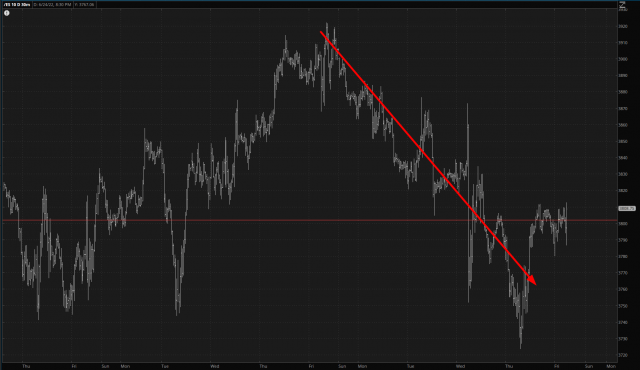

Happy Friday, everyone. Well, the /ES spent the entire night clinging to its Fibonacci like crazy. As I’m typing this, it has managed to reach an escape velocity of some kind, up about 40 points at this particular moment.

On the whole, this has been a down week for the market, and so far today is the exception.

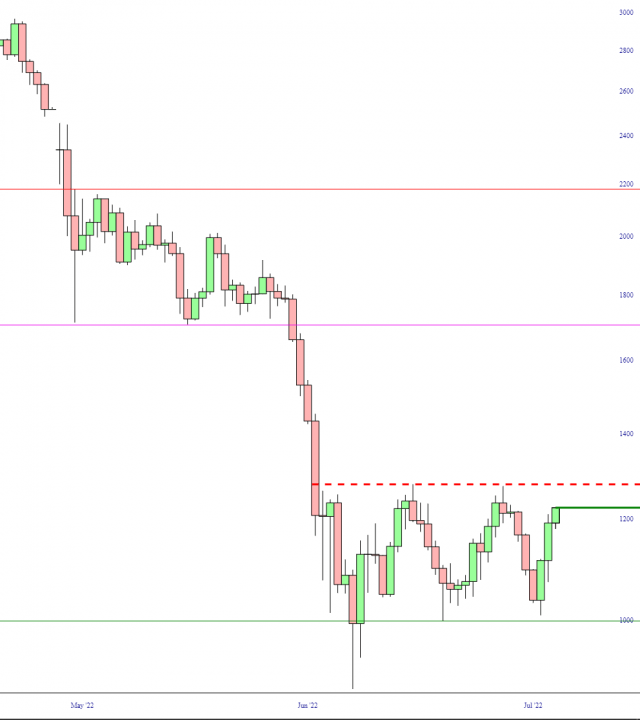

For the bulls out there, the most positive thing they could hope for would be an escape from the range that crypto has been in for about a month. This range is very similar-looking for both $BTC and $ETH.

As for crude oil, which has been a real favorite of mine, I’ve been easing out of there, taking profits. I still have COP (Nov puts) and MRO (Oct puts) but otherwise am out, stepping aside in anticipation of a counter-trend rally. We got to the lowest level we’ve seen in months just yesterday.

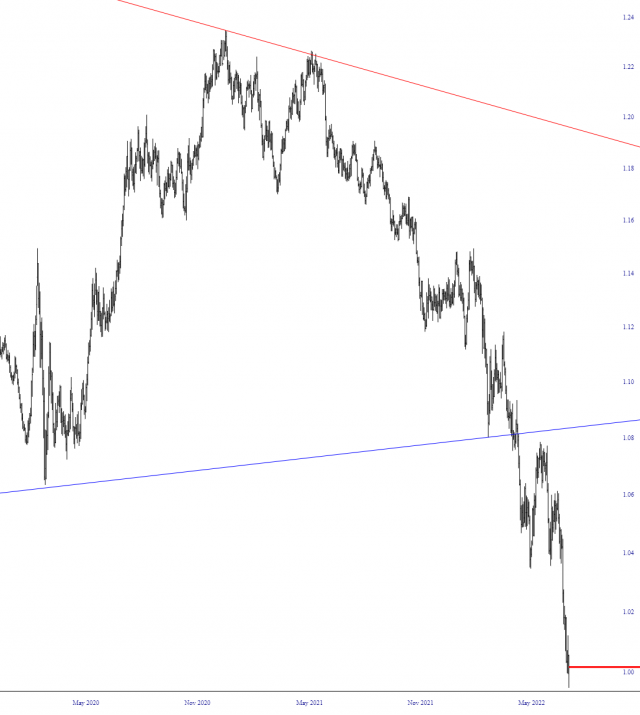

Perhaps the most potent driver for a rally in gold and equities right now would be for the dollar rally to cool off, which it is starting to do right now. You can see this reflected in the Euro/USD chart. The Euro famously went sub-par, and that psychologically-important level has been defended, and there is ample room for a bounce to that trendline before it exhausts itself. I’m not sure it’ll get as far as the trendline, but there’s no doubt that it’s deeply oversold.