Since the market bottomed on June 16th, the /ES has gone up hundreds of points (well over 300) and the Dow Industrials is up thousands. There has been an enormous change in sentiment, with the consensus being that the brief bear market (if you want to call it that) experienced during a tiny portion of this year was all the suffering that was required to clear out all the sins of the past quarter century.

Besides the fact that Zerohedge has more bullish articles every week than even the likes of Yahoo Finance, even Elliott Wave has thrown in the proverbial towel, declaring their “alternate scenario‘ (AKA the bear market ain’t happening) is in play. It wasn’t that long ago that they were stone-cold certain that we’d be plunging non-stop. This afternoon, hat in hand, they meekly sent out an ‘Interim Bulletin” (never a good sign) that raised the white flag. Their mojo is gone. Totally. Elliott Wave has SURRENDERED.

As for myself, I sure as hell was having a ball with this market until recently. Today, my all-short portfolio was terribly robust, at one point even showing a profit when the /ES was up 60 points. Once Powell started speaking, however, things started falling to pieces. In spite of the fact that my options expire sometime around the time we plan to have completed colonies on Mars (more precisely, an average of 164 days in the future), I’m not a fan of red numbers, so I started ditching positions left and right. By day’s end, I had a puny 25 positions and a nauseating 50% cash. Powell simply seems masterful at manipulating the perception of reality to his liking.

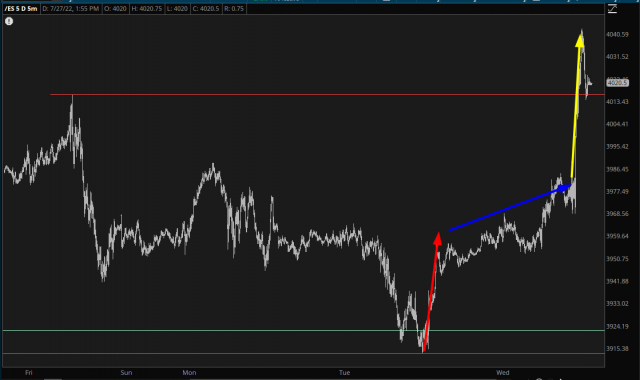

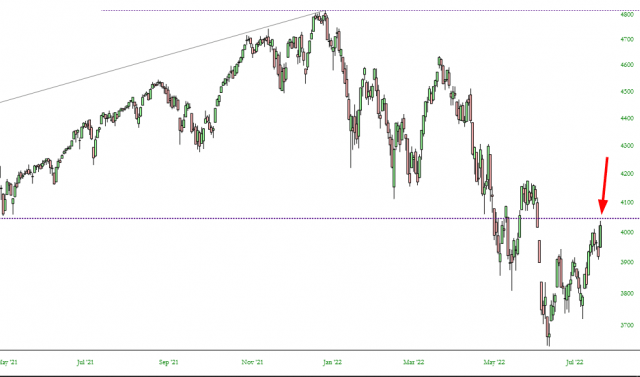

If you look at what transpired over a mere twenty-two hours, it was extraordinary. On the /ES:

- The red arrow shows the Google/Microsoft relief rally;

- The blue arrow shows the growing optimism predicated upon the same rally;

- The yellow arrow indicates the absolute bull-gasm that was had upon hearing the silky sound of Powell’s voice. In the process, we blew right past last week’s peak.

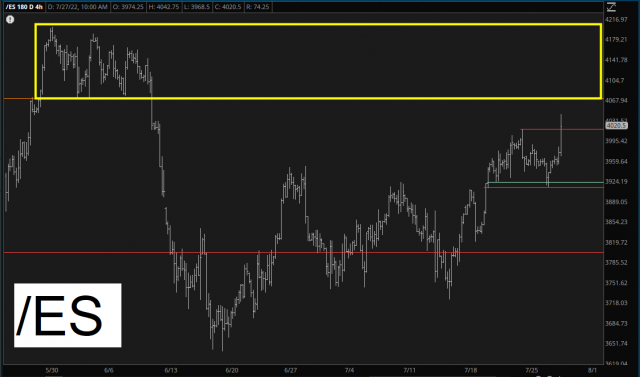

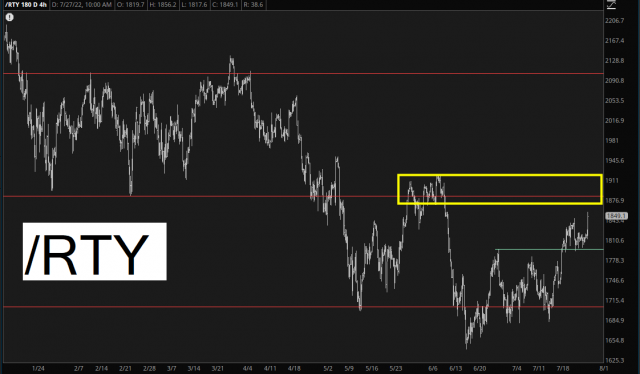

So when do I join Zerohedge and Elliott Wave International and simply give up on any bear market happening? Well, we’d have to get above this zone of overhead supply.

Which, should it transpire, would almost certainly mean this similar zone was defeated.

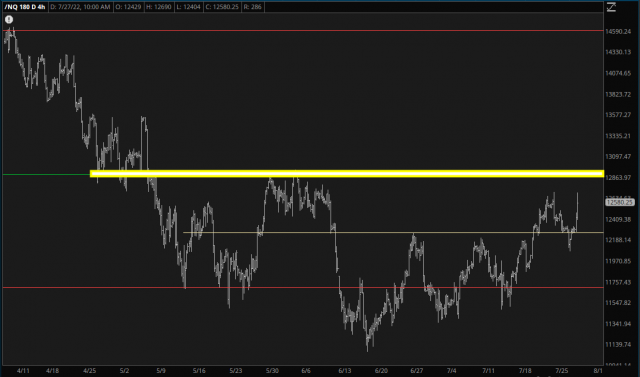

Another deal-breaker, although this could happen quite easily, would be a successful push by the /NQ above this line, indicating a large bullish base.

For the moment, however, we are (just barely) hanging on to well-constructed tops. You can see here on the S&P 500 index that we have spent the past 41 days doing a beautiful job sealing up the June 9th price gap and recapturing the Fibonacci retracement level.

I’ll say one last thing before signing off for the night, and it has to do with the concept of “at the margins.’ Let me give a very simple example to illustrate my point.

Let’s say you had a portfolio that started with a value of 100. You grew it to 102. Then it shrank to 101.

You could declare that you lost 50% of your profits, which sounds absolutely horrible. But the figure is big because you’re dealing with arithmetic at the margins. Your portfolio actually went down not even 1%, but because a profit of “2” went to “1”, you’ve got spine-tingling “loss’ gnawing at your soul.

But it’s an illusion, because the monstrous profit drop was………..at the margins. That’s something I’m definitely keeping in mind, since I’m nowhere near to cutting into my principal, but my profits for 2022 have had wild swings, especially recently.