/rebranding), Gamestop was in a dying sector of the videogames industry. Games are downloadable now directly from Xbox/Playstation stores, so who needs Gamestop? As such, the shorts piled on to short OVER 100% OF THE FLOAT.

From an individual trader perspective, this was a smart bet (dying business = going to $0). But wsb/reddit was actually able to come together and force an epic short squeeze which, I’m sure, will be legendary in financial markets in years to come. Granted there was a lot more details that I am skipping over (they were diversifying their business away from physical games, blah blah blah, whatever), but the story is now set in stone. The stock jumped from $20 to nearly $440 at its top in less than a month in early 2021. And it has been on this sideways drunken walk ever since.

So what does this story have to do with my bashing it now? Well, first off, I am not directly bashing the company. They may actually be turning their company around and successfully selling toys and merchandise. In fact, the company itself is irrelevant for my purposes (as it seems to be for the many bag-holders of GME stock). My vitriol towards it is actually that it represents those still clinging to some kind of hope that the stock can be squeezed like it did in 2021. And until that hope fades, then this market has more to fall. When I see GME crashing back to Earth where it belongs, that is when the bulls have officially thrown in the towel.

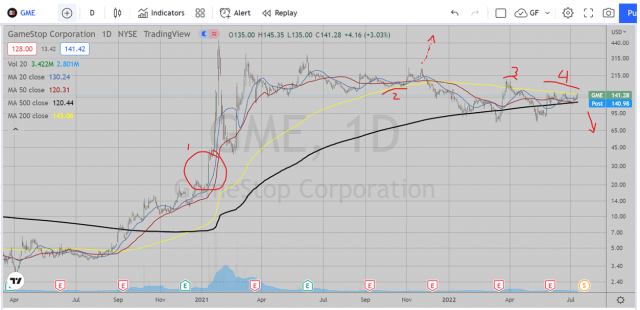

As a reference, here is a daily chart of GME from mid-2020. I circled the Meme stock jump in early 2020 (spot 1). I highlighted spot 2 in October 2021 where bulls were trying to bounce off that 200 EMA (dotted line indicating the path which a truly strong company could have taken). Then after breaking below that 200 EMA, bouncing between the 200 and 500 EMA at spots 3 and 4.

In fact, the past month, relative to the broad market, this has been incredibly strong, trading in a tight 25 point range between 120 and 145. Where does it go from here? Who knows? I indicated my red downward arrow as that is obviously where I think it belongs, but I have gnarled up my past 3 or 4 “stock pick” shorts, keep in mind, which is why I am not trading the stock itself. I am just using it as a measure of hope left in this market. When this dies then it is time to start covering.

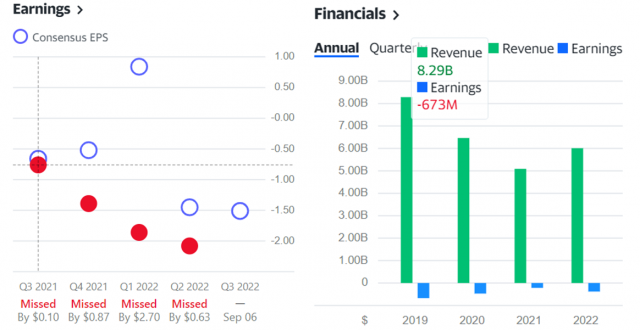

As a second and third point of reference: