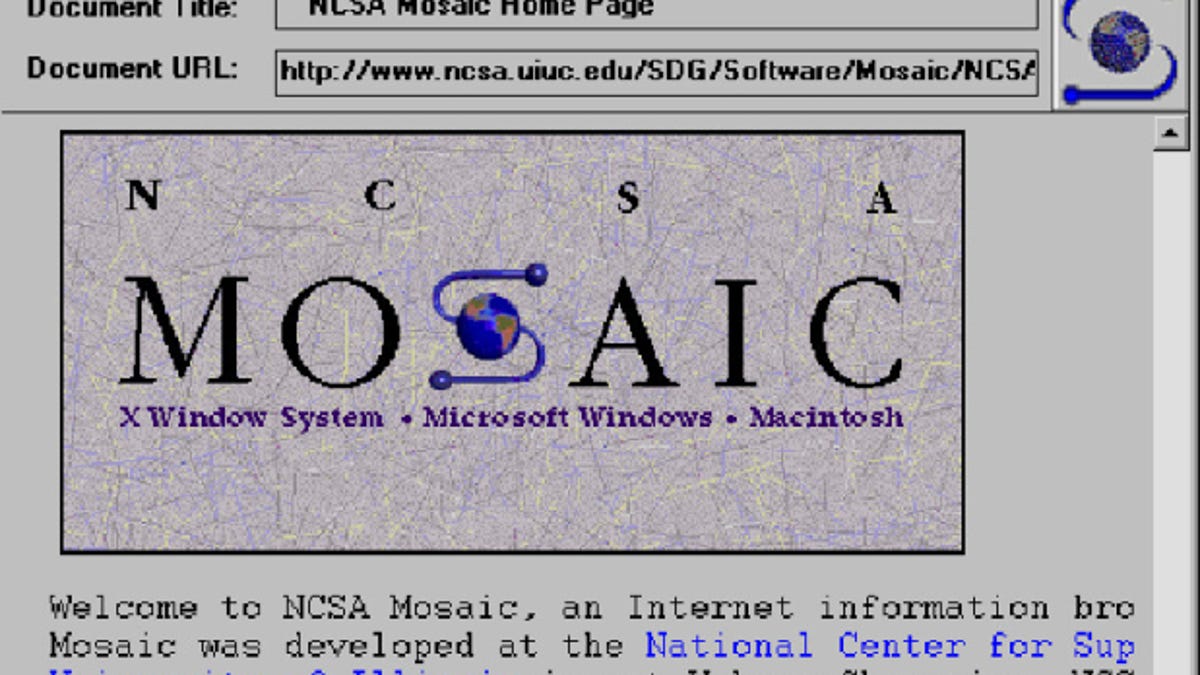

My story begins in the summer of 1993. We were renting an office for my one-year old company, Prophet Financial Systems, and one of the guys called me over to his desk to show me something. He fired up something on his screen called a “browser” which allowed him to use this thing called the “Internet.” At what should have been an epiphanic moment, I shrugged and told him it seemed like a way for nerds to look at nude pictures (which wasn’t too far off the mark, but didn’t exactly suggest a visionary moment on my part).

I offer this anecdote to explain why, since that fateful day nearly a third of a century ago, I have been somewhat insecure about my ability to perceive The Next Big Thing. In recent years, the purported revolution has been, of course, crypto. From this aforementioned insecurity, I have tried – – I have really, really tried – – to get it. I’ve read countless articles, books, and watched videos. And, time and again, I’ve reached the same conclusion: this is a solution in search of a problem.

A good friend of mine from Slope was kind enough to send me a book he thought would help me see the proverbial light. He’s a big crypto believer, and he made me promise that if he bought me the book, that I’d read it. So that was that, and the book showed up.

Having finished the book, allow me to share a few thoughts:

- The book, in fact, has very little to do with Bitcoin; it doesn’t even really get into the subject until about 200 pages in;

- Instead, it is mostly an very enjoyable economics book – – a true pleasure to read;

- The author is delightfully feisty – – and if you’re a fan of John Maynard Keynes, you definitely don’t want to open this thing up, because he has a white-hot disdain for the guy.

The name of the book is The Bitcoin Standard which, as I said, has surprisingly little to do with bitcoin itself. Indeed, only the final portion of the book is about bitcoin, and the content kind of fizzles out by then. It’s pretty much the same boilerplate stuff about crypto that every other book has. The difference is that the other books have pretty much ONLY that boring boilerplate stuff, whereas the first 80% of this book is a terrific introduction to the Austrian school of economic thought.

I’ll say right now that I absolutely recommend this book, and if you’re not into crypto, don’t let the title dissuade you. If you have any libertarian tendencies, this book will definitely amplify them, as it did my own. The author considers Keynes and the central banks to be responsible for most of the world’s woes and about 100 million human deaths, and he also considers bitcoin to be the ONLY legitimate digital currency.

Instead of summarizing the whole book, I’ll just share a variety of excerpts I typed from the book to give you a taste of its content and the author’s enjoyable piss ‘n’ vinegar style of prose:

A son of a rich family that had accumulated significant capital over generations, Keynes was a libertine hedonist that wasted most of his adult life engaging in sexual relationships with children, including traveling around the Mediterranean to visit children’s brothels.

And having lived off his family’s considerable fortune without having to work real jobs, Keynes showed no appreciation of saving or capital accumulation in their essential role in economic growth……..he would also have understood that the only cause of economic growth in the first place is delayed gratification, saving, and investment, which extend the length of the production cycle, increase the productivity of the methods of production, leading to better standard of living. He would have realized the only reason he was born into a rich family in a rich society was that his ancestors had spent centuries accumulating capital, to bring gratification and investing into the future.

Modern artists have replaced craft and long hours of practice with pretentiousness, shock value, indignation, and existential angst as ways to cow audiences into appreciating their art, and often added some pretense to political ideals, usually of the puerile marks its variety, to pretend play that it is deep. To the extent that anything good can be said about Modern Art, it is that it is clever, in the manner of a prank or practical joke. There is nothing beautiful or noble about the output or the process of most modern works, because it was produced in a matter of hours by lazy, talentless hacks who never bothered to practice their craft.

While most people imagine that socialist societies are a thing of the past and that market systems are real capitalist economies, the reality is that a capitalist system cannot function without a free market in the capital, where the price of capital emerges through the interaction of supply and demand of the decisions of capitalists are driven by accurate price signals. The central bank’s meddling in the Capital Market is the root of all recessions and all the crises which most politicians, journalists, academics, and leftist activists like the blame on capitalism. Only through the central planning of the money supply can the price mechanism of the capital markets be corrupted which is the cause of disruptions in the economy

Central Bank planning of the money supply is neither desirable nor possible. It is ruled by the most conceited, making the most important Market in an economy under the command of the few people who are ignorant enough of the realities of market economies to believe they can centrally plan a market as large, abstract, and emergent as the Capital Market. Imagining that central banks can prevent, combat, or manage recessions is as misguided as placing pyromaniacs and arsonists in charge of the fire brigade. It is typical of the Milton Friedman brand of libertarianism in that it blames the government for an economic problem, but the flawed reasoning suggests even more government intervention is the solution.

Only the vanity of the insane can be affected by changing the units with which they’re measured. Making the meter shorter might make someone whose house area is 200 square meters believe it is actually 400 square meters, but it would still be the same house. All that this redefinition of the meter has caused his ruin and engineers’ ability to properly build or maintain a house. Similarly, what you value in a currency may make a country richer nominally, or increase the nominal value of its exports, but it does nothing to make the country more prosperous.

The fundamental scam of modernity is the idea that government needs to manage the money supply. It is an unquestioned starting assumption of all mainstream economic schools of thought in political parties. There isn’t a shred of real-world evidence to support this contention, and every attempt to manage the money supply has ended with economic disaster. Money supply management is the problem masquerading as its solution; the Triumph of emotional hope over reason, the root of all political free lunches sold to gullible voters. It functions like a highly addictive and destructive drug. Such as crystal meth or sugar, it causes a beautiful high at the beginning, fooling his victims into feeling Invincible, but as soon as the effect subsides, the come down it is devastating, and has the victim begging for more. This is when the hard choice needs to be made: either suffer the withdrawal effects of ceasing the addiction, or take another hit, delaying the reckoning day, and sustained severe long-term damage.

There are two main government-approved mainstream schools of Economics thought: Keynesian and Monetarists. While these two schools have widely disparate methodologies and analytical Frameworks, and while they are engaged in bitter academic fights accusing each other of not caring about the poor, the children, the environment, in equality, or the buzzword du jour, they both agree on two unquestionable truths: first, the government has to expand the money supply. second, both schools deserve more Government funding to continue researching really important big questions which will lead them to find ever more creative ways of arriving at the first truth.

The real impact of this is the widespread culture of conspicuous consumption, where people live their lives to buy ever larger quantities of crap they do not need. When the alternative to spending money is witnessing your savings lose value over time, you might as well enjoy spending it before it loses its value. The financial decisions people also reflect on all other aspects of your personality, engendering a high time preference in all aspects of Life: depreciating currency costs, less saving, more borrowing, more short-termism in economic production and in artistic and cultural Endeavors, and perhaps most damaging, the depletion of the soil of its nutrients, leading to ever lower levels of nutrients in food.

As it stands, a large number of firms in all the advanced economies specialize in Warfare as a business, and are thus reliant on perpetuating War to continue being in business. They live off government spending exclusively, and have their entire existence reliant on their being a Perpetual Wars necessitating ever-larger arms spending.

In his sweeping history of five centuries of Western Civilization, from dawn to decadence, identifies the end of World War I as the crucial turning point to begin the demise of the West. It was after this war that the West suffered the replacement of liberalism by liberality, The Imposter claiming its mantle but in reality being its exact opposite. Where is liberalism held the role of government as allowing individuals to live in Liberty and enjoy the benefits, and suffer the consequences of their actions, liberality was the radical notion that it was government’s role to allow individuals to indulge in all their desires while protecting them from the consequences. Socially, economically, and politically, the role of government was recast as the wish-granting genie, and the population merely had the vote for what it wanted to have filled

Keynes has problem with socialism, then, is that its end goal was increase in individual Freedom. For Keynes , the end goal should not be concerned with trivial issues like individual freedom, but for government to control aspects of the economy to his liking. He added three main roles for government: first, the deliberate control of the currency and of credit by a central institution, the belief that laid the groundwork for modern Central Banking. Second and relatedly, Keynes believed it was the role of the government to decide on the scale on which it is desirable that the community as a whole should save, the scale of which the savings should go abroad in the form of foreign investments, and whether the present organization of the investment market distribute the savings along the most nationally productive channels (“I do not think that these matters should be left entirely to the chances of private judgment and private profits as they are at present”). And finally Keynes believed it was the role of government to devise a considered National policy about what size of population, whether larger or smaller than at present or the same, as most expedient. (“And having settled this policy, we must take steps to carry it into operation. The time may arrive a little later when the community as a whole must pay attention to the innate quality as well as to the mere numbers of its future members.”)

These excerpts might make the book seem like an endless anti-Keynesian rant, but fear not, there’s a lot more to it than that. I just particularly like these sentiments! There’s a lot to learn here, and although I think Michael Saylor (who wrote the preface) is still a bit whacky, his bizarre tweets actually make more sense to me now that I’ve finished this book (which, reportedly, was the inspiration for him to buy billions of bucks in bitcoin). I would again urge you to check the book out, because I thoroughly enjoyed it.